Hello dear EOS readers!

We hope you’re enjoying a well-deserved summer break — whether that’s on the beach, exploring Spain, or simply relaxing with family.

After spending the last few years very focused on expanding our services beyond our well-known stage of off-plan property claims, this year we want to dedicate more time to this beautiful EOS community, of which we’ve proudly been a part since 2006.

And we’ve got great news: over the coming months we’ll be sharing more content than ever — not just here on the blog but also through podcasts, guides, and practical tips to make your Spanish journey smoother. So stay tuned!

Let’s begin with one of the most common questions we hear from our favorite group of readers — retirees dreaming of or already enjoying life in Spain:

“How much time can I spend outside Spain without losing my residency?”

The rules in simple terms

If you follow these rules, you’ll be able to renew your residency without problems and, after 5 years, apply for long-term (permanent) residency.

If you don’t — for example, by spending 7 months abroad in one go, or a total of 12 months over the first 5 years — you risk losing your residency and having to start again.

Real-life examples

-

Example 1: Within the rules

A retired couple spends 2 months every winter visiting their children in the US. After 5 years, they’ve been away for 10 months in total — perfectly fine.

-

Example 2: Still okay

One year you’re abroad for 4 months, but then just short trips in the following years. Total time away is still under 10 months in 5 years. No problem.

-

Example 3: Breaking the rule

You’re away for 7 consecutive months to help a family member. Even if the total is under 10 months, the 6-month consecutive rule is broken, so you could lose your residency.

-

Example 4: Too much travel

You love travelling and end up spending 12 months abroad in 5 years. That’s above the 10-month total limit, which could put your residency at risk.

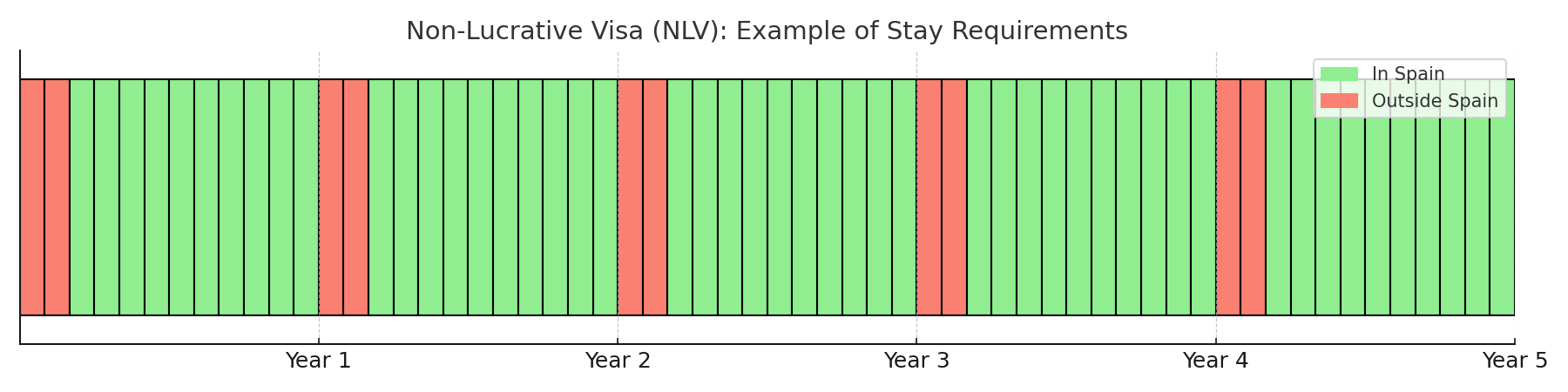

A simple visual

To make it even clearer, here’s a simple visual example of how the “10 months in 5 years” rule works in practice. In this chart, the red blocks show time spent outside Spain and the green blocks show time living in Spain. This example stays within the rules: two months abroad each year, adding up to 10 months in total over five years.

A quick tax note

Remember that holding an NLV means Spain should be your main home. If you spend more than 183 days in Spain in a calendar year, you’re considered a Spanish tax resident and must declare your worldwide income here. For many retirees this is perfectly manageable, but it’s worth checking with a tax advisor so there are no surprises.

If you have any questions, please leave your comments below — we’d be happy to answer them.

https://www.costaluzlawyers.com/contact/

This message was last edited by mariadecastro on 8/21/2025.