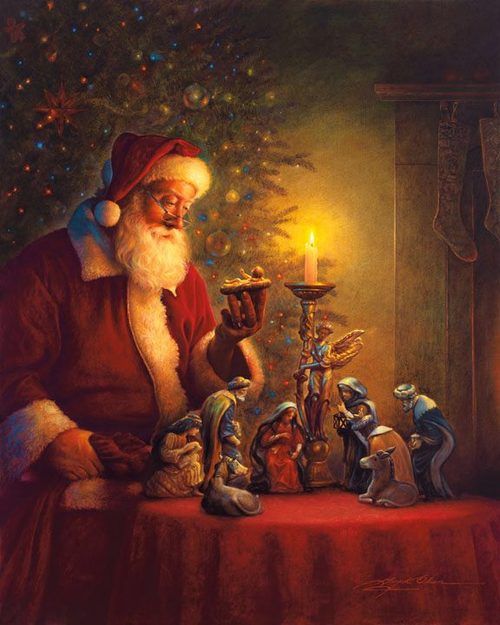

Feliz Navidad from CostaLuz Lawyers

Saturday, December 24, 2016

Our best wishes of a peaceful and joyful Christmas season

CostaLuz Lawyers

3

Like

Published at 8:54 PM Comments (1)

3

Like

Published at 8:54 PM Comments (1)

Legal tip 1422. Case won in the Provincial Appeal Court against SGR for an off-plan property from Herrada del Tollo at Santa Ana del Monte

Wednesday, December 21, 2016

Our clients were extremely pleased to hear recently that we had won their LEY 57/1968 Bank Action case against SGR in the Provincial Appeal Court.

No Individual Guarantee

Our clients did not receive an individual Guarantee from the developer, Herrada del Tollo or from the Bank to which their off-plan deposit was paid, BBVA. SGR did grant a General Guarantee to the developer.

First Instance Court Sentence

In the First Instance Sentence BBVA was convicted according to its obligations under Article 1.2 of LEY 57/1968 for the off-plan deposit paid by our clients to the developer’s bank account at BBVA. SGR (an insurance company) was also convicted jointly and severally with BBVA due to the General Guarantee it issued to the developer.

The Appeal

SGR appealed using 4 main arguments which were all rejected by the Magistrates in the Provincial Appeal Court. The First Instance Sentence has been confirmed. Costs of the First Instance procedure were not imposed on any party; therefore each party will pay its own costs relating to the First Instance procedure. Costs of the Appeal are imposed on SGR.

As per the First Instance Sentence SGR & BBVA are jointly & severally liable to refund the total amount of our clients off-plan deposit plus legal interest from the date the amount was paid to the developer’s account.

Important Statements from the Appeal Court Magistrates

“The appellant argued in the Appeal that the buyers were never informed of or provided with, a copy of the General Guarantee at the time of signing the Purchase Contract with the developer and therefore they are not protected by the policy. However, as we have already pointed out in our Sentence of 19 May 2016 the conviction of SGR applies from the moment a line of Guarantees or General Guarantee is granted to the developer.

In short it is irrelevant whether or not the buyers were provided with a copy of the General Guarantee because the responsibility of SGR arises from the mere fact of having granted the Guarantee to the developer, who then failed to complete the housing.

The appellant also argues that it never received the amounts paid by the buyer as the funds were paid to the developers account at BBVA & Banco CAM. However, SGR is responsible under the General Guarantee regardless of whether it received the amounts paid by the buyers or not.

SGR stated that the maximum limit of the General Guarantee was 6.5 million euros and that it could not be liable for any amounts in excess of that limit. The Supreme Court has already ruled that whether in the form of a Bank Guarantee or Certificate of Insurance there cannot be a limit imposed which is less than the total amount delivered by the buyers.

The appellant company also stated that there was an unfair delay in the claim made by the buyers, since they waited more than 9 years to file the Lawsuit and therefore interest should only be payable from the date of filing of the Lawsuit. This Court has repeatedly ruled in accordance with Article 3 of LEY 57/1968 that interest shall accrue from the date the buyers paid to the developer’s bank account.

In light of the above, all the arguments of the appellant are dismissed. According to Article 398.1 and Article 394 of the Civil Code the appellant should be ordered to pay the costs of this Appeal”

Possible Supreme Court Appeal

SGR has 20 working days from the date of notification of the Sentence, which was 20 December 2016, to comply with the Sentence or to file a Cassation Appeal to the Supreme Court.

Although Appeals must be submitted strictly within a 20 working day deadline, we do not normally receive notification of an Appeal or of a firm sentence from the Court until a few weeks after the deadline due to the workload of the Court.

If a Cassation Appeal to the Supreme Court is filed by the Bank it will be necessary for us to file an Opposition to the Appeal on behalf of our client.

1

Like

Published at 6:59 PM Comments (11)

1

Like

Published at 6:59 PM Comments (11)

Legal tip 1420. Case won in the Marbella First Instance Court against UNICAJA for an off-plan property from the developer MARTINSA FADESA at Campos de Guadalmina

Tuesday, December 20, 2016

We were extremely pleased to inform our clients recently that we had won their LEY 57/1968 Bank Action case against Unicaja in the First Instance Court in Marbella for an off-plan property they reserved at Campos de Guadalmina from the developer Martinsa Fadesa.

Individual Guarantee provided by Unicaja

Our clients paid their off-plan deposit to the developer’s account at Banco de Andalucía. Unicaja issued the Individual Guarantee for the buyers off-plan deposit paid to the developer’s bank account at Banco de Andalucía.

First Instance Court Sentence

The First Instance Court has found Unicaja guilty according to its obligations under LEY 57/1968 and sentenced the Bank to refund the full amount of the off-plan deposit plus legal interest from the date the buyers paid to the developer’s account. Costs of the First Instance procedure are imposed on the Bank.

Interesting Statements from the First Instance Sentence

“The plaintiffs filed a Lawsuit against Unicaja, requesting the conviction of the bank according to its responsibility under LEY 57/1968 for the individual Guarantee it issued to the plaintiff. The plaintiff requested the refund of the total amount paid to the developer’s bank account and covered by the Guarantee under the Purchase Contract plus interest & costs.

On 27 February 2003 the plaintiffs signed a Purchase Contract to purchase a property in the development ‘Campos de Guadalmina’ from the developer Martinsa Fadesa. On 5 March 2004, Unicaja issued an Individual Guarantee to the plaintiff for the off-plan deposit that was paid according to the purchase contract to the developer’s account at Banco de Andalucía.

Unicaja opposed the Lawsuit on the grounds that the plaintiff had paid the off-plan deposit to Banco de Andalucía and not to an account at Unicaja. The bank also stated that the Guarantee was only valid until 30 December 2005.

We must note that the Supreme Court Sentence dated 13 January 2015 states the fact of the buyer having not entered the amounts in the special account does not exclude the insurance coverage.

Furthermore Article 4 of LEY 57/1968 establishes that “Once the Certificate of Occupancy is issued by the Provincial Delegation of the Ministry of Housing and given by the promoter of the housing to the buyer the rights guaranteed by the insurer or guarantor will be cancelled”, therefore the bank cannot set the expiry date of the Guarantee in contradiction to the Law. In this case the delay in delivery of the property has been more than 12 years.

These are, in short, the parameters that should be considered in this Sentence which is aligned with the undisputed dominant jurisprudence which strengthens extraordinarily the position of an off-plan homebuyer according to the legal Guarantee that was issued.

This decision, no doubt, will make it harder in practice for banks to grant these guarantees, but will also encourage banks to force promotors to deliver the properties in the agreed period, thereby avoiding the serious situations of possible abuse that have occurred in many cases in recent years.

The consequence of the above is that Unicaja must proceed with the repayment of the amounts paid by the buyers to the developer together with legal interest and costs”

Possible Provincial Court Appeal

Unicaja has 20 working days from the date of notification of the Sentence, which was 19 December 2016, to comply with the Sentence or to file an Appeal to the Provincial Appeal Court of Malaga.

Although Appeals must be submitted strictly within a 20 working day deadline, we do not normally receive notification of an Appeal or of a firm sentence from the Court until a few weeks after the deadline due to the workload of the Court.

If an Appeal to the Provincial Appeal Court is filed by the Bank it will be necessary for us to file an Opposition to the Appeal on behalf of our client.

A nice little square of Marbella

1

Like

Published at 2:51 PM Comments (0)

1

Like

Published at 2:51 PM Comments (0)

Legal tip 1419. Case won in the Madrid First Instance Court against BANKIA for an off-plan property from the developer Studios Inmobiliarios Howell at Mundo Aguillo

Tuesday, December 20, 2016

We were very pleased to inform our clients recently that we had won their LEY 57/1968 Bank Action case against Bankia in the First Instance Court in Madrid for an off-plan property they reserved at Mundo Aguillo from the developer Studios Inmobiliarios Howell.

No Individual Guarantee

Our clients paid their off-plan deposit to the developer’s account at Bancaja (now Bankia). The Bank failed to issue or verify the existence of the Individual Guarantee for the buyers off-plan deposit paid to the developers account opened in its branches.

First Instance Court Sentence

The First Instance Court has cancelled the Purchase Contract due to serious breaches by the developer and found Bankia and the Developer jointly and severally liable according to Article 1.2 of LEY 57/1968 to refund the full amount of the off-plan deposit plus legal interest from the date the buyers paid to the developer’s bank account. Costs of the First Instance procedure were also imposed on the Bank & Developer.

The Judge based her Sentence on the Supreme Court Sentences dated 21 December 2015 & 9 March 2016.

Interesting Statements from the First Instance Sentence

“The plaintiffs filed a Lawsuit against the developer Studios Inmobiliarios Howell & Bancaja (now Bankia), requesting cancellation of the Purchase Contract and the joint conviction of the developer & bank according to its responsibility under LEY 57/1968. The plaintiff requested the refund of the total amount paid to the developer’s bank account under the Purchase Contract plus interest & costs.

On 15 December 2006 the plaintiffs signed a Purchase Contract to purchase a property in the development ‘Mundo Aguillo’ from the developer Studios Inmobiliarios Howell SL. According to clause 5 of the purchase contract the property should have been completed within 300 days from the date of the contract.

At the time of signing the purchase contract the plaintiffs paid their off-plan deposit to the developer’s account opened at Bancaja (now Bankia).

The plaintiffs did not receive a Guarantee for their off-plan deposit.

The Town Hall of Pulpí stated that as of 7 October 2015 the developer had not started the construction of the property due to the fact they never obtained the corresponding building licence.

A serious contractual breach is clear and the purchase contract is cancelled.

The defendant financial institution in which the off-plan payment was deposited must be jointly liable with the developer for the return of the money to the plaintiff together with the payment of interest. This is a responsibility under the provisions of article 1.2 of LEY 57/1968.

This has been confirmed by the Supreme Court Sentences dated 21 December 2015 & 9 March 2016.

The financial institution that receives the off-plan deposit is obliged to demand that the amounts are held in a separate special account and that the corresponding Guarantee is issued. If the bank receives off-plan deposits without having opened the separate special account or without ensuring the corresponding guarantee is issued, then it will be jointly responsible with the developer for the refund to the buyer in the same way that the guarantor or insurer would have been if the property did not commence or complete on time.

Therefore the Lawsuit is upheld.

It is also appropriate that the defendants are jointly and severally liable to pay legal interest from the date the buyer paid the amounts to the developer’s bank account.

In accordance with Article 394.1 of the Civil Procedure Act, having fully upheld the Lawsuit the costs must be imposed on the defendant bank”

Possible Provincial Court Appeal

Bankia has 20 working days from the date of notification of the Sentence, which was 15 December 2016, to comply with the Sentence or to file an Appeal to the Provincial Appeal Court of Madrid.

Although Appeals must be submitted strictly within a 20 working day deadline, we do not normally receive notification of an Appeal or of a firm sentence from the Court until a few weeks after the deadline due to the workload of the Court.

If an Appeal to the Provincial Appeal Court is filed by the Bank it will be necessary for us to file an Opposition to the Appeal on behalf of our client.

A typical street (one of the oldest) in the neighbourhood of Austrias in Marid.

1

Like

Published at 2:27 PM Comments (0)

1

Like

Published at 2:27 PM Comments (0)

Legal tip 1418. Case won in the Provincial Appeal Court against BANCO SABADELL, SGR & BBVA for an off-plan property from Herrada del Tollo at Santa Ana del Monte

Wednesday, December 14, 2016

Our clients were very happy when we informed them recently that we had won their LEY 57/1968 Bank Action case against Banco Sabadell, SGR & BBVA in the Provincial Appeal Court.

No Individual Guarantee

They did not receive an individual Guarantee from the developer, Herrada del Tollo or from the Banks to which their off-plan deposits were paid, BANCO SABADELL & BBVA.

First Instance Court Sentence

The First Instance Sentence found Banco Sabadell & BBVA responsible only for the amounts actually paid to the developers accounts opened in their branches. Banco Sabadell filed an Appeal against the First Instance Sentence.

SGR & BBVA had also issued General Guarantees to the developer; however the First Instance Judge acquitted both entities of any responsibility according to the General Guarantees. We filed an Appeal on our client’s behalf regarding the acquittal of SGR & BBVA under the General Guarantees.

The Appeal

The Provincial Appeal Court has upheld our Appeal and dismissed the Appeal filed by Banco Sabadell.

So now all 3 entities, BBVA, BANCO SABADELL & SGR are condemned in solidarity for the full amount of the off-plan deposit.

There was no imposition of costs in the First Instance Sentence, and that remains the case, so each party will pay its own costs.

There was no imposition of costs for our Appeal, so each party will pay its own costs for the part of the procedure relating to our Appeal.

The costs of the Appeal filed by Banco Sabadell are imposed on the Bank.

Possible Supreme Court Appeal

BANCO SABADELL, BBVA & SGR have 20 working days from the date of notification of the Sentence, which was 18 November 2016, to comply with the Sentence or to file a Cassation Appeal to the Supreme Court.

Although Appeals must be submitted strictly within a 20 working day deadline, we do not normally receive notification of an Appeal or of a firm sentence from the Court until a few weeks after the deadline due to the workload of the Court.

If a Cassation Appeal to the Supreme Court is filed by the Bank it will be necessary for us to file an Opposition to the Appeal on behalf of our client.

Castle of Jumilla, Murcia, Eastern Spain

1

Like

Published at 3:05 PM Comments (4)

1

Like

Published at 3:05 PM Comments (4)

Legal tip 1417. Case won in the Provincial Appeal Court against BANCO SABADELL for an off-plan property from Casa Mediterranea Construcciones S.A at Pinada Del Rio

Wednesday, December 14, 2016

Our clients were extremely pleased to hear recently that we had won their LEY 57/1968 Bank Action case against Banco Sabadell in the Provincial Appeal Court.

No Individual Guarantee

They did not receive an individual Guarantee from the developer, Casa Mediterranea Construcciones S.A or from the Bank to which their off-plan deposit was paid, BANCO GUIPUZCUANO (now BANCO DE SABADELL S.A.)

First Instance Court Sentence

In the First Instance Sentence the Judge stated:

“The claimant signed a purchase contract with the entity Casa Mediterranea Construcciones S.A. on 10 August 2004 for the purchase of a home in the development Residencial Pinada del Rio.

The off-plan deposit was paid to the Special Account of the developer at Banco Guipuzcuano (now Banco Sabadell).

The Bank argued that it was not a Special Account. However, during questioning at the Trial the developer confirmed that the Bank had knowledge that the account was used for the receipt of off-plan funds. From documentary evidence relating to the account it is clear that payments into the account were referenced as being for specific housing types at Pinada Del Rio.

Therefore it is clear that the funds were from buyers for off-plan purchases. If the Bank did not make adequate efforts to manage control of the said account then it cannot claim that lack of diligence against a third party”

The Appeal

The Bank appealed using 3 main arguments.

Firstly the Bank stated that the action should be dismissed for Res Judicata (a matter already judged). On this subject the Bank states that the claimant originally took an action for contract cancellation against the developer in 2007 with a Sentence being issued in 2008 cancelling the purchase contract and condemning the developer to refund the off-plan deposit. Due to its financial situation the developer never paid. The Bank is of the opinion that the buyer cannot then make a claim against the bank in relation to the same matter.

The Appeal Court Magistrates said that the previous action was an action for contractual resolution and not a claim against a guarantor according to LEY 57/1968. Therefore, Res Judicata does not apply.

The second appeal argument was that the time limit for this type of claim is 2 years and that the buyers had far exceeded the allowable time limit. The Appeal Court Magistrates dismissed this argument as the time limit for these types of actions according to Article 1964 of the Civil Code is 15 years.

Thirdly the bank alleged violation of Articles 1 & 2 of LEY 57/1968 including unjust enrichment due to the previous action against the developer.

Important Statement from the Appeal Court Magistrates

“In conclusion and as is clear from the Supreme Court Sentence dated 21 December 2015 reiterated by the Supreme Court Sentences of 9 March & 17 March 2016, Banco Sabadell is responsible, as clearly explained in the First Instance Sentence, because it had an obligation to identify and protect the buyer’s income paid into the developer’s account opened in its branches. The Bank also alluded to the risk of unjust enrichment due to the claimants already having won a previous case against the developer, however firstly, as was stated in the Lawsuit, it has not been possible to obtain the refund from the developer, secondly, the Banks own defence to the Lawsuit confirmed that the developer is in liquidation and, thirdly, the Bank did not make the argument of unjust enrichment in its original defence to the Lawsuit, therefore this argument must now be rejected as new arguments cannot be considered in an Appeal. As to the costs of this appeal, they must be imposed on the Bank”

Possible Supreme Court Appeal

BANCO SABADELL has 20 working days from the date of notification of the Sentence, which was 9 December 2016, to comply with the Sentence or to file a Cassation Appeal to the Supreme Court.

Although Appeals must be submitted strictly within a 20 working day deadline, we do not normally receive notification of an Appeal or of a firm sentence from the Court until a few weeks after the deadline due to the workload of the Court.

If a Cassation Appeal to the Supreme Court is filed by the Bank it will be necessary for us to file an Opposition to the Appeal on behalf of our client.

Some houses in Pinada del Rio, Alicante, Eastern Spain

1

Like

Published at 2:44 PM Comments (0)

1

Like

Published at 2:44 PM Comments (0)

Legal tip 1416. Case won in the Orihuela First Instance Court against BANCO POPULAR for an off-plan property from the developer San Jose at Playa Golf III in Jumilla

Wednesday, December 14, 2016

We recently informed our clients that we had won their LEY 57/1968 Bank Action case against Banco Popular in the First Instance Court in Orihuela for an off-plan property they reserved at Playa Golf III in Jumilla from the developer San Jose.

No Individual Guarantee

Our clients paid their off-plan deposit to the developer’s account at Banco Pastor (now Banco Popular). The Bank failed to issue or verify the existence of the Individual Guarantee for the buyers off-plan deposit paid to the developers account opened in its branches.

First Instance Court Sentence

The First Instance Court has found Banco Popular guilty according to its obligations under Article 1.2 of LEY 57/1968 and sentenced the Bank to refund the full amount of the off-plan deposit plus legal interest from the date the buyers paid to the developer’s account. There was no imposition of costs of the First Instance procedure; therefore each party will pay its own costs.

Interesting Statements from the First Instance Sentence

“The plaintiffs filed a Lawsuit against Banco Popular, requesting the conviction of the bank according to its responsibility under LEY 57/1968. The plaintiffs requested the refund of the total amount paid under the Purchase Contract and recognised in the insolvency procedure of the developer, plus interest & costs.

In 2006 the plaintiffs signed Purchase Contracts to purchase off-plan properties from the developer San Jose Proyectos e Inversiones S.A. at Playa Golf III-Orihuela in Jumilla. The properties were due to be completed in December 2007, however on that date the building works had not even started.

San Jose is in liquidation and the claimants are recognised as creditors of the company in the insolvency procedure.

The claimants state in their Lawsuit filed in May 2012 that the defendant Bank issued a General Guarantee to the developer but failed to issue the Individual Guarantees for the money received into the developer’s bank account opened in its branches.

The Bank opposed the Lawsuit on the grounds that the account to which the buyers paid their off-plan deposits was a normal current account and not a special account. The Bank also stated that the Guarantee referred to by the claimants was issued to another developer, Herrada del Tollo S.L. and that it was not a General Guarantee. It also said that LEY 57/1968 did not apply to residents of the United Kingdom and that the purchases were purely speculative. Finally the Bank said that it did not intervene in the purchase contracts and that the properties were completed with First Occupation Licences in January 2009.

Regarding the responsibility of Banco Pastor (now Banco Popular), we must take into account the Supreme Court Sentences of 23 September 2015 and the most recent Supreme Court Sentence of 21 September 2016 where in a similar case the responsibility of the Bank is established.

The bank account must be considered a Special Account, even though the bank considered it to be a normal current account, because it was clear that the entries into the account were from buyers of off-plan properties and therefore the bank had the obligation to open a Special Account and to issue or verify the existence of the corresponding individual guarantees.

This is a line of jurisprudence that has been ratified by our Supreme Court on a number of occasions”

Possible Provincial Court Appeal

BANCO POPULAR has 20 working days from the date of notification of the Sentence, which was 17 November 2016, to comply with the Sentence or to file an Appeal to the Provincial Appeal Court of Alicante.

Although Appeals must be submitted strictly within a 20 working day deadline, we do not normally receive notification of an Appeal or of a firm sentence from the Court until a few weeks after the deadline due to the workload of the Court.

If an Appeal to the Provincial Appeal Court is filed by the Bank it will be necessary for us to file an Opposition to the Appeal on behalf of our client.

Jumilla, Murcia, Eastern Spain

0

Like

Published at 1:47 PM Comments (0)

0

Like

Published at 1:47 PM Comments (0)

Legal tip 1415. Our Top Five Cases Against Off-Plan Property Developer’s Banks

Saturday, December 3, 2016

We have now won more than 220 cases against Spanish Off-Plan Property Developer’s Banks and have sent millions of euros back to our clients, making them happy and achieving good justice in Spain.

Victims were those whose off plan purchases failed in Spain after the financial and real estate credit crunch.

Let me tell you something you may or may not know: at the beginning of our fight in 2009 we were called a bunch of fools fighting recklessly and lying to people to make our own treasure. Yes, some other lawyers even described us as Ambulance Chasers. The same type of lawyers who were an important part of the mess and who are trying to entice people again with a so-called instant-100% safe-no win no fee action.

Their laughing at us was actually a good sign for us. Robin Sharma’s quote: “If people are not laughing at your dreams, at least once a week, you are aiming too low!” describes very well how we process our profession: fighting like dreamers to protect the rights of British people in Spain.

The point we were fighting for was to make the banks liable for the off plan disasters they had financed, for buyer’s money they held in developer’s accounts and whose refunds they often guaranteed in writing. In many cases, when a client did not have an individual certificate of Bank Guarantee, there was NO WAY TO OBTAIN YOUR REFUND, so thousands of people ended up with no house and no money in a foreign country with an unknown legal system.

Back in 2009 we took this fight upon our shoulders and filed our first LEY 57/1968 Lawsuit in February 2011……..and the victories started coming, initially from the First Instance Court in Hellín in June 2012 and more recently from the Supreme Court in Madrid in March 2016.

Five milestones we have achieved so far are:

- Keith Rule’s Finca Parcs Case in Hellín against Banco CAM (now Sabadell) and the developer Cleyton Ges was won in the First Instance Court in June 2012 and then confirmed by the Albacete Provincial Appeal Court in April 2013. That victory was the energy for many more victories to come after Keith joined our team in 2013. Banco CAM was condemned to repay our clients all their off-plan deposits plus legal interests and legal costs. A full account of the whole story is at Finca Parcs Action Group

- Herrada del Tollo and San Jose cases in the development Santa Ana del Monte has produced numerous victories for our clients in that unfortunate project. The most recent being in October 2016. Banks who received the buyer’s off-plan funds and the entities issuing General Guarantees (Popular, SGR…) blame each other on many occasions. The Supreme Court has already established doctrine by which once there is a General Guarantor, banks where deposits were made are not liable. The simple mention of the existence of a General Guarantor in a contract opens the possibility for the buyer to claim against that Guarantor. There is no limit to liability of the Guarantor, all the amounts the buyer can prove as being paid, plus legal interests from date of payment need to be refunded.

- Huma Mediterráneo and Casares del Sol Victories are also very meaningful as there were hundreds of affected people in those developments.

- Los Lagos de Santa María in Marbella made us especially proud as this is one of the developments subject to a corruption case by the Marbella Local Council.

- Last but not least in our Top 5 is our case that the Supreme Court used in March 2016 to confirm its doctrine on Banks liabilities for receiving buyer’s off-plan funds. This is of great satisfaction to us as the Highest Court in the country used our victory to confirm this successful strategy against the Bank. The same strategy we have been fighting for since 2008 when Keith Rule first contacted us. We actually lost this case against the developer’s Bank in both the First Instance and Provincial Appeal Court, however the client trusted us enough to instruct us to submit a Cassation Appeal to the Supreme Court which we won! The development was “El Sobrao” in Triquivijate, Fuerteventura.

The Supreme Court has now fixed jurisprudence (Case Law) regarding Banks liabilities and obligations according to LEY 57/1968 as follows:

‘In house sales governed by Law 57/1968 credit institutions (banks) that receive income from buyers in the promoter’s account without requiring the opening of a special account and the corresponding guarantee or warranty, shall be liable to the buyer for the total amounts paid by buyers and deposited in the account or accounts the developer has opened in that entity’

There are still hundreds of cases in the Courts. We are very positive on the outcome of these and future cases as there is now, after all these years, a clear interpretation of LEY 57/1968 by the Supreme Court. All we hope is that some of those funds that we successfully recover for our clients are then wisely re-invested in Spain to make many retirement dreams finally come true.

3

Like

Published at 6:11 PM Comments (5)

3

Like

Published at 6:11 PM Comments (5)

Legal tip 1414. Who Said the Lawyer isn’t Liable?

Saturday, December 3, 2016

Case Law in Spain has already declared liabilities of conveyance lawyers who assisted clients in off plan purchases when clients lack Bank Guarantees

Depending on possibilities of proving (1) effective damages arising from this lack and (2) direct cause-effect relationship between the damage and the negligence, indemnization amount varies

- If a buyer lacking an individual Bank Guarantee or Insurance Title has been able to obtain the refund using the General Bank Guarantee action but this has caused additional costs, these additional costs plus fee once paid to their legal advisors can be claimed against the Lawyers´ indemnity insurance

- If a buyer lacking individual Bank Guarantee or Insurance Title has been able to obtain the refund using action against bank where payments were made but again, this has involved additional costs, an action against Lawyers’ indemnity insurance can be played for the refund of all the additional costs and fees paid in it’s time to the conveyancers

- If a buyer has no action against any Bank because it is not possible to locate where payments were made, and a conveyancing lawyer was used, an action for all paid amounts plus legal interests and costs, and refund of fee and associated costs is claimable against the lawyer´s indemnity insurance

Banks liabilities are stronger as there is an special law covering these situations and stating liabilities of Banks in regards to protection of off plan deposits, but…. if you hired a lawyer and due to his lack of diligence, rights of law 57/68 cannot be played, he is liable. To more or less extent depending on how strong your rights using Law 57/68 are or can be.

For more info you can look at Costaluzlawyers litigation service

1

Like

Published at 6:09 PM Comments (2)

1

Like

Published at 6:09 PM Comments (2)

Legal tip 1413.Supreme Court Crack Down on Timeshare Contracts

Saturday, December 3, 2016

Our Supreme Court is being very brave and wise when sanctioning illegal schemes of timeshare rights which are spread out along the Spanish Coasts.

Law which is being applied is from 1998 which rules all existing timeshares in Spain till July 2012, when the current law entered into force. Both texts are a great combination of both European and Spanish Law (Directives and national law of Spain). They aim for a harmonic and no contradictory body of rules to govern these products.

A recent emblematic Court decision on this field was passed by the Supreme Court on the 29th of March, 2016. The statements of this Supreme Court decision are being applied by numerous Appeal Courts and Supreme Court itself since then.

The High Court states that contracts with no precise “object: housing unit” or “time: period of enjoyment which needs to be 3-50 years” are null and void. This means, in principle, that a full refund of all payments plus interests to the consumer/user is due.

2 specifications

1) Proportional refund

Supreme Court applying the “corrective” article 3 of our Civil Code, it states that it has to be evaluated that the consumers enjoyed the timeshare scheme for 11 years and therefore “the reimbursement of the paid amounts do not have to be total but proportionated to time it will not be enjoyed, knowing that the legal maximums for these contracts are of 50 years.

Other previous judgments of the Supreme with the same pronouncements are those of January 15, 2015, September 8, 2015 and January 15, 2014.

2) Banks are also liable

Spain Supreme Court has also established, in April 2015, that Financers (Banks, Saving Banks, lenders….) which participated of the business by providing the loans are also under the obligation to refund you.

In our practice almost all contracts signed by timeshare owners coming to the Law Firm for advice are in-existent (null and void) or can be cancelled, in both cases with refund of amounts paid after applying the proportionality rule explained above.

For more info, you can look at CostaluzLawyers Timeshare service

0

Like

Published at 6:04 PM Comments (0)

0

Like

Published at 6:04 PM Comments (0)

Spam post or Abuse? Please let us know

|

|