Legal tip 1308. Paying higher Spanish IHT tax due to being a non-resident? A refund is possible!

Tuesday, June 30, 2015

Our Spanish Constitutional Court has recently declared unconstitutional the requirement of Article 12a of the Valencian IHT Act. This article established a 99% bonus on the taxable amount in the hereditary acquisitions for close relatives of the deceased ALWAYS provided they had habitual residency in Valencia.

This Court decision is in line with the judgment of the Court of Justice of the European Union issued on September 3, 2014 (Case No. C-127/12), in which the Court finds that the Kingdom of Spain has failed to fulfill its obligations concerning free movement of capital by allowing differences in the tax treatment of donations and successions between beneficiaries and grantees depending on residency.

Constitutional Magistrates understand, that residency lacks any legitimizing justification as an element of differentiation and therefore this requisite was not only against principle of equality (Art. 14 Spanish Constitution) but also a breach of fair tax system ( art. 3.3.1. SC)

|

If you paid IHT in Spain during the last four years, a refund claim might be possible if you paid in excess due to being a non resident.

We can check out your IHT payment and advise you on this. Initial appraisal has no charge.

You can send us your story

|

Guadalest, Alicante, Valencia, Eastern Spain

0

Like

Published at 4:19 PM Comments (0)

0

Like

Published at 4:19 PM Comments (0)

MARIA de CASTRO´s Law and Fun in ALCAIDESA

Friday, June 26, 2015

We are planning quarterly gatherings in Alcaidesa , for legal tips and advise and some cultural fun. Starting in October.

Do you want to come?

If so, please email us with some suggestions

La Alcaidesa and Gibraltar (on the left side) and the Bay of Algeciras(on the right side), at the back of the picture. La Alcaidesa and Gibraltar (on the left side) and the Bay of Algeciras(on the right side), at the back of the picture.

0

Like

Published at 11:02 AM Comments (0)

0

Like

Published at 11:02 AM Comments (0)

Legal tip 1306. Banks to refund timeshare claimants

Tuesday, June 23, 2015

You might just want to get out of the eternal scheme that the timeshare linked you to, and in a sense, that would already be a great relief but…….

Know that Spain Supreme Court has recently established that Financers (Banks, Saving Banks, lenders….) which participated of the business by providing the loans are also under the obligation to refund you all amount paids in a null contract.

Spain Supreme Court has very clearly established nullity of timeshare contracts that under legislation in force since 1998 were performed against this in regards to:

- Timeframes ( perpetual schemes are null, maximum is 50 years)

- Object ( Floating, point systems are null: object needs to be on an specific registered estate)

- Quick payments: 3 months have some Courts established as a cooling-off period

Good that Supreme Court is so very well caring for consumers’ protection in an area where illegal contracting was of the essence. Good for Spain and Spain tourism sector

Good for you who have been suffering this illegal tactics and uses.

|

Tell us if you or anyone you know is under the pressure of an illegal Timeshare contract so we can see if we can help you

|

Our email address

The Cathedral of Granada, South eastern Spain

0

Like

Published at 1:18 PM Comments (0)

0

Like

Published at 1:18 PM Comments (0)

Legal tip 1305. NEW! WON CASE AGAINST ZURICH INSURANCE PLC FOR A GROUP OF OFF-PLAN BUYERS FROM THE DEVELOPER INMOBILIARIA NADALSOL S.L. AT MEDINA GOLF RESIDENCIAL

Thursday, June 18, 2015

WON CASE AGAINST ZURICH INSURANCE PLC FOR A GROUP OF OFF-PLAN BUYERS FROM THE DEVELOPER INMOBILIARIA NADALSOL S.L. AT MEDINA GOLF RESIDENCIAL

We were pleased to notify our clients today that Zurich Insurance PLC had lost its Appeal against the First Instance Sentence and that we had won our Appeal regarding the amount of interest awarded. The clients did not receive individual Guarantees from the developer, Inmobiliaria Nadalsol or from the Bank to which their off-plan deposit was paid; however Zurich Insurance PLC had issued a General Guarantee to the developer.

Re: YOUR CASE AGAINST ZURICH INSURANCE PLC

Please find attached Sentence number xxx from the Provincial Appeal Court Section 4 in Granada.

I am very pleased to advise you that the Appeal filed by Zurich Insurance PLC has been dismissed and your Appeal in respect of interest only being awarded from the filing of the Lawsuit has been upheld.

The final paragraphs of the First Instance Sentence delivered on 11 December 2014 and notified on 23 December 2014 stated:

“I estimate the Lawsuit filed on behalf of 7 claimants against ZURICH INSURANCE PLC and condemn the defendant to pay the plaintiffs the amount of 505,959.81 Euro plus legal interest from the date of filing of the Lawsuit until payment in full, with legal costs imposed on the defendant”

Zurich Insurance PLC filed an Appeal against the First Instance Sentence.

We filed an Appeal regarding the interest only being awarded from the date of filing of the Lawsuit. We asked for interest to be awarded from the date the buyers paid to the developer’s bank account.

The final paragraphs of the Provincial Appeal Court Sentence delivered on 29 May 2015 states:

“1. That estimating the Appeal filed on behalf of the Plaintiffs we revoke the First Instance Sentence only in terms of the computing of the legal interest payable. Instead the calculation shall be produced and made from the date each amount was paid to the developers account.

2. We dismiss the Appeal filed by ZURICH INSURANCE PLC and fully confirm the First Instance Sentence with the imposition of the costs of this Appeal on the Appellant”

So the Provincial Appeal Court has dismissed the Appeal filed by Zurich Insurance PLC against the First Instance Sentence.

The Provincial Appeal Court has upheld our Appeal regarding the interest only being payable from the date the Lawsuit was filed. In this respect only, the First Instance Sentence is revoked and interest will now be payable from the date each amount was paid to the developer’s bank account, until full payment to the Court.

The costs in respect of Zurich’s Appeal are imposed on Zurich Insurance PLC.

Interesting statements from the Provincial Appeal Court are:

“The appeal is not acceptable as it favours the Appellant to the detriment of the Plaintiffs who are consumers and may not be affected by any possible breach between the promotor and insurer. According to the provisions of the Ministerial Order of 29 November 1968 the insurer assumes certain obligations when issuing a General Guarantee and should therefore meet the minimum requirements of that standard, which allows it to check the validity of all documentation relevant to the obligation and, in particular, the movements of the aforementioned Special Account.

We must emphasise the protective nature of LEY 57/1968 and complementary regulations, having been expressed by the Supreme Court, that the purpose of this law is to establish general preventative rules ensuring both the real and effective protection of funds paid in advance by buyers of off-plan homes.

The point is not whether the buyers receive individual guarantees, but that the defendant has concluded the insurance required by LEY 57/68, which generates the inalienable rights of the buyers as we have already stated (article 7 of LEY 57/68).

Consequently the original ruling does not incur the alleged violations and the Appeal filed by Zurich Insurance PLC is rejected.

The plaintiff also appealed as they disagreed with the original judgment regarding the awarding of limited interest only from the date of filing of the Lawsuit. While indeed this was an alternative claim contained in the original Lawsuit we have now been asked to consider calculating interest from the date of payment of the respective amounts to the developer’s account.

As for its origin, we must stress that the payment of interest is an obligation imposed by the law, to repay the amounts paid on account plus interest initially imposed by Articles 2 & 3 of LEY 57/68 and then the D.A. First of LOE maintained this but with setting the interest at the ‘legal rate’.

The legal obligation of the promotor or seller who fails to comply with the content of those provisions cannot be interpreted differently and interest will be paid from the date of the respective payments.

This obligation is guaranteed by the Insurance Agreement which is required by LEY 57/68.

Consequently the Plaintiffs Appeal regarding the payment of interest from the date of payment to the developer’s account must be upheld”

Gol "Alcaidesa" and Gibraltar to the bottom, Cádiz, South east of Spain Gol "Alcaidesa" and Gibraltar to the bottom, Cádiz, South east of Spain

1

Like

Published at 8:19 AM Comments (0)

1

Like

Published at 8:19 AM Comments (0)

Legal tip 1304. New Law on Guarantees for off plan deposits coming

Thursday, June 11, 2015

Will keep you updated!

Already approved by Congress, to be ratified or modified by Senate

María

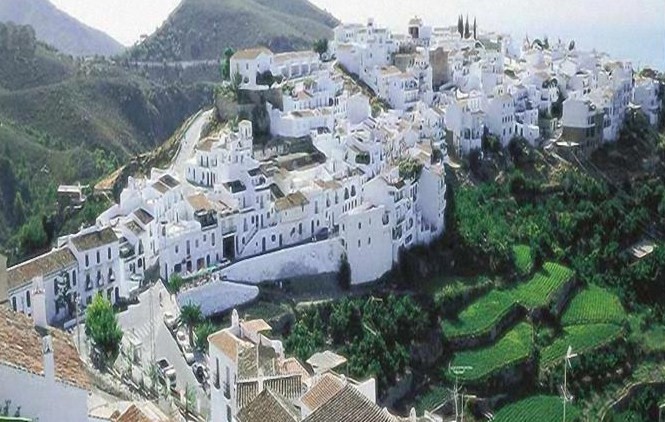

Frigiliana, Málaga, South eastern Spain

0

Like

Published at 3:54 PM Comments (1)

0

Like

Published at 3:54 PM Comments (1)

Legal tip 1303. NEW! Won case in Miraflores and Banco Popular

Wednesday, June 10, 2015

WON CASE AGAINST BANCO POPULAR FOR MIRAFLORES DEVELOPMENT INVERSIONES BUYER AT THE ‘VISTAS DEL LAGO’ DEVELOPMENT

We were pleased to notify our client today that we had won their case against Banco Popular. The client did not receive an individual Guarantee from the developer, Miraflores Development Inversiones or from the Bank to which their off-plan deposit was paid, BANCO POPULAR (formerly BANCO DE ANDALUCIA).

Re: YOUR CASE AGAINST MIRAFLORES DEVELOPMENTS INVERSIONES S.L. & BANCO POPULAR ESPAÑOL S.A.

Please find attached Sentence number XX/15 from the Provincial Appeal Court Section 8 in Cadiz.

I am very pleased to advise you that your Appeal has been upheld and the Sentence issued by the First Instance Court No.2 In Arcos de La Frontera has been reversed in the sense that BANCO POPULAR ESPAÑOL S.A. is now convicted in solidarity with MIRAFLORES DEVELOPMENT INVERSIONES S.L.

The final paragraphs of the First Instance Sentence delivered on 1 May 2014 stated:

“I estimate the Lawsuit filed on behalf of xxxxxx & xxxxxx against MIRAFORES DEVELOPMENT INVERSIONES S.L. and declare terminated the Purchase Contract signed between the parties dated 12 December 2006 and condemn the defendant, MIRAFLORES DEVELOPMENT INVERSIONES S.L. to return to the plaintiffs the amount of xx,xxx Euro plus interest at the legal rate from the date of delivery of those amounts until payment to the Court, plus the costs of these proceedings.

I must acquit and absolve BANCO POPULAR ESPAÑOL S.A. of all claims made against it with the imposition of costs on the plaintiff”

The final paragraph of the Provincial Appeal Court Sentence delivered on 19 May 2015 states:

“That estimating the Appeal filed on behalf of xxxxxxxx & xxxxxxx against the Sentence from the First Instance Court No. 2 of Arcos de La Frontera in Ordinary Trial number xxx/2011, we reverse that Sentence in the unique sense of condemning in solidarity BANCO POPULAR ESPAÑOL S.A. to pay to the Plaintiff the sum of xx,xxx Euro plus interest at the legal rate from the date of payment of that amount until the full payment to the Court.

No special pronouncement in respect of the costs of this Appeal, however we now impose the costs of the First Instance procedure on BANCO POPULAR ESPAÑOL S.A.”

So your Purchase Contract was cancelled in the First Instance Sentence and now the Provincial Appeal Court has ruled that BANCO POPULAR is condemned in solidarity with MIRAFLORES DEVELOPMENT INVERSIONES S.L. to pay you the sum of xx,xxx Euro plus legal interest from the date you paid the amount to the developers bank account, until full payment to the Court.

The costs of the First Instance Procedure are now imposed on BANCO POPULAR.

There was no pronouncement regarding the imposition of costs relating to the Provincial Court Appeal therefore each party will pay its own costs in relation to the Appeal.

Interesting statements from the Provincial Appeal Court are:

“The purpose of LEY 57/1968 is to ensure that the Purchaser is able to recover amounts paid in advance for off-plan properties in the situation where the construction is not started or completed on time. This is a protective norm that has to be interpreted according to its spirit and purpose in a way that ensures the effective return of the amounts paid in advance, assuming the construction is not completed, as also stated in the preamble to LEY 57/1968.

Our Supreme Court is now issuing Sentences interpreting a rigorous and formal attention to the protective nature of LEY 57/1968. Therefore it requires an interpretation consistent with consumer protection.

The requirement that LEY 57/1968 imposes on the Bank is not only to enter the buyers amounts in a Special Account but not to allow the opening of that account without the Guarantees required by the Law, which are imposed ‘under its responsibility’. Therefore, by receiving deposits into the developers account there is a legal obligation on the bank to demand the Guarantees, and if not, then the Bank must respond to the homebuyers with compliance to its obligations under the Law.

This Court, under the principal of consumer protection, considers no legal impediment for not having issued the individual guarantee to the buyers and therefore the bank must assume the obligation to return the amounts delivered.

The Bank knew perfectly well that the developer was constructing a residential complex as the Bank even signed a General Guarantee with the developer and opened an account for the receipt of off-plan funds, but did not require the developer to obtain specific Guarantees for individual buyers.

It is true that Article 1 of LEY 57/1968 refers to the opening of a Special Account and the account used by the developer in Banco Popular was not, but the requirement imposed by the Law when it says that the Bank will require for the opening of this account, and under its responsibility, the Guarantee previously mentioned, cannot be interpreted in a formalistic sense as this would remove the protective standard when the bank knows and allows the use of such an account for the receipt of off-plan funds.

In short, the bank should not permit the use of an account in its entity without confirming that the developer has assumed a legal obligation to effectively ensure the return of the amounts paid in advance by homebuyers. To do so gives rise to the responsibility of the Bank and accordingly we estimate this Appeal”

A street of Arcos de la Frontera, Cádiz, South of Spain

2

Like

Published at 11:21 AM Comments (7)

2

Like

Published at 11:21 AM Comments (7)

Legal tip 1302. Turning my commercial premise into my home

Wednesday, June 3, 2015

Can I turn my commercial premise into my house?

A lovely NY loft style… at a ground floor in Spain!!!!!. Is it legal ?

Supreme Court has recently accepted this as legal. Commercial premises can be turned into a home: with the limitation of obtaining the corresponding license of habitation from the Local Council

Supreme Court has established that the change:

(1) does not alter the community of owners’ shares

(2) does not alter common elements.

Prohibition to this need to be registered in the Land Registry so that it is effective against third parties

Do not forget that:

1) License of habitation is always required.

2) This does not apply for transformation of storage into a home

3) Change can never produce alteration in determining community shares in the Community of owners

4) If there is collective energy expenditure, the change use should not alter volume of use either.

Are you thinking on renovations/refurbishments at home? Our Surveyors/Architect/Lawyers team can provide to you a quote of these services for FREE

Contast us here

Callejón de las Flores, Córdoba, South of Spain

0

Like

Published at 2:46 PM Comments (0)

0

Like

Published at 2:46 PM Comments (0)

Spam post or Abuse? Please let us know

|

|