Legal tip 692. Both useless and unfair

Monday, January 30, 2012

An answers in a question today in the forum:

Dear Mega:

Enforcing these Court decissions against the developer is, in our opinion both useless and unfair:

Useless: Becuase many developers and bankrupted or with bery low solvency rates. Their developed properties all have a preexisting mortgage in favour of a Bank ( which was funding the development) and if entered into Creditor´s meeting your rights are very poorly recognised by the Bankruptcy Act.

Unfair: law 57/68 stablished liabilities for both the developer and ( I would say MAINLY) for the bank which received people´s deposits.

It is a joy that this Law which keeps a pro-consumer, pro-person approach of bank´s rols is active and enforceable in Spain. It gives to us a right and balanced picture ( even much breached) of these businesses where Banks had much to gain and little to risk. They were constituted as guardians of deposits in 1968

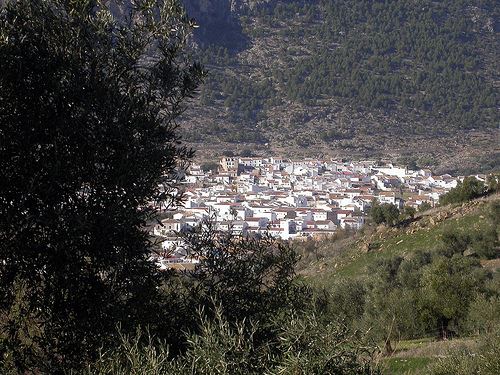

"Street in Algodonales", Cadiz, Spain, by nikosfotos, at flickr.com

0

Like

Published at 3:25 PM Comments (0)

0

Like

Published at 3:25 PM Comments (0)

Legal tip 691. Murcia Appeal Court is clear on publicity as part of the contract

Monday, January 30, 2012

On recent Court decission dated december the 9th, 2011.

It cannot be otherwise as the contrary would be against Law, Supreme Court Case Law and European Law, a recent excellent Court decission by the Murcia Tribunal clearly states that:

"When publicity contains specific and objective data in relation to essential and relevant characteristics of the contract ( STS 26 March 1993 and 28 January 2000) and the date of delivery of property to buyers, according to recent Court decision of the Supreme Court dated 12th of July, this is “ important in an unquestionably way for contract integration as that publicity has been relevant to the making decision process".

This Murcia Sentence is in accordance to Supreme Court decissions of 18th and 20th of March 2002, 15th of June 2000 and 23rd of May of 2003.

.jpg)

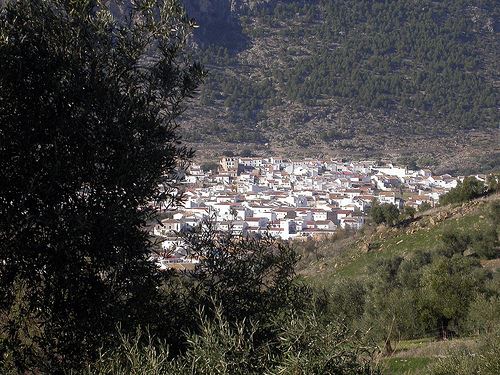

"Algodonales, pueblo aceitero", Cadiz, Spain, by maesejose, at flickr.com

0

Like

Published at 2:12 PM Comments (3)

0

Like

Published at 2:12 PM Comments (3)

Legal tip 690. Re-edited answers for community of owners 4

Friday, January 27, 2012

23.Can I turn my apartment into two? Yes, you can. Flats can be divided and joined, the consent of affected parties and of the Community of Owners by unanimity is needed.

24.Am I fully free to keep my house dirty or un-maintained? No…. you are not, for the common good of the neighbours. If smells, leaks, noises … cause damage to your neighbours, you will have the obligation to compensate them.

25.Should I bear every work agreed by the Community? Of course, you have, even if they limit your ownership rights if they are for the creation of common services of general interests (access to handicapped people, additional elevators for stairs stretches, anti-fire devices….)

26.What if I want my Community mail to be sent to the UK? You cannot receive your community mail in the UK. You need to choose an address in Spain. Your Spanish lawyers´ address may be a good idea as he/she will be ready to oppose anything found illegal in the mail right away! Some foreigners suffer the decline of their rights just because they did not receive a communication or a lawsuit. Some plaintiffs take advantage of this to win judicial cases!

27.Can I communicate the mail address by telephone? No, you need to use a mean which leaves proof of reception: a registered fax or letter most advisably.

28.I have not communicated any special address in Spain. Where is the secretary sending the communications? In defect of any specific mail address, the secretary sends the letters to your apartment located in that Community and if not possible there, he/she places a post in the news board of the building!

Have a joyful weekend!

"Vista general de Grazalema de noche", Cadiz, Spain.

0

Like

Published at 10:46 AM Comments (0)

0

Like

Published at 10:46 AM Comments (0)

Legal tip 689. Re-edited answers for community of owners 3

Thursday, January 26, 2012

13 .My community established additional rules to the Statutes, is this legal?

Yes, owners can establish new rules (always provided they are respectful towards applicable Law). Just majority is needed in these cases.

Nothing against Law, moral or public order can be agreed

14 .What if the rules are against Law?

If a rule is against Law, it is null and void and you are not under legal obligation to obey it.

15.I want to do some refurbishment in my apartment? What do I need to do?

Firstly, go to Town Hall and ask for the corresponding " Licencia de obra menor"

In respect to Community, rest of owners: you just need to communicate it to the President in written.

Every owner can just do building works in his flat or premise, modifying its architectural elements, installations and services, provided:

*The safety of the building, its general framework and its outer configuration and conditions are not altered.

*None of the other owners’ rights are damaged.

16.My community does not allow pets? Is this a legal prohibition?

Community of owners cannot restrict the way you use your private property or the guests you have in it: other way said they have no jurisdiction on your home (thank goodness!).

Decisions by the Community need always to be made just regarding common elements. So the answer is… YES. You can have pets; provided they behave according to the rules of the Community in common areas and they are healthy, safe and innocuous. (can not have a panther for instance).

Owners, in a community meeting, can agree for tenants not to bring pets, but can never impose restrictions to your ownership rights.

17.But what if a neighbour has a dangerous animal or has a pet in unhealthy conditions?

After reporting it to President, for an amicable solution, you can also report it to the Police and the Health Local Authorities, which can oblige the owner to “relocate” the funny animal out of the Community.

18.Can the community prohibit me to walk my dog through the common elements?

No, they cannot. Always the dog performs in healthy, safe and innocuous condition. They can ask you to always walk your dog tied up as a matter of safety or health and/or clean if he/she…"burn ...” or “water...”

19.What can we do if an unhealthy behavious by an animal persists in the Community?

The President of the Community of Owners either by own initiative or by the initiative of any of the owners or users, must request the owner to stop the facts and inform that person about the legal actions against him/her that might be started if the behaviour is not stopped.

If the offender persists doing it, the President, once authorised by the committee of owners, can call the Police and local health authorities.

20 .What if the problem is a noisy baby?

Babies cry and it is unavoidable. There is nothing to do but use ears blockers or... offer some help to those busy parents.

21.What if an owner plays music very high?

Disturbing=illegal. The president can ask him to stop and if persisting can call the Local authorities for a stop.

22.Can a Judge ask the owner to compensate damages?

Of course yes, if a judicial procedure is needed to stop an illegal activity, the Judge can order:

- The offender to stop the forbidden activity once and for all.

-The offender to compensate the Community for the produced damages.

-The offender to be deprived of the right to use the house or premise for a period no longer than three years.

"Grazalema y su iglesia principal de noche", Cadiz, Spain.

0

Like

Published at 6:16 PM Comments (0)

0

Like

Published at 6:16 PM Comments (0)

Legal tip 688. Good quote at the FT for thinking

Wednesday, January 25, 2012

http://www.ft.com/cms/s/0/2f0babbe-3e30-11e1-ac9b-00144feabdc0.html#ixzz1kT9MkTM5

"As a result, consumers and investors are doing increasingly well but job insecurity is on the rise, inequality is widening, communities are becoming less stable and climate change is worsening. None of this is sustainable over the long term but no one has yet figured out a way to get capitalism back into balance. Blame global finance and worldwide corporations all you want. But save some of your blame for the insatiable consumers and investors inhabiting almost every one of us, who are entirely complicit."

The writer is a professor of public policy at the University of California at Berkeley, and was US secretary of labour under President Bill Clinton

.jpg)

"Algodonales 2009", Cadiz, Spain, by Tom@There, at flickr.com

0

Like

Published at 1:47 PM Comments (0)

0

Like

Published at 1:47 PM Comments (0)

Legal tip 687. Re-edited answers for community of owners 2

Wednesday, January 25, 2012

5. Do I own some of the common elements?

Yes you co-own them. You are the exclusive owner of your apartment and co-owner of the common elements: stairs, patios, yards, entrances, elevators, structural elements, power supplies´ installations, pools, gardens, tennis courts, common facades, roof…

6. How do I know which are "my" common elements of my Community of Owners?

The chart of individual and common elements is a Notary deed, the deed of Horizontal division which is granted when the building is finished. It is kept by preident/ administrator and the Notary. You can ask for a full copy of it if you want.

It is a document which describes the building as a general unit and every flat or premise individually, with indication of surface, floor and annexes such as parking garages, attics or storage rooms.

7. So, as I am a co-owner, can I freely allot some of them for my privative use?

Unfortunately not. Co-ownership on these just implies you need to maintain them (there the community of owners quota) and you need to be asked on any alteration of them. Of course you can also make a commun use of the same ( pools, tennis courts...) according to the internal rules of the Community which are agreed by all owners.

8. Oh well... how is that quota calculated?

Every apartment or premise has a quota or share of ownership (cuota de participación) of the total value of the building, which is the scale to determine the percentage on the community expenses to be paid by each owner.

The proportional share of every flat or premise is fixed having as the calculation base, the net usable area of every flat or premise in relation to the whole building, its interior and exterior location, situation, and the kind of use of common elements that the owner is supposed to be doing in the future.

9. What if I do not agree with the quota assigned to me?

You can of course analise how it was calculated and challenge it before the Community of Owners. You can also go to Courts if they keep " overcharging you".

10. How can I know where are the legal rules of the Community? I do not want to obey too many rules...

That Notary chart, the horizontal division deed, also has certain regulations ( called Estatutos) of the building use, its flats and premises, installations and services, expenses, administration, maintenance and repairs. Every new owner will be bound automatically by them and the decisions legally taken at previous meetings.That´s the reason why it is very advisable to read previous rules before buying a property: for instance:on the allowance of pets, smokers... Any addittional set of internal rules can be democratically passed by owners legally constituted.

11. Where can I know of previous decisions made by the Community of Owners?

The minutes of the Meetings of the Community are kept by the President or Administrator.

12. Can stupid rules be removed?

Of course yes but you need the unanimous consent of all the owners if they are part of the Statutes and the majority if they are part of additional internal rules.

"Algodonales main square.The preparations for the Carnival are underway", Cadiz, Spain, by gunnsteinlye, at flickr.com

0

Like

Published at 9:17 AM Comments (0)

0

Like

Published at 9:17 AM Comments (0)

Legal tip 686. Re-edited Answers for community of owners 1

Thursday, January 19, 2012

Some answers:

1) It is NOT possible to register a Community debt against a property at the Land Registry in Spain:It is possible once approved the preventive seizure of goods by the Judge.

2) Someone asked about virtual meetings. They are possible if the system can prove the real identity of owners or proxies.

3) If a Community may not deprive a debtor of the use of communal facilities, may debtors be deprived of the use of a communal facility upon which major expenditure has been made since they have not been paying their dues?

If the expenditure has been made to keep the commun use he cannot be deprived, if the expenditure is a improvement he can.

Section 11

1. No unit owner may demand new installations, facilities, services or improvements not required for

the correct maintenance, habitation, safety and accessibility of the building, in accordance with its nature

and characteristics.

2. Where resolutions are validly adopted to carry out improvements that may not be imposed in

accordance with the provisions of the last preceding subsection and whose cost of installation exceed the

ordinary common expenses for three months, dissenters shall not be bound, nor their fee modified, even

where they cannot be deprived of the improvement or benefit.

If dissenters wish at any time to take advantage of the benefits of the innovation, they shall have to share in

the cost of installation and maintenance, duly updated by application of the legal interest rate.

3. Where resolutions are validly adopted to carry out work to ensure accessibility, the community

shall be obliged to pay the cost even where it exceeds the ordinary common expenses of three months.

4. Innovations impeding or barring any unit owner from using and enjoying any part of the building

shall require, in any case, the express consent of such owner.

5. Special assessments for the implementation of improvements made or to be made in the building

shall be at the expense of whoever is the unit owner at the moment when the amounts corresponding to

such improvements become due.

4) There is something about that in the Horizontal Property Law, but could it be applied to major repairs to an existing facility? This is an obligation of the community and the non payer owner can have a charge on his property due to the lack of payment of these. You can use arbitration ( much advised) to solve possible discrepancies.

Section 10

1. The community is obliged to carry out work necessary for the proper upkeep and maintenance of

the building and its facilities in order to preserve appropriate conditions as regards its structure,

imperviousness, habitation, accessibility and safety.

2. The community, at the request of owners of units in which persons with disabilities, or persons

over the age of seventy, live, work or render voluntary or altruistic services, is obliged to carry out work to

permit accessibility to and use of common elements in accordance with the disability of said persons, or

work to install mechanical and electronic devices favouring their communication with the outside, provided

the total cost of such work does not exceed the ordinary common expenses of three months.

3. Unit owners exercising opposition to or causing delay of the execution of orders decreed by the

appropriate authority shall be held accountable individually and be subject to administrative sanctions.

4. Discrepancy concerning the nature of works to be carried out shall be resolved by the owners’

general assembly. The interested parties may also apply for arbitration or for a technical opinion in the

terms established by law.

5. The obligation to satisfy expenses arising from maintenance and accessibility work herein stated

shall be attached to the unit in the same terms and conditions as those established in section 9 for general

expenses.

"Algodonales from the main takeoff at Sierra de Lijar", Algodonales, Cadiz, Spain, by gumnsteinlye, at flickr.com

0

Like

Published at 9:24 AM Comments (2)

0

Like

Published at 9:24 AM Comments (2)

Legal tip 685. Taxes in rentals with option to buy

Wednesday, January 18, 2012

It depends on the way the contract is agreed, there is NOT just ONE formula for this type of agreements but can be tailored according to parties wishes:

-If you pay an initial amount for the option, this and rentals will be taxed with VAT 18%. Once the option is exercised, you will substract the amount paid at the beginning and will pay either transfer tax or VAT- depending on first of subsequent transmissions- at the applicable rate ( 4% or 7%)

- Same if you pay nothing at the beginning but the contract clearly stablishes that rentals will be counted as part of the price if the option is exercised.

- If the contract states that amounts are partially rent and partially will be considered part of the price. Each part will tribute correspondingly ( rentals- 18%,part of the price 4% or 7%). If the option is not finally exercised the taxpayer will be reimbursed the amounts paid as part of the price and its corresponding taxes.

.jpg)

"Algodonales, pueblo aceitero", Cádiz, Spain, by maesejose, at flickr.com

0

Like

Published at 11:47 PM Comments (0)

0

Like

Published at 11:47 PM Comments (0)

Legal tip 684. Unanimity in Community of Owners

Wednesday, January 18, 2012

In the Spanish Horizontal Property Act a valid unanimity is that of owners present in a Community of owners meeting, being enough quorum, and the meeting being validly called

Not all the members need to be present, but all need to have been validly and legaly called.

.jpg)

"Algodonales 2009", Cadiz, Spain, by Tom@There, at flickr.com

0

Like

Published at 11:44 PM Comments (1)

0

Like

Published at 11:44 PM Comments (1)

Legal tip 683. I like Arenas´programm for government

Tuesday, January 17, 2012

Among other proyects, it contains:

- Promotion of Andalucía as the best residential area of the European Union.

- Enhancement of tourism, agriculture and residential areas.

- Support to SMEs, freelancers, youth and employment: elimination of bureaucracy and the creation of "express license", which will reduce to 24 hours the required procedures to set up a company. Tax deductions and credits for hiring young people and promotion of internationalization of SMEs.

-Arenas also pledged to eliminate Inheritance Tax gradually over four years.

-Announced a bill to tighten budgetary discipline conditions of government spending.

- Remarked importance of democratic regeneration: recovery of basic democratic values

Commun sense and simplicity... I do like it!

.jpg)

"Sierra Nevada", Granada, Spain, by Sergio.Poppi, at flickr.com

0

Like

Published at 8:51 AM Comments (0)

0

Like

Published at 8:51 AM Comments (0)

Legal tip 682. Banks need to pay Community of owners fees

Saturday, January 14, 2012

From the Forum today:

Do Banks have a legal obligation to accept ALL debts relating to the property upon repossession and become liable for those debts, even if there is an outstanding mortgage?

Not all debts but those with the Community of owners corresponding to year of repossession and year before. Rights linked to the outstanding mortgage will be realised by the Bank by public auction: they will be recovering all or a substantial amount of the debt through this.

Obligations of the new owner ( bank is the owner of those properties in the interim from repossession to adjudication in public auction) needs to be covered irrespective of outstanding mortgage. These are two different legal concepts which do not interfere one with the other.

Where does Spanish Law stand on this? Obligation of new owner with Community of owners is stated in provision 9.1.e of the Horizontal Property Act. New owner owes to pay any outstanding debt of year of acquisition and previous

Also in the case of claims against individual owners who refuse to pay their debts, isn’t there a small claims route that can speed up this process for communities (and also prove more cost effective?) Yes: the monitorio is a small claim procedure, unfoatuantely not too effective and quick. Hope new government with the announced reforms of Justice change this.

It appears so unfair for communities to be continually burdened by these debts and the costs involved in gaining recompense. Is this yet another area where consumer protection is lacking in Spain and needs to be reviewed? It is not a matter covered by Consumers Law but it certainly needs Judges to consider that Banks are acquisitors of properties since embargo and therefore their obligations to pay start then.

.jpg)

"Sierra Nevada", Granada, Spain, by enric archivell, at flickr.com

0

Like

Published at 11:53 AM Comments (0)

0

Like

Published at 11:53 AM Comments (0)

Legal tip 681. Debt reductions by Banks

Thursday, January 12, 2012

Lindorff Group, who bought in 2011 a big bunch of bad credits from Banco de Santander has started to accept debt reductions when an individual person is under the protection of a judicial creditor´s meeting

As my admired colleague Carlos Guerrero expects, I do expect too for other Banks to start doing the same....

Cheer up!

Maria

.jpg)

"Atardecer en Sierra Nevada", Granada, Spain, by Landahlauts, at flickr.com

0

Like

Published at 6:23 PM Comments (0)

0

Like

Published at 6:23 PM Comments (0)

Legal tip 680. Friend Sarah Schaeffer on Spanish Banks buildings

Wednesday, January 11, 2012

Spanish Banks Try to Build Their Way Out of Home Glut

By Sara Schaefer Muñoz And Ilan Brat

MADRID—On a weedy dirt lot here, lender Bankia is pursuing its answer to a banking and property crisis that has left Spain with a glut of around one million vacant homes. Its approach: Build even more.

Bankia and a local developer plan to build a 212-unit housing complex featuring a gym and movie theater on the central Madrid site where a bus station once stood. Construction begins early this year, even though sales of existing properties are practically nonexistent and only 45 of the planned new units have been sold in advance.

"The market is at a standstill," said César Cabal, a real-estate broker working with the developers.

The drive to keep building in a housing market drowning in empty properties shows the depth of Spain's banking crisis. The country's housing bust saddled banks with not just vacant homes, but also billions of euros worth of undeveloped land.

Yet rather than writing off the land as a loss and attempting to sell it, Bankia and its peers have begun selectively building on empty lots. In some cases there are buyers lined up but in other cases there aren't.

A Bankia spokesman said the bank is building only in high-demand areas, like central Madrid, and that the new projects are a smart way to give a dud asset new value.

There were about 700,000 vacant newly built homes at the end of 2010, the most recent numbers available, according to Spanish government figures. Including repossessed properties, some economists and real-estate consultants estimate the total could be as high as one million, or even 1.5 million. There were 19,457 housing starts in the third quarter of last year, down 7% from the second quarter and down 5% from the year-earlier period. Ernesto Tarazona of consultant Knight Frank España SA estimates that Spanish banks and cajas will develop 5,000 to 6,000 new units in the next two years.

Lenders are hoping that the moribund Spanish property market will pick back up. But that is hardly a sure thing in a country with more than 22% unemployment and uncertain growth prospects.

Banks are trolling for foreign buyers, and last year—with Spanish officials in tow—they went on property roadshows in the U.K., the Netherlands, Germany and Sweden. They served wine and Spanish ham, and pitched Spain's sunny climate and relaxed lifestyle.

Even meager home sales could benefit certain lenders in Spain. But there are concerns that building more homes will drive prices down further, compounding the problems of the housing market, and by extension, the banking sector.

Since its property bubble burst in early 2008, the Spanish financial sector has been dogged by fears that it has put off doing a deep clean of the estimated €176 billion ($224 billion) in troubled assets sitting on its books. Banks have set aside funds to cover about a third of that amount.

The Bank of Spain has forced a wave of bank consolidation and recapitalization, resulting in new entities like Bankia, created by the forced merger of seven regional savings banks. Over the past two years, Spain has injected a total of €22.3 billion into its banking sector, from the state or its deposit guarantee fund, and dodged the market cross-hairs as concerns about euro-zone debt shifted to Italy.

Spain's new finance minister, Luis de Guindos, said earlier this month the sector will need an additional €50 billion to swallow losses on its bad property holdings. Eager to avoid a state-financed bailout, Mr. Guindos said the money would come from banks' own profits over several years, after another round of mergers in the sector.

But some economists fear such moves still don't go far enough. Unless the now-struggling banks start generating enough profits to absorb these losses, the sector could face a state-backed or international bailout, said José García Montalvo, an economics professor at the University of Pompeu Fabra in Barcelona.

"Spain's strategy has been 'wait and see. We'll inject money but little by little,'" said Mr. García Montalvo. "We are no longer in 'wait and see.' Now we are in 'wait and pray.'"

The same drawn-out approach to bank woes has been seen elsewhere in Europe. French banks fought for several years to avoid shoring up their loss-absorbing buffers. But worries about their health have persisted, hitting their share prices hard and restricting their access to funds.

Even if the Spanish government wanted to intervene, it has become very expensive to do so. Spain has been paying a record premium on its debt and would have much more difficulty raising needed funds that it would have had even six months ago. The interest rate it must pay its borrowers has hovered between 5% and more than 6% in recent months, close to an unsustainable level of payments for the government in the long term.

Problems with property exposure have plagued Spain's banks since its housing boom began to collapse in 2007. The year before, Spain built more housing units than Germany, the U.K. and Italy combined, according to data from the European Mortgage Federation.

Especially hard-hit were Spain's regional savings banks, known as cajas de ahorro—or savings boxes. Local lenders often controlled by regional politicians or even the Catholic Church, they lent heavily to local construction firms and projects.

When the market crashed, the banking sector acquired €60 billion in properties, either through repossession or assets required in exchange for debt forgiveness. Savings banks were particularly saddled with these assets: They own €40 billion of the total, according to government and bank data.

In the past two years, the former government of Prime Minister José Luis Rodríguez Zapatero made strides in addressing the issues through broad reforms in Spain's financial sector. The government shepherded the consolidation and strengthened the savings banks, shrinking the number of players as stronger ones merged with weaker ones.

Some investors remain skeptical. Graham Neilson, chief investment strategist at Cairn Capital Ltd., a London-based fixed-income asset manager, said many banks still are carrying real estate at unrealistic valuations on their books. "Some of these assets are close to worthless but have not been marked as anywhere near to that," he said.

Problems have continued to emerge. The Bank of Spain took over troubled lender Caja de Ahorros del Mediterraneo in July, and in December the government decided to inject several billion euros from the Spanish bank insurance fund to help ease its sale for a single euro to Banco de Sabadell SA. In early December, it nationalized Banco de Valencia, infusing a lifeline of €1 billion.

Analysts and investors say that the practice of building on empty lots is one among several moves that have helped banks obscure the size of inevitable losses. They say that banks also have been refinancing loans to developers that in many cases have little hope of paying them back.

Spain's banks have €338 billion in exposure to the real-estate sector, mostly through loans to developers, according to Bank of Spain data. This number has hardly budged in the past three years, despite a wave of developer bankruptcies following the property market decline.

Joaquín Maudos, a professor of economics at the University of Valencia, said that statistic indicates banks are continuing to refinance loans, instead of writing them off. "They are putting makeup on these bad loans," he said.

A division of Sergesprom 2000, a struggling midsize developer in Catalonia, is one example. It received about a €30 million loan from a local savings bank to build 200 homes during the property boom. But the market collapsed, and Francisco Gómez, the building firm's chief executive, said he hasn't been able to sell the homes, or even pay interest on the loan, for the past three years.

Instead of foreclosing, he said the bank—which he won't name—has been lending him more money to cover the interest payments, adding an extra €3 million to the total debt. Mr. Gómez isn't confident he can pay it off. He has said he has been "on my hands and knees to ask the banks to please give me work" completing unfinished homes the banks have repossessed.

A spokesman for CECA, Spain's savings-bank association, said that some developers still have some ability to pay. "We're in a down cycle right now," he said. "These things take time."

A Bank of Spain spokesman said it doesn't permit banks to disguise bad loans in any way, and has strict rules that require disclosure and funds to be set aside cover such loans.

Things were looking up at the beginning of last year, with a 32% increase in foreign investment in Spanish property. But now euro-zone fears have taken a deeper hold on the continent, and buyers have pulled back. Home sales were 81,310 units in the third quarter, down 2.6% from the previous quarter, and down 34% from a year earlier, according to Spain's national institute of statistics. The situation is growing still worse, as cash-strapped Spaniards have trouble paying their mortgages.

Home repossessions totaled 10,869 in the third quarter, up 14.2% from the period a year earlier, according to data from Spain's courts.

Selling down banks' housing inventory "is like bailing out a boat as more water is coming in," said Robert Evans, a real-estate agent for several Spanish banks.

Yet banks are building in strategic spots, where they say there is more demand. Banco de Sabadell, a midsize lender based in Barcelona, is building or planning to build 50 new construction projects, and also funding the completion of 150 projects that developers wouldn't have otherwise finished because of slack demand, said Salvador Grané, director of the bank's real-estate division. Meanwhile smaller Banco Pastor is working on five new apartment buildings around Madrid and the northwest.

Mr. Cabal, the real-estate broker, is pitching properties for the Bankia project in central Madrid. The bus-station location sits near the intersection of two freeways, and homes will have features like floorboard heating systems and a device that can automatically draw the blinds, start the clothes washer or call the fire department. The bank is selling them for about €4,500 a square meter and sharing the proceeds with the developer.

"People are hiding their money under the floor boards, and they won't take it out until things are better," Mr. Cabal said. "With the euro fears, we're all scared stiff" about whether the homes will sell.

In some instances, banks are waiting until they have lined up buyers before starting construction. Banco Pastor took possession of a parcel in one of Madrid's upscale districts in 2008. It is now continuing to round up home buyers for Mindanao House, with 104 of its 130 apartments spoken for. It started construction early last year, when about 50 units were already spoken for.

In all, Banco Pastor is involved in building or completing 10 projects assessed at €160 million. The bank and clients are putting up an additional €35 million to build and finish the structures.

This year, Pablo Rodríguez-Losada, Banco Pastor's director of real estate, says the bank plans to put into motion another €150 million worth of its land portfolio.

Mr. Rodríguez-Losada says market studies have shown there is a demand from well-off buyers for high-end new housing in and around big cities.

As the new homes go up, older developments languish. The Valcastillo development in Pioz, northeast of Madrid, comprises about 500 homes on the outskirts of town that were built by a developer at the height of the boom. Yards in the developments are overgrown with weeds, metal sockets have been torn out, and plaster is crumbling off brick walls.

About half of the Valcastillo homes are occupied. For two years, Manuel García of real-estate agent Básico Homes has been trying to sell 108 of the rest.

The bank that owns them, Grupo Caixa Catalunya, contracted Mr. García's company to help sell the empty homes. The initial developer had been pitching them for €169,000, but Básico thought they would move if priced under €120,000. The plan at first was to sell the homes at around that price and then slowly raise it as demand grew, unloading all the property in two years, he says.

"It was optimistic," says Mr. García. So far, he has only sold 27 homes.

Write to Ilan Brat at ilan.brat@wsj.com and Sara Schaefer Muñoz at Sara.Schaefer-Munoz@wsj.com

.jpg)

0

Like

Published at 8:42 PM Comments (0)

0

Like

Published at 8:42 PM Comments (0)

Legal tip 679. Measures for trust on Banks

Tuesday, January 10, 2012

Spain´s National Share Market Commission (CNMV) is making a close control on Banks and Savings banks´ accounts, especially on information regarding exposure to sovereign bonds, corporate shares strategy or valuation of assets.

Both these efforts and those other ones for a higher control by Bank of Spain are welcomed by investors.

Prevention, control, measure, regulations are great ingredients to enhance investors´trust. Much of what we need.

During all these years of fights for the Finca Parcs clients, and in relation to some other similar situations, I have been able to contrast the role of our central bank with other ones such as the UK one, mainly through my conversations with Keith Rule, the coordinator of the Bank Guarantees in Spain petition, being alerted on how ridiculously low was the power that Bank of Spain was able to display on financial entities.

It seems this is changing now.

.jpg)

"Sierra Nevada", Granada, Spain, by JEspi, at flickr.com

0

Like

Published at 11:08 AM Comments (2)

0

Like

Published at 11:08 AM Comments (2)

Legal tip 678. Chattels left by tenants are now mine

Tuesday, January 3, 2012

After the tenant is being evicted by Courts, or just leave the house, all chattels left there are considered as "abandoned" and the owner of the property can do whatever he decides with them.

.jpg)

"Sierra Nevada", Granada, Spain, by Jexweber.fotos, at flickr.com

0

Like

Published at 4:16 PM Comments (0)

0

Like

Published at 4:16 PM Comments (0)

Legal tip 677. European banks made the Spanish greed. Spain Off plan: perfect business for European Banks

Tuesday, January 3, 2012

Someone on the forum has been recently asking why it is so difficult to obtain the refund of your money despite a case being won:

It is simple. Because individual certificates of bank Guarantees were not delivered to off plan buyers, these, when claiming had to start with an action against the developer and try to obtain the refund out of developers´assets. Very difficult and very unfair. Perfect situation for Banks which enjoyed a perfect business with no risk for years.

Very difficult: If developer is bankrupted, liquidated or repossessed, ( in most of the cases pressurised by Banks), the effective enforcement of the Court decission against the developer gets an almost impossible exercise.

At the end, developers made some earnings but in depth were just the silly tool by which Banks kept high the lending levels of those years ( a necessary instrument). In many cases, same Bank officers left Bank jobs to start development companies in Spain. No casuality.

Very unfair: Becuase Law provides an automatic instrument for inmediate refund in these cases: Bank Guarantees or Insurance Policies whose existence,banks receiving deposits for off plan business had to controll, under its liability.

If the individual certificates of Bank Guarantees had been provided the refund would have been an easy, almost instantaneous exercise. But Banks did not want to put things that easy or that legal. They wanted the whole business from themselves. We all know now. Spanish Banks had lots of availability for European money which run in businesses where Consumers guarantees were not protected, against what Law required as irrenouncable rights of individual people.

In Spain, due to great Law 57/68, there is existing case law condemning Banks who issued bank Guarantee and did not provided the individual certificates to buyers. The best punishment against what it was for banks during a long decade ( both spanish and europeans) a golden an illegal business.

But... what if general Bank Guarantees do not exist? In our opinion, provision 1segundo of Law 57/68 and also professional indemnity of lawyers should cover this.We will comment more extensively about this tomorrow.

.jpg)

"Sierra Nevada", Granada, Spain, by Jexweber.fotos. at flickr.com

0

Like

Published at 2:02 PM Comments (4)

0

Like

Published at 2:02 PM Comments (4)

Spam post or Abuse? Please let us know

|

|