Financial Times praises Spanish Bank System

Tuesday, September 30, 2008

Not many banks have emerged from recent events with their reputations intact. Santander might be the exception that proves the rule.

A decade ago the bank was barely known outside Spain’s business community or Latin America. Now it is emerging as one of the more savvy survivors of Europe’s banking storm.

Not only is Santander snapping up cut-price assets (such as the juiciest parts of Bradford & Bingley) but it has also avoided the credit horrors that have triggered the humiliation of so many other mighty European names.

And while that sunny vista might yet change – after all, not even bankers seem truly to know what their banks hold these days – Santander’s run looks doubly remarkable given that Spain is in the aftermath of a property boom.

So what lies behind Santander’s seeming escape? In part, the persona of Emilio Botin, its chief executive, who has a reputation for being extraordinarily shrewd. However, another more interesting issue revolves around the way that Madrid runs its banks.

One key factor protecting Santander from some of the global woes is the tough approach that the Spanish central bank has taken towards regulating its banks in recent years.

Earlier this decade the central bank in essence decided it disliked the idea of banks keeping vast quantities of credit assets off their balance sheets. It also quietly demanded that banks hold higher levels of reserves than international accounting laws required.

Consequently, it furtively “gold plated” – or rewrote – European Union rules to discourage Spanish banks from creating entities such as structured investment vehicles (SIVs). And when banks such as Santander embarked on an acquisition spree in Mexico, the central bank reined them back.

When the central bank initially took this stance, it looked pretty odd. After all, in the early years of this decade institutions such as the Federal Reserve were convinced that banks could hold less capital than before because innovation had made them less exposed to credit risk.

However, Spain had experienced a searing domestic banking crisis two decades earlier and its central bank was consequently risk averse. It was also more willing to be maverick than, say, the Germans.

None of this guarantees that Spain will escape the credit crisis unscathed. A domestic property bust is always painful.

However, Madrid’s conservative stance has helped to cushion the blow of the storm. And that highlights some interesting lessons. First, it shows some of the wisest financiers are those who have experienced shocks.

Second, Spain’s story shows it pays for small countries to challenge the dominant global consensus from time to time.

But third, the Spanish tale shows the benefit of having central banks involved in regulation. In recent years other European banks have also become uneasy about trends in the global banking world; look at statements made by Jean Claude Trichet, ECB president, last year. Yet Mr Trichet could never turn this vague alarm into tangible controls since the ECB did not oversee the banks.

However, as the storm grows worse in Europe’s banking world it is becoming clearer that this state of affairs will need to be reviewed. And one place to start any debate might be with an examination of why some banks are going bust – but some, such as Santander, notably are not.

From The Financial Times Limited 2008

By Maria L. de Castro

web@costaluzlawyers.es

www.costaluzlawyers.es

0

Like

Published at 11:04 PM Comments (0)

0

Like

Published at 11:04 PM Comments (0)

Teo: the typical spanish kid

Tuesday, September 30, 2008

http://www.planetadeagostini.es/coleccionable/Biblioteca-Teo---Enero-2007.html

Teo, the simple, cotidian spanish boy!

A great treasure to bring to your kids if they want to get acquainted with a typical spanish kid.

By Maria L. de Castro

web@costaluzlawyers.es

www.costaluzlawyers.es

0

Like

Published at 10:07 PM Comments (4)

0

Like

Published at 10:07 PM Comments (4)

The promise of politics

Monday, September 29, 2008

0

Like

Published at 9:17 PM Comments (0)

0

Like

Published at 9:17 PM Comments (0)

Jarrea, jarrea

Monday, September 29, 2008

0

Like

Published at 6:13 PM Comments (0)

0

Like

Published at 6:13 PM Comments (0)

Whale watching in Tarifa.

Saturday, September 27, 2008

0

Like

Published at 11:33 AM Comments (0)

0

Like

Published at 11:33 AM Comments (0)

For your fridge: as a courtesy of Costaluzlawyers

Friday, September 26, 2008

|

Teléfonos de emergencias en España

Emergency phones in Spain

|

|

Service

|

Phone Number

|

|

Emergencias

Emergencies

|

112

|

|

Guardia Civil

Guardia Civil (Security Body)

|

062

|

|

Policía Nacional

National Police

|

091

|

|

Policía local

Local Police

|

092

|

|

Bomberos

Firemen

|

080 o 112

|

|

Ambulancias

Ambulances

|

061 o 112

|

|

Protección Civil:

Civil Protection (National Organism for Citizenship Safety)

|

1006

|

|

Cruz Roja Emergencias

Red Cross Emergency

|

901.222.222

|

|

Teléfono contra los malos tratos Mistreatment

|

016

|

|

Policía Autonómica:

Regional Policy:

|

|

|

Mossos d'Esquadra (Cataluña):

|

088

|

|

Ertzaintza (País Vasco):

|

112

|

|

Policía Foral (Navarra)

Navarra Police

|

112

|

|

Instituto nacional de toxicología National Institute of Toxicology:

|

Phone:91 562 04 20

Fax: 91 563 69 24

http://www.mju.es/toxicologia/intframe.html

|

|

It seems that 112 is quite a common good option....

|

( From http://es.wikipedia.org/wiki/N%C3%BAmeros_de_tel%C3%A9fono_de_emergencias#Tel.C3.A9fonos_de_emergencias_en_Espa.C3.B1am)

0

Like

Published at 4:33 PM Comments (0)

0

Like

Published at 4:33 PM Comments (0)

Alcaidesa Marina will be a leader nationally and internationally

Friday, September 26, 2008

Yesterday, the 25th of September, first stone of the project was placed

- Alcaidesa Marina will be a leader nationally and internationally

Manager of Alcaidesa, Juan Ignacio Jiménez

"Alcaidesa Marina will be a leader nationally and internationally"

The building work on Alcaidesa Marina has got underway following the signing in late july of an agreement between the Alcaidesa and Ferrovial companies. The general manager of Alcaidesa, Juan Ignacio Jiménez Casquet, provides us with all the details on this ambitious project.

-

-

By Maria L. de Castro

-

web@costaluzlawyers.es

www.costaluzlawyers.es

- descarga pdf

0

Like

Published at 3:38 PM Comments (0)

0

Like

Published at 3:38 PM Comments (0)

Situation of the world financial system and its effects on the European economy

Thursday, September 25, 2008

Joaquín Almunia

European Commissioner for Economic and Monetary Policy

Situation of the world financial system and its effects on the European economy

European Parliament Plenary Debate

Brussels, 24 September 2008 |

|

| Reference: SPEECH/08/456 Date: 24/09/2008 |

|

|

|

|

SPEECH/08/456

Joaquín Almunia

European Commissioner for Economic and Monetary Policy

Situation of the world financial system and its effects on the European economy

European Parliament Plenary Debate

Brussels, 24 September 2008

Many thanks Mr. President,

Ladies and Gentlemen,

The series of events we have witnessed in financial markets during the last year, and in particular during the last few days, are of a magnitude that exceeds anything we have seen in our lifetime. Many believe, and I tend to agree, that this will trigger important changes in the functioning of the international financial system.

Since the outbreak of the crisis in August 2007, disclosed losses have totalled more than 500 billion dollars, a sum equivalent to the GDP of a country like Sweden. And unfortunately the final figure is considered to be larger still.

The acceleration of declared losses in the US during the last few weeks, and the subsequent decline in investor confidence, has pushed several major financial institutions to the brink of collapse. In cases where the fall of one of these institutions would have implied a systemic risk, that is to say, put the entire financial system at risk, emergency rescue operations have been required.

Some of these rescue operations took the form of public interventions, such as those carried out by the US Treasury and the Federal Reserve to avoid the bankruptcy of the world's largest insurance company, AIG, or of the mortgage financiers Fannie Mae and Freddy Mac, that together underwrite half of all mortgages in the United States.

Others took the form of private takeovers, such as the purchase of the investment bank Merrill Lynch by Bank of America.

For others like the case of investment bank Lehman Brothers or almost two dozen US regional banks, bankruptcy was the only option possible. In short, we have witnessed an extraordinary transformation in the US banking landscape.

Consequently we have reached a point where the US financial system is facing a substantial confidence problem. At this juncture, according to the US authorities, a series of bail outs is not the answer anymore. A systemic solution is urgently needed.

In the short term, we all need a response that will restore confidence and stabilise markets.

The US plan announced by Paulson last week is a good initiative. In short, the US Treasury Secretary proposes to set up a Federal fund to remove from the banks balance sheets the illiquid assets – those mortgage linked securities that are at the root of the problems we face. Removing these from the system would help to remove uncertainty and re-focus markets on fundamentals.

However, the details of this proposal need to be properly defined – and quickly – if it is to succeed.

I should say that we are talking about a US plan, adapted for circumstances in the United States, where it should be recalled, the crisis originated and where the financial sector has been most severely affected.

But we all have to analyse why this has happened, we all have to cope with the consequences and react to the present situation.

To do this, we first have to understand how we arrived at this point.

The origins of the turmoil we see today lie in the persisting global imbalances in the world economy which created an environment of high availability of liquidity and poor assessment of risks.

The interconnectedness of global financial markets, the high level of leverage and the use of innovative and complex financial techniques and instruments, which were only poorly understood, caused this risk to spread across the international financial system on an unprecedented scale.

What is clear is that market participants, but also regulators and supervisors were unable to properly understand the risks of this situation and therefore could not prevent the consequences that we see today.

True, in the months leading up to the crisis the IMF, the ECB and the Commission, among others, all warned of these underlying risks. We knew this situation was unsustainable. But what we could not know, and what no-one was able to predict, was how, when and just how violently the crisis would be triggered by rising defaults in the sub-prime mortgage sector.

What we are now seeing is the process of the last few years going into reverse, with the financial system grappling with the consequent need to deleverage. Because of the exceptionally high leverage and the scale of linkages between risks, this process of unwinding is proving particularly painful.

The lack of transparency in the system and the inability of supervisors to piece together an accurate and complete picture of the situation, has led to a dramatic fall in confidence.

The financial sector has been most severely affected, as nervousness among banks has caused liquidity to dry up in the interbank lending market.

Several key credit markets remain disrupted and recently there has been a renewed flight to quality among investors accompanied by widening spreads between benchmark bond yields and yields on relatively risky investments.

Thanks to the swift and coordinated interventions by Central Banks, with a relevant role of the ECB, we have managed to avoid a severe liquidity shortage. Nevertheless, banks remain under pressure. The crisis of confidence has provoked a fall in asset prices, compounding the strain on banks balance sheets. Combined with the situation in the interbank market, banks face difficulties to recapitalize.

The situation we face here in Europe is less acute and Member States do not at this point consider that a US style plan is needed.

Taking a medium term perspective, it is evident that we need a more comprehensive structural response. The latest events in financial markets have made it clear that the current model of regulation and supervision needs to be revamped.

In the short term, we rapidly need to address the weaknesses in the current framework. In this respect, the ECOFIN roadmap of regulatory actions and the recommendations of the Financial Stability Forum contain all the elements necessary.

As you know, these include concrete initiatives on enhanced transparency for investors, markets and regulators; revised capital requirements for banking groups and clarification of the role of credit ratings agencies. Work is progressing and the Commission will soon come forward with proposals on a revision to the Capital Requirements Directive and new legislation on Credit Rating Agencies.

But given the latest developments, it is likely that we will need to explore additional issues that have come to light. We will continue to discuss what else should be done to better ensure financial stability and to correct the reasons lying behind this crisis.

Finally, let me turn to the impact of the financial sector crisis on the economy.

There can be no doubt that events in the financial sector are hurting the real economy. These effects have been compounded by the inflationary pressures of rising oil and commodity prices and the severe housing market corrections in some Member States.

This combination of shocks has impacted directly on economic activity via higher costs and negative wealth effects and indirectly via a sharp erosion of economic confidence. The result has been a break on domestic demand at a time when external demand is fading.

Leading indicators on economic activity point to a marked deceleration in the underlying growth momentum in both the EU and the euro area. Against this background, GDP growth for 2008 was revised down significantly in the European Commission's latest interim forecast to 1.4 % in the EU (and 1.3% in the euro area).

At the same time inflation for this year has been revised up substantially to 3.8% in the EU and 3.6% in the euro area. Inflation could, however, be at a turning point as the impact of past increases in energy and food prices gradually fades in the coming months. This could possibly be reinforced by a further downward correction in oil and other commodity prices, although this remains to be seen.

Overall, the economic situation and outlook remain unusually uncertain. Risks to the growth outlook remain on the downside, while risks to the inflation outlook are on the upside.

Indeed, uncertainties are even higher regarding economic developments in 2009, but we expect growth in both the EU and the euro area to remain relatively weak next year.

How should we respond the economic slowdown? The best answer is to make use of all the policy instruments we have at our disposal.

First, in budgetary policy, we must preserve our commitment to fiscal discipline and the rules of the Stability and Growth Pact while letting the automatic stabilisers play their role. In this regard, the reform of the Pact in 2005 is being very helpful.

Second, a clear commitment to implement structural reforms, as defined in the framework of the Lisbon strategy and the National Reform Programs, would be crucial to boost consumer and investor confidence in the short term and improve the resilience and dynamism of our economies in the longer term. Measures to strengthen competition in retail and energy markets and improve the functioning of labour markets would be particularly valuable at this juncture.

Finally, delivering improvements in financial market regulation and meeting the goals of the Ecofin roadmap is, as I have already stressed, more urgent than ever before. An effective and rapid solution to the difficult challenges we are facing could go a long way to restore confidence quicker than expected and limit the damage to our economies.

In each of these policy areas, our actions will be more efficient and effective if we coordinate them at EU and euro area level. Inevitably, we will need to overcome some resistance by Member States to agree common action. Yet, the consensus we reached during the ECOFIN meeting in Nice last month should be deepened and developed.

European countries face common challenges. We will overcome them most effectively if we work together to find common solutions. In this respect, EMU is a formidable asset and we should exploit the opportunities it provides to strengthen coordination, along the lines we proposed in our EMU@10 report and Communication.

However, events make clear that internal European action is not sufficient to confront global challenges. We need to reinforce common external action in the Financial Stability Forum, Basel Committee and G7, as well as devote more attention to the future role of the IMF. Looking ahead, we need to think about how we can shape the future of our financial systems and global governance. And the role of EU in this regard is vital.

Europe can be a driving force behind reinforcing global coordination and should take a leading role in international debates in this area. And this first requires EU countries to work together and agree on internal solutions.

Ladies and gentlemen, thank you for your attention.

|

|

By Maria L. de Castro

web@costaluzlawyers.es

www.costaluzlawyers.es

0

Like

Published at 11:11 AM Comments (0)

0

Like

Published at 11:11 AM Comments (0)

Walker, there is no road..

Thursday, September 25, 2008

0

Like

Published at 9:03 AM Comments (0)

0

Like

Published at 9:03 AM Comments (0)

The tipping point.

Wednesday, September 24, 2008

Have yu read " The Tipping Point"? Steven Schaffer, our Steven, loves it, together with this other one: Have yu read " The Tipping Point"? Steven Schaffer, our Steven, loves it, together with this other one:

We read and talk a lot on philosophy,values, human resources and potential... in our Law Firm. We do not have anyone to fire us for not doing express legal work the 8 hours around.

We actually hire and fire us themselves!  It is very expensive to hire a boss and they are... actually....kind of old fashioned! It is very expensive to hire a boss and they are... actually....kind of old fashioned!

By Maria L. de Castro

web@costaluzlawyers.es

www.costaluzlawyers.es

0

Like

Published at 9:48 AM Comments (0)

0

Like

Published at 9:48 AM Comments (0)

I am just a connector

Wednesday, September 24, 2008

Yes, I am still a lawyer, but does it mean that I cannot be a person?

That is what we always try to express with both our private clients and our public posts or forum interventions. Some colleagues do not like my style, but this is not a question of colleagues agreeing on our way of working.... profess-ion is, should be for everyone, the way to share the person you are with the rest of the community, and we are much more than just.... lawyers or postmen or taxidrivers.. or politicians, are not we?

I live in Algeciras ( Cadiz), even when I would rather prefer living in Grazalema... all in Cadiz Province... my province Mater... therefore I owe these lands the breath I have taken. Once in my life I wanted to emigrate to te US, but life says NO, and I stayed and have a family and a place here now. Juts rigth where I was born.

That is why I am driven to share with you the gems of my land and my people, together with the pieces of legal advice that we ( with the extraordinary help of www.decastro.es, the litigation excellent gang) can work to offer.

Thanks to my family again, and to all the team of Costaluzlawyers and DeCastro who makes this possible... I am just a connector... at the end of the day.

Well, this is one of the Cadiz treasures:

Los Alcornocales Natural Park

From Wikipedia, the free encyclopedia

Los Alcornocales Natural Park (in Spanish, Parque Natural Los Alcornocales) is a nature reserve located in the south of Spain, in the autonomous community of Andalusia; it is shared between the provinces of Cádiz and Málaga. The natural park occupies a territory spanning seventeen municipalities with a total population of about 380,000. "Los Alcornocales" means "the cork oak groves".

Nearly all of the uninhabited land in the park is covered by Mediterranean native forest. While some of the land has been cleared for cattle ranches, much of the human activity in the park is devoted to exploitation of the forest's resources: hunting wild game, collecting wild mushrooms, and foraging for good specimens of tree heath. The tree heath (Erica arborea, called "brezos" in Spanish) is a small evergreen shrub, rarely more than two or three meters high; it is the source of the reddish briar-root wood used in making tobacco pipes, and its wood is excellent raw material for making charcoal.

Above all, however, the park's forests are exploited for the production of cork. The cork oak (Quercus suber) is a tree with a spongy layer of material lying between the outer surface of its bark and the underlying living layer called the phloem (which, in turn, encloses the non-living woody stem.) Cork is generated by a specialized layer of tissue called cork cambium. Properly done, harvesting cork from a given tree can be undertaken every ten to twelve years without damaging the tree; the cork cambium simply regenerates it. Cork has many commercial uses, including wine-bottle stoppers, bulletin boards, coasters, insulation, sealing material for jar lids, flooring, gaskets for engines, fishing bobbers, handles for fishing rods and tennis rackets, etc.

[edit] Climate

Given the geographic position of Los Alcornocales, the dominant climate in the zone is, logically, Mediterranean, but a series of factors contribute to its uniqueness. Its close proximity to the sea helps keep the temperature relatively mild all year long. The average rainfall usually reaches over 800 L/m², with certain zones receiving more than 1,400 L/m² thanks to the ocean front. In the mountain ranges to the south, there are great fogs known as the barbas del levante (the beards of the east). These fogs provides the humidity to form precipitation during the long dry seasons that usually characterize Mediterranean climates. Nearly constant winds make this area the best place to construct wind farms in all of Spain.

The park is characterized by the most extensive forest of cork in Spain and one of the largest in the world. In contrast to the mountains of cork in other latitudes where the tree density is low, in this zone the trees form an authentic forest with a rich variety of shrub and herbaceous vegetation intimately connected. This assures a natural regeneration of the forest, a good mix of ages, and a high level of floral and animal biodiversity.

Forests and smaller wooded areas within the park are comprised mainly by cork oaks (Quercus suber), Portuguese oaks (Quercus faginea), Pyrenean oaks (Quercus pyrenaica), olive trees (Olea europaea), alders (Alnus glutinosa and Alnus incana incana), holly trees (Ilex aquifolium), bay laurels (Laurus nobilis), rhododendrons (Rhododendron ponticum), ferns, mosses, and lichens.

See also: Cork as a commercial material and Forests of the Iberian Peninsula.

[edit] History

The cork oak groves of Los Alcornocales are situated in a strategic place. They sit astride two important axes, one an east-west axis, the other north-south. The land here has allegiances to both the Atlantic Ocean and the Mediterranean Sea; similarly, it forms the throat of a bridge between Europe and Africa, a bridge broken only by the narrow Strait of Gibraltar. Its geographic position is the circumstance, as much as its climate, topography, or suitability for agriculture, that has dictated its patrimony.

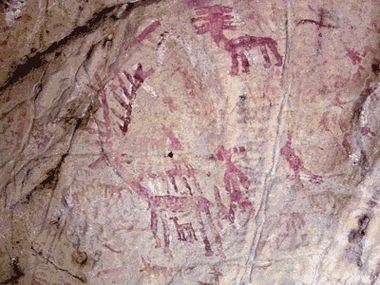

The area has been populated for tens of thousands of years. This is attested by the presence of archaeological remnants of settlements by Neanderthals dating back more than thirty thousand years, as well as stone implements, engravings, and cave paintings from both the Paleolithic and Neolithic ages. Of the greatest interest to visitors, however, are the Bronze Age cave dwellings that dot the area. Of more than fifty caves discovered so far, there are three that have special artistic value: the Cueva del Tajo de las Figuras (Cave of the Figures on the Precipice), which has been compared to the Sistine Chapel among examples of cave art; the Cave of the High Laja, that houses pictures of the earliest-known boats to ply the Mediterranean; and the Cave of Bacinete, with more than a hundred pictographic representations in a magnificent state of conservation.

Later in history, a succession of civilizations and cultures, one superimposed on the next, has dominated this area, all of whom have contributed to its ethnological character. Each has left its marks on the landscape; there are megalíthic monuments, Iberian, Phoenician, and Roman ruins, Arab strongholds, etc. Many of the towns that today comprise the park reached their highest state of civilization during the Muslim Nasrid dynasty, when this area was on the western fringe of the Kingdom of Granada. Today, in this area, many examples of the architecture introduced during the period of Muslim occupation survive; among them are the unique White Towns of Andalusia. Jimena de la Frontera, Castellar de la Frontera, and Medina Sidonia are magnificent examples.

The Cueva del Tajo de las Figuras, located near the town of Benalup-Casas Viejas, belongs to the group of paleolithic and neolithic sites in southern Spain that have examples of rock art that the Spanish call "art sureño" (southern art). In 1913, Juan Cabré and Eduardo Hernández-Pacheco began the first systematic studies of "art sureño" at this cave. The paintings are mostly representations of birds and odd four-footed man-like figures dating from neolithic times.

Cave painting of deer at Tajo de las Figuras

In 1924 the Cueva del Tajo de las Figuras was declared an Artistic Architectonic Monument by the Spanish state. For several decades, in order that visitors might better able to discern the paintings on the wall, tour guides have repeatedly sprayed water on them. This practice has resulted in the deposition of layers of lime on the paintings. Beginning in 2005, an effort to restore them was undertaken.

[edit] The ecological disaster at La Janda

Near the Cueva del Tajo de las Figuras was the ancient Laguna de la Janda, a haven where millions of birds, both resident and migratory species, found a suitable habitat for feeding and reproduction. Unfortunately, during the middle part of the twentieth century, this important ecological niche was destroyed. To support local rice-growing, water from the lagoon and its associated fresh-water wetlands was diverted, and the area dried up almost completely. In the process, the last reproductive Spanish population of the Eurasian crane (Grus grus) was lost as well.

[edit] Towns and cities within the park

All or part of sixteen municipalities of the Province of Cádiz lie within the Natural Park of Los Alcornocales : Alcalá de los Gazules, Algar, Algeciras, Arcos de la Frontera, Benalup-Casas Viejas, Benaocaz, Castellar de la Frontera, El Bosque, Jerez de la Frontera, Jimena de la Frontera, Los Barrios, Medina-Sidonia, Prado del Rey, San José del Valle, Tarifa and Ubrique. Likewise, there is one town in Málaga province, Cortes de la Frontera, that has land within park boundaries. There are lots of paths connecting these municipalities, nowadays used for hiking.

[edit] External links

[edit] Bibliography

- Acosta, Pillar: “The schematic cave painting in Spain”, Faculty of Philosophy and Letters of the University of Salamanca, Salamanca, 1968

- Bergmann, Lothar: “Treatment of images: Applications in the investigation of Rock Art”, COMPUTER, Magazine of computer science diffusion, Cadiz, 11/1996

- Breuil, H. and Burkitt, M.C. : “Rock Paintings of Southern Andalusia, a Description of the Neolithic and Copper Age Art Group”, Oxford University Press, 1929

- Cabré, J., Hernandez - Pacheco, E.: “Introduction to the Study of Prehistoric Paintings of Southern Spain”, Works of the Commission of Paleontological and Prehistoric Investigations, No.3, National Museum of Natural Sciences, Madrid, 1914

0

Like

Published at 8:54 AM Comments (0)

0

Like

Published at 8:54 AM Comments (0)

Financial crisis in personal terms

Tuesday, September 23, 2008

Let us try to explain the current financial crisis in personal terms:

Suppose you are an average citizen of a first world country, i.e. USA, U.K... The last past few years you have experienced that the prices on properties have grown inmensely, and... suddenly you realize that instead of having your money in your bank or in the stock market, it probably would be wiser to buy a piece of property. But how can you afford to buy a property if you have little money or no money at all? So... you say to yourself: "Well I'm going to ask the bank to lend me some money and I will guarantee it with the same property I'm buying, because, anyway, it will cost a lot more in the next future than what I'm paying for it right now".

You go to your bank, and they study your case and tell you.

Bank: "Well Mr. X, I can see that you have these incomes and those debts and so on and so forth, and given that you are not really in a position to borrow any money, I have no other choice but to deny this loan".

You: But,... you said to yourself .... "oh my... I´m loosing this great opportunity, some bank or financial institution will probably accept my deal If I accept a higher interest rate (a subprime mortgages perhaps!!), beacuse of course, and honestly speaking, the bank is taking some risk on me".

So one day, early in the morning you go to one of those Magic banks willing to lend you money for a higher interest rate, "because you can not afford to pay any mortgage or loan, but .... given that you are buying this beautiful property in DreamLand and it is going to be worth a lot more money in the future, if you do not pay them (the bank), they will anyway keep the property and sell it for a higher price"

So this fantastic guy in the Magic Bank tell you:

MagicBank: "Ok, Mr. X here is the money and here is your mortgage document... please sign here".

You sign and go home happy becuse you are about to make some interesting money and, who knows, perhaps you could sell this property in the future for a lot more money and get that beautiful house of your dreams for you an your family. Oh, guess what!!??, your neighbors Mr. and Mrs Y also got their loan even though he is currently unemployed!!!!.

Days when on, but as they passed the Real Estate bubble bursted ... and.... property prices, not only stoped raising, but started to drop away. Suddenly you found yourself trapped in this nightmare, having to pay for an amount of money that you know you can not afford, because of interest rising and because your company, the promissing building company you thought was going better and better last year, is not really going well anymore. In fact, you still have in mind the day you had to fire your secretary Elizabeth. Oh my, what are you going to do? .... well in your case is not so bad anyway ... the bank will keep the beautiful house and that's it. But Mr. and Mrs Y, gave their own house as guarantee to the bank; he is still unemployed and she, last time you heard, was about to lose hers. Oh my ... your neighbors just lost their house!!

But that Magic bank that gave you the money you needed, is in real troubles now. It has those mortgage papers it can not collect and own these properties that are worth less than before.The Bank says Oh my!! we are losing money and it does not look that it is going to improve.

John, that magic bank clerk that authorised your subprime mortgage, heard that although the bank was facing some problems things were not really bad because some other bank decided to get some mortgage packages at a real good price, and with that money they were going to cut their loses. Not only that but also some other even more "inteligent banks" sold those debts to their clients, at a very attractive price they could not even refuse, thinking in all the money they were going to make out of pennies. Besides, these clients thought, the bomds are supported and backed up by these famous banks in the US and some other around the world.

The thing is that now, hardly any body would be able to recover his/her money if goverments do not intervene by granting some money that will support this situation and avoid a total collapse of some banking and financial institutions.

Oh and guess what!! you and I and Mrs. Y have our savings deposited in some of these institutions but .... oh my.... they have lost so much money that .... I do not even want to think about, because goverments around the world and some healthy financial companies in the UK, Japan, South Korea are taking over these financial institution for a real bargain price.

As we say in Spain "A río revuelto, ganancia de pescadores", that is to say "in troubled waters, fishermen gain". I´m sorry for you Mr. X and even more sorry for the Y's but that's how it goes.... the economy was claiming for it's own balance, the real value of things, and human greed needed a call of attention.

So far so good, now goverments realize how difficult things currently are, and after sometime they have remembered that some laws were supposed to be applied, not to mention that some survaillance was needed .... but who really cared about some time ago if everything was going Hunky Dory!!

That is why the Spanish authorities as well as some others around the world are now telling the public that they are now taking measures!!!!

By Steven Schaffer. Economist and MBA. Member of Costaluzlawyers team.

0

Like

Published at 4:21 PM Comments (0)

0

Like

Published at 4:21 PM Comments (0)

Agreement on naked short selling by Spanish securities supervisors (CNMV)

Tuesday, September 23, 2008

Agreement of the Executive Committee of the CNMV

on naked short selling, adopted on September 22nd

2008

The Executive Committee of the CNMV, on an extraordinary session held today, recognizing the exceptional circumstances of securities markets and the initiatives taken by securities supervisors in other jurisdictions, on short selling, has agreed to:

1. Remind all regulated market members of the existence of rules that prohibit and penalize naked short sales and the need to observe them tightly. To this end, taking into account article 64 of the Stock Exchange Regulation, regulated market members are urged to use the powers that article 39 of the Securities Markets Act confers to them to ensure that their clients hold the securities before processing their orders to sell, either by relying on their own registers if they act as their custodians or by obtaining the explicit assurance by the client that they are not conducting a naked short sale.

2. Watch closely the observance of these rules by members of regulated markets and their clients to avoid any conduct that might alter the orderly functioning of markets or constitute market abuse.

3. After establishing the limitations of the accuracy of existing public information on securities lending, the CNMV considers it necessary adopt temporary measures, in the current market context, aimed at reinforcing the public information on short positions. Therefore, according to article 85.5 of the Securities Markets Act (SMA), we have agreed to require any natural or legal person holding short positions over shares or

The disclosure mentioned above will be made through a statement addressed to the Dirección General de Mercados (General Markets Directorate) of the CNMV, stating the date, the entity making the disclosure and the resulting net positions, expressed in number of securities and percentage of the listed capital (or

This measure is adopted on a temporary basis, starting at 00:01 h Madrid time of the 24

4. For the purpose of this agreement, a

For the sole purposes of point 3, a short position will be the net result of all positions in financial instruments, including shares or

5. The content of this agreement is without prejudice to the mechanisms established by Iberclear (Spanish CSD) to ensure settlement finality, including penalties for undelivered sales.

6. Hiding disclosable short positions and transmitting false information to market members regarding the fact that the client is not conducting a naked short sale will be regarded by the CNMV as an indication of a possible market manipulation. To this effect, the CNMV will take into account the operating needs of market makers and liquidity providers, understood as firms that trade on a principal basis to provide liquidity, hedge or process clients trades and hedging of derivative instruments positions.

Without prejudice to the above mentioned measures, the CNMV will reinforce its supervision and monitoring powers on financial instruments trading conducts and in particular those that could constitute market abuse.

Any clarification request in relation to this agreement can be sent to the Secondary Markets Directorate of the CNMV.

In Madrid, on September 22

Annex 1

List of issuers of shares or

short positions, according to the agreement of the Executive Committee

of the CNMV of September 22 2008:

Banco de Andalucía

Banco de Castilla

Banco de Crédito Balear

Banco de Galicia

Banco Guipuzcoano

Banco Pastor

Banco Popular Español

Banco Sabadell

Banco Santander

Banco de Valencia

Banco de Vasconia

Banco Español de Crédito

Bankinter

BBVA

Caja de Ahorros del Mediterráneo

Grupo Catalana Occidente

Mapfre

Inverfiatc

Bolsas y Mercados Españoles

Renta 4

From CNMV website

By Maria L. de Castro

web@costaluzlawyers.es

www.costaluzlawyers.es

0

Like

Published at 8:27 AM Comments (1)

0

Like

Published at 8:27 AM Comments (1)

A practical guide to having a job and a life

Monday, September 22, 2008

| FromIESE website |

A Practical Guide to Having a Job and a Life

Steven Poelmans, Paula Caligiuri |

|

|

It's been a hard day. You started at 8 a.m., worked through lunch and hurdled one problem after another. Now it's 5 p.m. and you're rushing out to pick up your kids. "Working just a half day?" a colleague sneers at you. The question stings and adds to that gnawing fear that you are choosing between your family and the fast track.

Scenarios such as this are not uncommon in a corporate world still coming to grips with the growing push for a better balance between professional and personal lives.

Indeed, when computer giant IBM underwent a widespread process designed to improve this balance for its staff, it had to first change the mindset of its managers and employees. They needed convincing to accept a flexible work environment and the company's various supporting tools.

The IBM case study features in a new book on how to create a better balanced working environment. "Harmonizing Work, Family and Personal Life" examines the challenges of introducing work-life policies and practices.

Drawing on a broad range of international case studies where such policies have succeeded and failed, the book serves as a practical guide for policy design and implementation.

Both authors are well-placed to offer counsel: Steven Poelmans, professor of managing people in organizations at IESE Business School, is co-founder and academic director of the International Center of Work and Family. Paula Caligiuri, professor of human resource management in the School of Management and Labor Relations at Rutgers University, is also the director of the Center for Human Resource Strategy.

The book is enriched by a wide range of additional contributors from both industry and academia, representing three continents. It is organized into three parts: describing different work-life policies, policy development and pitfalls; policy design, implementation and deployment; and cultural change.

The Need to Woo Middle Managers

"The purpose of the book is to provide ideas and guidelines on how to create a working environment that encourages the harmonization of work, family and personal life, while respecting the bottom line," writes Poelmans in the introduction.

"Although many books on individual work-family conflict and dual-income families have been published, few of them pretend to offer a practical guide to managers who want to develop work-life policies and practices in the firm.

"We recognize the fundamental importance of the support and accountability of middle managers, an often strongly underestimated source of failure in implementing these policies."

The book goes on to say that the mere implementation of work-life programs does not necessarily guarantee a family-friendly working environment.

"Only if employees perceive their organizations as 'family-supportive' will work-family policies actually reduce work-family conflict.

"The attitude of the direct supervisor thereby plays an important role, because he/she decides if and how formal procedures are implemented on a daily basis. Small day-to-day decisions and subtle reactions to employees prioritizing work over family or vice versa shape the organizational culture."

British Petroleum (BP) is cited as an example of a creative approach on the issue. Its managers and employees are urged to sign contracts that outline work-life boundaries and ensure that both agree to respect each other's time.

In another company, an MBA graduate who regularly burned the midnight oil was held back from promotion until he set a better example by working fewer hours.

And the scenario painted at the start, of someone being made to feel guilty despite putting in a full day, was from Marriott International Vice President Bill Munck. The hotel chain introduced a program to counter such attitudes and told managers that when not needed, they "were expected to go home and have a life."

Fear of Career Suicide

In looking at the issue of backlash, the book cites research showing that both male and female accounting professionals who used flexible work arrangements were judged as less likely to advance to partner, more likely to leave the company, and less likely to be requested on a future assignment than were those not using them.

"Employees fear that taking advantage of work-life initiatives will damage their careers. Such fears are justified and must be addressed with clear communication, support and coaching," the book urges.

"All managers and all employees need to understand the purpose of work-life policies and how work-life benefits the business."

Bottom Line Benefits

Why should businesses suffer the cost and complexity of improving employees' work-life balance?

The book emphasizes that firms increasingly compete on the effectiveness and competence of their core human talent. It says "unhealthy" companies that tolerate high turnover among eager young employees will have to pay increasingly high salaries to at least keep that talent long enough not to erode their customer base.

Consumer goods producer Procter & Gamble has freely shared details of its flexible work arrangements. "The company does not fear giving away its competitive advantage. It knows it takes at least a decade to develop," the book notes.

"Companies that start today to apply and develop their cultural intelligence, to figure out ways to cater to this wide diversity in needs, will be able to attract and retain the most valuable employees tomorrow."

"Firms leading the way in becoming flexible, family responsive and culturally intelligent have greater chances to thrive and survive, socially and economically."

As the book poses, "Given a choice, wouldn't you prefer to work for such a firm?"

|

By Maria L. de Castro

web@costaluzlawyers.es

www.costaluzlawyers.es

0

Like

Published at 11:07 PM Comments (0)

0

Like

Published at 11:07 PM Comments (0)

Bienal de Flamenco. Sevilla

Saturday, September 20, 2008

0

Like

Published at 8:12 AM Comments (0)

0

Like

Published at 8:12 AM Comments (0)

What happen with my money if my Bank goes bust?

Friday, September 19, 2008

A solid financial system

What will happen with my savings if the Bank goes bust?

The Spanish National Financial system is solid and has a wide net of organisms for the control and supervision of the Bank activity in order to put a stop, from the roots, to any problem that may arise.

Countries that are more exposed to the contagion of the financial crisis derived from the subprime mortgage crisis are those who have over valuated property prices, or companies or individuals who are excessively in debt.

Old crisis such as Argentinean "corralito" and the bankrupt of Banesto in 1993 contributed for our bank system to become stronger. This system has now enough means to detect a financial problem and put a solution so consumers will not be affected. In Spain, there are several National organisms to look for the security of users of Financial Institutions Funds for Bank Deposits Guarantee

They guarantee Bank clients of the refund of Bank deposits and financial assets to a specific limit. This institution also reinforce the solvency and operating status of a Bank in a difficult situation in order to defend the interests of both the depositors and the Fund itself.

The Spanish Guaranteeing system is made of three different institutions:

1.- Fund for the guaranteeing of Money deposits in Banks, (Fondo de Garantía de Depósitos en Establecimientos Bancarios (FGDEB),

2.- Fund for the guaranteeing of Money deposits in Savings Banks ( Fondo de Garantía de Depósitos en Cajas de Ahorros (FGDCA) y

3. - Fund for the guaranteeing of Money Deposits in Credit Cooperatives. Fondo de Garantía de Depósitos en Cooperativas de Crédito (FGDCC).

Every Bank, Saving Bank and Credit cooperative needs to obligatorily be a member of its respective Fund

Foreign Banks operating in Spain, when they are not members of the European Union or when their deposits are not guaranteed in the origin country need to be a member of the FGDEB.

The National Gazette ( Boletin Oficial del Estado) publishes those institutions that are members of each of the said funds. These funds have their own patrimony coming from annual contributions of the member institutions. These contributions are established by Law. Exceptionally some extraordinary contributions can be asked and even the Bank of Spain can be asked to make contributions to the fund.

Offered guarantees

* How much is paid?Money deposits: 20.000 € per person or company

Financial assets deposits: 20.000 € per person or company

* When are they paid?

In two different occasions:

a) If a Bank/Saving Bank/ Credit cooperative is declared bankrupt

b) If a Bank cannot paid back deposits which are due for payment and if the Bank of Spain consider the Bank to be unable to pay them in an immediate timeframe.

Financial experts recommend savings to be diversified within several banks and institutions and place in each one that maximum guaranteed amount (20.000€). It is also advisable to have several holders by each account.

Payments by the Guarantee Funds needs to be made within three months, even though, under specific circumstances, these payments can be postponed if the Bank of Spain decides so. If a client has a deposit higher than the guaranteed limit, he will have to intervene in the judicial creditor’s meeting procedure of the Bank for the refunding of his money.

Investment funds, pension plans, insurances... are also guaranteed by other organisms such as:

· Comisión Nacional del Mercado de Valores (CNMV) for investment funds

· Dirección General de Seguros y Planes de Pensiones ( DGSFP: an office of the Treasure National department) for the control and safety of Pension Plans and Insurances.

Countries of the European Union will share expenses in the case of bankruptcy of a bank that operates in several member countries. This is out of the Slovenia Agreement signed by them this year.

By Maria L. de Castro

web@costaluzlawyers.es

www.costaluzlawyers.es

0

Like

Published at 2:53 PM Comments (8)

0

Like

Published at 2:53 PM Comments (8)

The boy in the striped pyjamas

Wednesday, September 17, 2008

0

Like

Published at 7:54 PM Comments (1)

0

Like

Published at 7:54 PM Comments (1)

Developments with no postal delivery.. it is legal

Wednesday, September 17, 2008

There was a Royal Decree passed in April 2007 by which a new class within postal regulations was created:

Developments with no delivery:

Are called " special surroundings " ( Entornos especiales) and Correos ( National Public Postal services) is under no obligation for home to home delivery. In these cases, letters and parcels will be placed in determined pigeonholes placed in an specific point of the development or group of houses.

This special rule is applied to those surroundings where the number of registered residents are 25 or less per hectare, or when the number of remittances are under 5 per week and address.

By Maria L. de Castro

web@costaluzlawyers.es

www.costaluzlawyers.es

0

Like

Published at 7:01 PM Comments (5)

0

Like

Published at 7:01 PM Comments (5)

Frozen mortgages

Wednesday, September 17, 2008

Caixa Manlleu is first financial institution which has announced its intention to freeze mortgages quotas for those who, now and due to the financial crisis, are unable to pay their monthly instalments.

These clients will have to extend the redemption period and will end up paying more interests. That is obvious.

Therefore, both clients and Caixa Manlleu will take a break in these tight times. The financial institution must be very fed up with seeing how delinquent accounts grow and grow...

By Maria L. de Castro

web@costaluzlawyers.es

www.costaluzlawyers.es

0

Like

Published at 8:53 AM Comments (4)

0

Like

Published at 8:53 AM Comments (4)

La tesis de Nancy

Tuesday, September 16, 2008

0

Like

Published at 7:51 PM Comments (2)

0

Like

Published at 7:51 PM Comments (2)

Official numbers for rentals

Tuesday, September 16, 2008

National Public office for Rentals in Spain made 2784 rental contracts from January to August. A 21% more than last year.

A total of 484 houses more than same period of 2007. This office valuated 12.692 during this period, a 91% more than same period last year. The office rejected a number of 4.090 houses, almost three times more than rejections at the end of August 2007.

0

Like

Published at 7:11 PM Comments (0)

0

Like

Published at 7:11 PM Comments (0)

Holiday rentals in Islas Baleares

Tuesday, September 16, 2008

Legal concepts and requirements are expressed in Decree 55/2005 dated the 20th of May of 2005 of Islas Baleares

For commun houses ( no those classified as " touristic" lodges), there is a classification on regular, superior and excellent holiday houses.

Minimums requirements for regular/ basic ones:

- Six bedrooms and twelve occupants as a maximum.

- Proved quality on building, facilities, finishes and furnitues.

- Effective system for water and electricty supply and proper treatment and evacuation of sewage waters according to current legislation.

- Fully equipped. Good state of furniture and facilities.

- Equipped with kitchen tools, crockery, glassware, cutlery adn linen according to the number of occupants.

Superior category needs 100 m2 at least.

Excellent category needs 150 m2 at least.

By Maria L. de Castro

web@costaluzlawyers.es

www.costaluzlawyers.es

0

Like

Published at 9:32 AM Comments (0)

0

Like

Published at 9:32 AM Comments (0)

To get a house without a mortgage

Tuesday, September 16, 2008

Different solutions exposed by "El Economista" yesterday:

1.- Right of building/ Right of use of the land ( for those houses in need of refurbishments)

2.- Dwelling communities: Number of houses owned by a group of people under similar circumnstances: disabled, retired...

3.- Rentals with an option to buy

4.- Guaranteed rentals

We need to change the static and rigid concept of access to ownership. We also need adaptation to the times in that sense. The old formula of a mortgage loan on and for full ownership rights can be retouched and modernised by, for example:

1.- Acquiring building rights ( and having a mortgage for that). Then, completing full ownership in some years´s time by part of the sales price.

2.- Acquiring shares of a dwelling community... can be transfered to people within same collective. Ownership on the whole community can be shared by actual users and a company... which means lower acquisition prices. Financing formulas are possible here too.

3.- Rentals with an option to buy: To agree on special clauses on mortgages loans with the lender for cases such as pre-planned acquisition of full ownership when renting with an option to buy. A canon needs to be paid to the lender in exchange.

4.- Rentals submitted to arbitration ( to avoid slow, costful eviction judicial procedures) and with an Insurance for unpaid rents. Justin is offering something special on this soon!

Imagination and a good legal advisor can adapt the formulas to the personal and current legal and financial situation of potential house buyers. Let´s get updated!

By Maria L. de Castro

web@costaluzlawyers.es

www.costaluzlawyers.es

0

Like

Published at 8:51 AM Comments (0)

0

Like

Published at 8:51 AM Comments (0)

Maria attacked by a colleague

Monday, September 15, 2008

Again, we are being somehow "verbally attacked" ( very expressly), I would say ,by some lawyers who do not like what we do. Their nasty behaviour constitutes a crime under Spanish Law but we are not spending time in self-defense. We prefer to spend that time on deffending you.

When we started posting in EyeonSpain 2 years an a half ago, at the same time we started writing legal articles for english speaking people in Spain, we could not imagine our business was going to grow so fastly. The reasons for that extraordinary growth were mainly two:

1.- Lack of independency of many conveyancing lawyers who were not providing full legal information to their clients. ( They started reading us and coming to us)

2.- Illegal practices by developers, Local Councils, Insurance Companies and Banks in Spain regarding off plan properties.

Those lawyers are obviously the same who attack us by every mean trying to damage our name and the honest and independent services we provide to our clients.

We are happy you already know who we are, how we work and how committed we are to help you find the Spain you are looking for.

Need to remark and remind ( as I have done in many ocassions) that the legal proffession in Spain is much more excellent than those bad examples and that there are hundreds of ethical and good lawyers working silent and independently for the best interests of their clients.

That´s life...

By Maria L. de Castro

web@costaluzlawyers.es

www.costaluzlawyers.es

0

Like

Published at 7:05 PM Comments (11)

0

Like

Published at 7:05 PM Comments (11)

Small claims procedure (SCP) in Spain. "Monitorios"

Monday, September 15, 2008

Small claims procedure (SCP) in Spain. "Monitorios"

SCP ( Small Claim Procedure) is a special judicial procedure for claims adding up to 30.050,61 €. The debt needs to be documented.

The document: can be of any sort, form or physical support . It needs to be signed by the debtor, stamped by him, or just marked by any physical or electronic signal.

Bills, invoices, reception statements, certificates... are also allowed. They just need to prove a commercial relationship between debtor and creditor.

A lawyer and a Procurator of Tribunals are just needed if the debtor opposes the payment of the debt and/or the claimed amount adds more than 901,52 €.

How is the procedure?

1.- Initial petition to the First Instance Judge. Lawyer and Procurator of Tribunals are not required here ( but advisable). The petition needs to contain indications of debtor´s personal data and address, origin and amount of the debt and document which proves the claim.

2.- Courts notify the claim to debtor for a voluntary payment within 20 days. The debtor can also oposse the debt within those 20 days, giving enough legal reasons for the opossition to the payment.

3.- The debtor can choose between:

a) Doing nothing. Not pay nor oppose the debt. The Judge will order execution of the debt against debtor´s assets.

b) Pay the debt

c) Oppose the debt, with the intervention of a lawyer and a Procurator of Tribunals.

The judge will convoke the parties for a Court Hearing.

Hope this helps!

By Maria L. de Castro

web@costaluzlawyers.es

www.costaluzlawyers.es

0

Like

Published at 6:39 PM Comments (91)

0

Like

Published at 6:39 PM Comments (91)

Zapatero´s initiative to boost up the construction sector

Saturday, September 13, 2008

The Government will put forward the first public purchase offer next October, which will amount to 300 million Euros

Wednesday, 23 July 2008

- This initiative is aimed at boosting up the construction sector in order to build social houses and it is intended to intensify and double the efforts made by the different public bodies to enhance the chances to access a house.

- A consensus will be attained with the Autonomous Regions and the Municipalities about the selection criteria so that the land purchased may contribute to the territorial planning.

- The Minister of Housing has asked citizens to trust the Government although she said that the investments carried out by promoters and constructors are necessary in order to reactivate and the reconvert this sector.

- Beatriz Corredor announced that the Plan Renove to implement energy rehabilitation plans in 500,000 houses during this Legislature will be granted 2,000 million Euros p. a. by the Official Credit Institute.

The Minister of Housing, Beatriz Corredor, has analysed the status quo of the real estate market at present, during the Foro Cinco Dias, and she has gone through the Government’s strategy to face the situation in the housing sector, which she has defined as “a great crisis that cannot be concealed”.

The Minister has explained that “the main difficulty to build social houses is the little amount of vacant lots at a reasonable price, and the public entities and businessmen agree on this”. Thus, Corredor has announced that “we will provide land to build social houses”.

As to public land, an Inter-ministry Committee will be in charge of State-owned territories and the Government is already working with the Autonomous Regions and with the Spanish Federation of Municipalities and Provinces in order to use municipal and regional vacant land for that same purpose. “But public land is not enough”, the Minister underlined.

Beatriz Corredor announced the elements of the action line that will be set forth by the Government “in order propitiate the use of the available land to build social houses through coordinated actions with the Autonomous Regions and with the Municipalities. This offer will soon bring about -according to Corredor- more social houses and a greater economic activity, which are doubtlessly the two priorities of the Government of Spain at present”. During the debate held later on she underlined that this is the purpose of this measure: “providing land to build public housing, as some Autonomous Regions do - namely, Murcia and the Canary Islands - instead of helping those companies that are facing financial difficulties. We are not intervening, that is what some say”, she remarked ironically.

Beatriz Corredor explained that this initiative, an initiative in which the Ministries of Economy and Housing have been working jointly since last May, will be implemented over the next four years and will be starting next October with the first public land purchase offer. This action will be developed by the public company Entidad Publica Empresarial de Suelo (SEPES), which depends on the Ministry of Housing and which will be in charge of buying the land and building the houses, by making an initial offer of 300 million Euros.

The Minister said that the Government, the Autonomous Regions and the Spanish Federation of Municipalities and Provinces will attain a consensus about the selection criteria next September “so that the land bought may contribute efficiently to the territorial planning. We will give priority to those offers for lots that may be transformed immediately. And we will also give priority to those lands placed by the population centres with the highest demand”.

The bidding period will start next October and will last three months. SEPES will keep a purchase option for six months in order to carry out the compulsory economic viability study and to consider the offer. Besides, the Autonomous Regions and the corresponding Municipalities will play the main role in the committee that will be in charge of evaluating the different proposals. The purchase price will depend on the offer put forward by land sellers in each case, according to the social housing modules.

Trusting the Government

Beatriz Corredor referred to the general situation of the sector and asked citizens to trust the Government because “in order to overcome our difficult situation it is necessary to trust each other. Companies must be confident that the Government is making its best so that the Spanish real estate sector may grow in a balanced way, creating a strong market from the structural point of view”.

But the main aim of the Government, the Minister said, “is not trying to prevent this adjustment from happening, for it has proved to be necessary, absolutely necessary. The Government is paying attention to the interests of all those sectors that are suffering its consequences and it is trying to make up for its consequences in the market, mainly in the case of workers. But it is necessary for the corporate logic of this sector to walk hand in hand with the social need to access a decent place to live”, Beatriz Corredor said, and she went on saying that “the investments made by promoters and constructors are necessary in order to boost up and reconvert this sector”.

Central role of the financial sector

The Minister of Housing mentioned the financial sector because “it is essential for the financial entities to intervene, for they must accept their responsibility in the present situation and offer the necessary liquidity to companies so that the latter can face the upcoming challenges”. She also encouraged them to keep on cooperating with the Government to restore citizens’ confidence. “Citizen’s confidence, the strength of the Spanish financial system, professional behaviours and the diversification of the real estate companies will be essential in order to overcome this situation, just as essential as the budgetary policy implemented by the Government over the previous Legislature in order to enhance stability during this new period”.

Corredor was optimistic about this: “I have the sensation that financial entities are going to cooperate as much as their can with the new Housing Plan”.

Great crisis

Beatriz Corredor admitted that Spain “is facing a complex crisis that is particularly affecting the construction sector”. She referred to the company that opened the bankruptcy proceedings voluntarily. “This is not good news”, the Minister said and she went on saying that “the Government and I have always said that the growth of the real estate sector was excessive and unsustainable. Spain couldn’t face the dramatic increase of the prices of housing any longer; Spain couldn’t face the frantic building activity of the last few years any more”.

After having made this evaluation she said “it is our duty to find the chances the current situation is offering us in order to carry out the necessary reforms in the housing sector”, as this was aimed at attaining “a sustainable development by implementing structural policies that may change our productive model, which is excessively dependent on the construction sector”.

Measures implemented by the Government

The Minister went through the main action lines of the State Housing Plan 2009-2012, which should come into force by the beginning of 2009; for the Government and the Autonomous Regions -“which will practically be the co-writers of the plan” - had already started to design it. Its three main axes will be the promotion of social housing, rentals and refurbishing.

The Government intends to build one and a half million of social houses over the next ten years, 40% of these houses will be set aside to let. Besides, Corredor explained that “the promotion of social housing rentals is intended to attain a medium-term complementary purpose: the creation of a stable rental market, which will be at the disposal of Public Organisms”. In order to improve the financing chances of those buildings that were built on a on public land under a surface right regime, the Minister announced that “we are already working with the Ministries of Economy and Justice to adapt the necessary regulations in order to allow the securitization of mortgages on this type of buildings; we intend to encourage the participation of companies and the supply of real estate investment funds in order to finance these type of houses”.

Beatriz Corredor said that the Government will put forward the corresponding bill drafts in order to reform the Rules of Civil Law Procedure and the Law on Urban Rentals over the next few days, so as to promote private rental. “Our aim –she said- is to set up procedural measures in order to accelerate evictions and the unpaid rental claims and to speed up the solution of rental conflicts, without damaging the legal guarantees of tenants”.

House refurbishing and renewal in towns and villages

The Minister has stated her compromise to promote refurbishing and she said that for her it was more than a mere personal matter: “it forms part of my firm conviction that it brings about a wide range of economic, corporate and social solutions that we cannot ignore. And this shows at three levels, energy efficiency and accessibility, the improvement of the structure of decayed buildings and the renewal of decayed town quarters”.

The Plan Renove, promoted by the Ministry of Housing, will be one of the main tools in order to achieve these purposes. It will be put forward at the Council of Ministers by the end of the year and the Minister has announced that it will be granted 2,000 million Euros p.a. by the Official Credit Institute, in order to refurbish 500,000 houses during this Legislature.

Rural areas will also benefit from this renewal, for they stretch over 90% of the national territory and 40% of our population live there. The main tools to implement this plan, she said, will be the Holistic Refurbishing Plans, which form part of the Law on the Sustainable Development of Rural Areas. These plans will be managed by the Inter-ministry Committee for Rural Development.

By Maria L. de Castro

web@costaluzlawyers.es

www.costaluzlawyers.es

Taken from:

www.la-moncloa.es/IDIOMAS/9/ServiciosdePrensa/NotasPrensa/MPR/ntpr20080723OfertaPubVivienda.htm

0

Like

Published at 1:05 PM Comments (2)

0

Like

Published at 1:05 PM Comments (2)

New baby of Mrs Andalusia and Mr Sun marriage

Saturday, September 13, 2008

Solúcar: renewable energy platform in Andalusia

Solúcar (Photo: afloresm/ Flickr)

Taking advantage of a potential of an average of almost 3,000 hours of sun a year, the Spanish region is a pioneer in the ‘third economic revolution’

‘We are currently facing a third economic revolution, a revolution which, after the industrial and technological revolutions, will consist of the transition from an economy dependant on carbon to an economy based on renewable energy.’ These are the words of José Luis Rodríguez Zapatero, the president of the Spanish government, in the speech he made in 2007 during his visit to the Solúcar platform. Solúcar, one of the most ambitious projects in the world for the production of energy using the suns rays, is situated around eighteen kilometres from Seville in Sanlúcar la Mayor, a town with little more than ten thousand inhabitants.

The excessive cost of these renewable energy installations and of their maintenance has caused questions to be raised about their ability to be a realistic alternative to other forms of energy. However, this doesn’t worry the Spanish government. As Zapatero emphasised at Solúcar, 'The countries that will benefit in the medium term will be those that distance themselves from the carbon economy, and those that do not move towards nuclear energy.' French president Nicolas Sarkozy and British prime minister Gordon Brown disagree. So Spain is preparing itself for the energy revolution. Meanwhile, it continues to buy electrical energy from French nuclear centres.

Andalusia, land of the sun

In Spain, renewable energy provides jobs for almost 200,000 people

The search for solutions that will reduce the effects of the dreaded climate change has provoked various initiatives that not only claim to offer clean energy, but also aim to be a source of income for the companies backing them. According to a study about renewable energy by the Reference Centre of the Union Institute of Work, Environment and Health (ISTAS), this energy provides work for 188, 682 people in Spain, 89,000 of those directly. The renewable energy sector is growing in Spain and according to official data in the last four years, the production of renewable energy has increased by 50%.

Field of heliostats at Solúcar (Photo: afloresm/ Flickr) Field of heliostats at Solúcar (Photo: afloresm/ Flickr)

An example of this rise in renewable energy is the Solúcar platform, which was opened on 30 March 2007. The Andalusian regional government dedicated 3.7 million euros (3 million pounds) in subsidies to the company Abengoa to help establish this project, but this is scarcely 0.31% of the total cost, which has risen to the impressive sum of 1,200 million euros (958 million pounds). The European commission’s ‘fifth framework programme’ has supported funds which help the project, in which one of the participants is the French company Saint-Gobain, which specialises in high quality glass and mirrors.

Abengoa is the biggest company in Andalucia and forms part of the Ibex 35 (the Iberia Index, the main stock market index in Spain), that groups together the main Spanish companies that are listed on the stock exchange, with a market value of around 2,000 million euros (1.60 million pounds). The Solúcar platform is the jewel in the crown of the solar division, which has participant instillations in the United States, Algeria and Morocco.

Light for Cologne or Brussels

It will not be possible to see the Solúcar plant working at full capacity until 2013. At the moment hopes are that it will produce energy for more than 150,000 homes, that is the equivalent to the supply for the city of Seville, Toulouse or Cologne. All of this is thanks to its 300 megawatts of power, which will prevent the emission of 185,000 tons of CO2 every year. Solúcar’s huge installations extend over eight hundred hectares of land.

Solúcar’s energy output will cover the energy needs of Seville or Cologne

At the moment only two of the five plants are functioning: Sevilla PV, the largest in the world for low concentration photovoltaic technology, and PS 10 which uses tower technology. This consists of a field of heliostats or moving mirrors, which position themselves according to the position of the sun. They reflect solar radiation, increasing its potential over 600 fold, onto a receptor which is situated at the top of a tower. It creates a landscape that looks like something out of a science fiction film. This solar heat is transferred to a liquid, which could be water or melted salts. The aim is to generate steam at a high temperature that will expand in a turbine linked to a generator in order to produce energy.

The sun will revolutionise a village

The Solúcar platform has not only revolutionised the renewable energy sector in Spain, but its economic impact in the area has also been considerable. The mayor of Sanlúcar la Mayor, Juan Escámez Luque, happily comments that the plant has generated ‘more than 500 jobs between direct and indirect employments in the construction phase.’ And the arrival of Abengoa in the area has been a blessing in economic terms: ‘We have become an international reference point in the field of solar energy.’ The energy produced in Solúcar can even be enjoyed across Spain. ‘The energy that is produced here is put into the grid and is distributed throughout the country,’ concludes Escámez.

By Maria L. de Castro

web@costaluzlawyers.es

www.costaluzlawyers.es

Article from cafebabel.com

0

Like

Published at 9:37 AM Comments (0)

0

Like

Published at 9:37 AM Comments (0)

Complaints to Bank of Spain in English

Saturday, September 13, 2008

Complaints Service. Purpose and functions

How it works

The function of the Complaints Service is to receive and process customer complaints about specific transactions of credit institutions subject to the Banco de España's authority. Claims against currency-exchange bureaux which, in addition to buying foreign banknotes or traveller's cheques, are also authorised to sell or transfer them abroad, are likewise addressed. The Complaints Service acts whenever the foregoing activities involve the possible infringement of norms of discipline or good banking practices and conduct. Complaints are processed free of charge.

The organisation and functioning of the Complaints Service are regulated under the Ministerial Order dated December 12th 1989 (Official State Gazette of December 19th) implemented by the Banco de España Circular 8/1990 of September 7th (Official State Gazette of September 20th).

Who can lodge a complaint?

Any individual or company that is a customer of a credit institution can lodge a complaint concerning concrete transactions that affect them.

Prior procedures

Before the Service can receive or process a complaint, the interested party must present evidence that the complaint has already been lodged in writing with the customer complaints department, or its equivalent, of the credit institution in question. This department must provide written evidence of receipt of the complaint presented.

If the customer complaints department refuses to handle the complaint (on grounds that must be justifiable), if the customer does not consider the solution given to be satisfactory, or if the complaint is not resolved within two months of its presentation, the interested party can then file a complaint with the Service.

For this purpose, an institution or group of institutions is considered to have established (or to be formally committed to) an institution or department created for the purpose of safeguarding the rights and interests of its customers, having notified the Banco de España to this effect.

Causes of Complaints

Infringement of the norms of discipline or good banking practices and customs.

Disciplining regulations: These are laws and administrative provisions of a general nature that contain precepts specifically relating to credit institutions, which are obliged to observe them. Among these provisions are both those approved by State bodies or, where appropriate, by the Regional Governments with responsibility for this area, and the Circulars approved by the Banco de España, under the terms envisaged in the Law dated 29th July 1988 on the Discipline and Intervention of Credit Institutions.

Banking customs: These refer to commonly accepted trade and banking customs.