Legal tip 155. Consumer rights to direct understanding of the contract.

Wednesday, September 30, 2009

Provision 10.1 RD 515/1989 of 21st April 1989 sets a prohibition for contract clauses to relate or refer to texts or documents which has not been previously or simultaneously provided to the consumer.

Sounds familiar? Hum... yes those clauses refered to Work License or First Habitation licenses for setting a completion deadline: abusive: null and void.

Consumers, at the contract moment needs to have all elements to allow a direct understanding of the contract clauses. Concreteness, clarity and simplicity: characteristics which are obligatory for every contract with consumers.

The equality of the contract parties is a prerequisite for the justice of contracts contents and one of the imperatives of legal policy in the sphere of economic activity.

As always: Consumer Law: the best way to appease the sometimes furious and brute market.

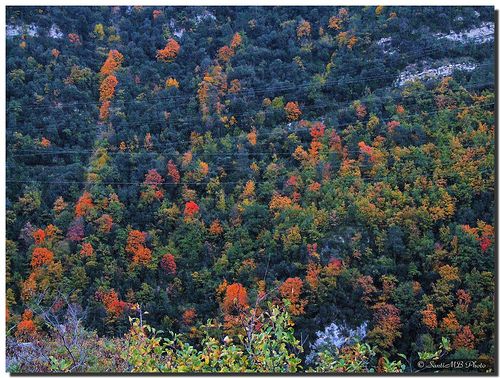

Autumn in Gerona ( Cataluña), Spain by Elsemiguel at Flickr.com

0

Like

Published at 6:23 PM Comments (0)

0

Like

Published at 6:23 PM Comments (0)

Legal tip 154. All the houses that Bank artificially financed

Tuesday, September 29, 2009

A forum member posted today because a friend of him cannot longer pay the mortgage.

First reaction: don´t get her life or her economy go sinking because of this because there was probably much financial artifice in the market when she took the decission: please encourage her to naturally return to a natural position.

She might try first to see if a mortgage change would enable her to keep paying :

Some related articles: legal tip 130 , legal tip 131 and legal tip 132

If the mortgage change does not relief her from the financial pressure.... no more anxiety.... go ahead and exercise rights out of the most of the Codes, our Civl Code, ancient Rome and Napoleonic tradition altogether! :"dation in payment" or a payment agreement ( with handing of keys) with the Bank so she liberates fully from the debt:

http://www.eyeonspain.com/blogs/costaluz/1094/legal-tip-27-dation-in-payment-a-right.aspx

If the Bank refuses to accept the dation, do not worry because after a proper offer to the Bank being done , the Bank will just be able to start a repossession to which you can then oppose with your already acted dation in payment rights so you both, Bank and client, can end up with an agreement for the payment of the debt ( of course including the full value of the handed property).

I am not calling to the irresponsability of individual people but Consumer and individual rights are always a brake to market hyper-acceleration... and we all end up being benefitted with a system is person tailored.

After an accepted dation in payment or an agreement for the satisfaction of the debt, she will not be recorded as a bad debtor in Spain. So... do not worry.

Has not been overcredit the reason of many problems? So... banks... here you have the houses you artificially created and financed.

Yes.. I know I am totally "bank-ly rude".

Maria

www.costaluzlawyers.es

0

Like

Published at 7:03 AM Comments (0)

0

Like

Published at 7:03 AM Comments (0)

Legal tip 153. Rent with an option to buy...still interesting?

Monday, September 28, 2009

Justin published an article by us a while ago : "In times of recession, imagination is needed" regarding renting with an option to purchase.

The question is now: Now that prices are decreasing and financiation is so convinient , is this still an interesting formula for those willing to buy and willing to sell? Or is it prefered to directly buy/sell?

Our opinion is the same for buyers and sellers as we always try to look into win-win shcemes:

Sales are a considerable option again, but still prices will keep decreasing till 2012. Anyhow, it is a good time to start looking at options as the bargains, rebate period is definitely open and you can certainly find the price and the mortgage you need now.

I would also pay attention to the fact that waiting to last-minute offers for the sake of price decrease will certainly come with a decrease of available units too. So make a balance of prices and availability.

Another aspect to consider is the Euribor staus these days. But the Euribor factor is just something to consider if you hire fixed rates mortgages, if you hire a variable financial product, any variation in the future will affect ( both positive and negatively) the price of your mortgage instalments.

So mainly: current prices and availability are the factors to consider.

If you decide to go for a renting with option to purchase, It is interesting to set a timeframe till the end of 2012 to finally fix the price as it seems the decreasing of the prices will last till then. According to good analysts 2013 will be the year of stabilisation and start of growing.

This way you can start habitating/enjoying a flat you will be paying a 2012 price for.

The clause of the contract you need to use is as follows:

“The parties agree that before the term of the present contract, ...........YEARS, comes to an end, the tenant should be able to acquire the property of the real estate – object of this lease.

To purchase the property, the tenant must formally inform the landlord about it within the last month before the date of expiration.

In case of possible purchase the sale price of the dwelling would be the normal market price of the said moment. This price will be reduced by the amounts already paid as rentals.

The sale of the real estate would be formalized by a public deed, free of charges. And the payment of the whole agreed price must be done in the moment of the deed signature.

Expenses and taxes originated by the sale would meet the requirements of the Civil Code.

Any of the parties shall be able to register this lease purchase contract in the Land Registry. The cost of the registration would be paid by the party who promotes it.

Of course, we always advise you to use a good lawyer to take charge of the drafting of this kind of contract.

Best week ahead,

Maria

www.costaluzlawyers.es

.jpg)

Autumn colors in Ribera del Duero, by Jesuscm ( away fro few days) at flickr.com

0

Like

Published at 12:41 PM Comments (0)

0

Like

Published at 12:41 PM Comments (0)

Low cost show in Madrid sold more than 50 million € real estate this weekend

Monday, September 28, 2009

The property "Low Cost" show in Madrid, closed its doors yesterday after receiving over 45,000 visits in three days and negotiate "real estate transactions in excess of 50 million euros” and contacts to realize operations in the coming days by more than 40 million" explained the president of the show, Enrique Lacalle.

In a statement, Lacalle said the success of the public "shows once again that there is interest in buying so now that prices have fallen substantially, the time has come to." In his view, there is a "pent-up demand that is exploding with discounts which shows that, if there are financing and rebates, there are sales and... a lot of sales”

The busiest stands have been the Banks´, with more resources to marketing: sellers, computers... and the most interested ones in releasing the stock.

The next chapter of this "low cost" show will be held in Barcelona from October 27 (Barcelona Meeting Point). As for Madrid, the hall will reopen next spring and will be "much bigger," the organization said.

What about EOS members having a stand there next time? It might include owners with payment difficulties, owners claiming back deposits, owners wanting to resale... We, Costaluz, offer to cover the legal aspects of it if you want.... it is just about talking.

Let´s start the week with some renewed enthusiasm about Spain and its richnesses.

Best,

Maria

www.costaluzlawyers.es

Autumn colours in Cercs ( Barcelona) by SantiMB at flickr.com

0

Like

Published at 11:42 AM Comments (0)

0

Like

Published at 11:42 AM Comments (0)

Communication, communication and communiaction

Friday, September 25, 2009

This is a most recent post from a nice client. Thank you.

Just can add as an own commentary that... well.... we try hard and that´s is much of what Costaluz is about: legal communication/ communication of rights.

The said post:

"Congratulations to Maria and her team for starting to provide monthly reports that clearly state the current situation with the individuals case.

The report provides details of the steps already completed and details of the next steps and estimated dates for completion.

The report also includes in detail what happens at each of the steps involved in Litigation i.e. when the Bank does not honour the Bank Guarantee.

This report certainly removes the frustration that everyone feels about not being kept informed and having to constantly pester Lawyers for information. The information on the report might not be what you want to hear, but at least you know exactly where you are in the process and what is happening.

Well done Costa Luz Lawyers"

Kel

Have you all the greatest weekend.

Maria

www.costaluzlawyers.es

spain diegoperez74.jpg)

Autumn in Lugo ( Galicia), Spain by diegoperez74 at Flickr.com

0

Like

Published at 6:43 PM Comments (0)

0

Like

Published at 6:43 PM Comments (0)

Legal tip 152. Spanish banks on the ropes

Thursday, September 24, 2009

Reading this new as been so energising this morning as even being conscious of how abusive unfair, disproportionate were some Bank’s practices regarding soil clauses and revision to Euribor, I certainly just have been able to advise people to denounce the practice to the Bank of Spain as a way to start “ the culture change”.

Well, it seems the culture is actually starting to react, the new comes to me as a sign of how civil society, associations of consumers and users can influence politicians to change Law and culture as this has been a claim of important associations of Consumers and Users in the financial sector for a while. It seems politicians are starting to be aware of Consumers´Law being the solution to many of our past, present and future problems.

The full Senate has unanimously approved yesterday a motion by the PP, agreed with CiU, which urges the government to take action against "unfair practices" of some credit institutions in relation to the revision of the mortgages, while asking the Bank Spain for a report about the terms of loans and the "effective translation" of the Euribor declines to mortgage instalments.

The Senate calls to set the effective translation of Euribor declines to mortgage fees, so that people can benefit quickly when the Euribor fall sas it is happening currently. Many of the contracts signed in recent years contain ceilings of 14% or 15% that financial institutions know that will never be met, while floors are between 3% and 5%

In this report, to be forwarded to the Senate within three months for discussion in plenary, the body headed by Miguel Angel Fernandez Ordonez also addresses the existence of clauses in contracts of mortgage loans that limit the rights of users, mean a lack of reciprocity or are disproportionate.

Finally, the motion requires the fulfilment of the Revised General Act for Protection of Consumers and Users, dated 2007, which establishes the exclusion of unfair contracts.

Well…. Certainly good, good news! Let’s keep moving ahead!

Autumn is finally here!

Maria L. de Castro

Autumn in Parque del Retiro, Madrid. By Swiv at Flickr.com

0

Like

Published at 11:47 AM Comments (0)

0

Like

Published at 11:47 AM Comments (0)

Legal tip 151. A guide for succesful house-buying. Part II (is TIME TO BUY)

Wednesday, September 23, 2009

We keep doing a review to the buying process because ... well, it seems the real estate sector, especially for the bargains chapter is having some life these days.

We celebrated my mother in law's birthday yesterday, (83 y/o) and it was for me a great joy to see that a niece (early 30s) has just purchased her first-home house and other three of his nephews (in their late 20s, early 30s) were effectively looking and finding good opportunities for a first home property to buy: one of them is having a baby in February. They were talking of very good prices: it was time for them ! I can imagine many people of their age and conditions doing the same these days in Spain.

Next September the 25th the Minister of Housing will be opening the LOW COST property exhibition in Madrid: both companies´ and individual sellers can attend.

It would be also interesting just for the sake of taking a look and testing the waters. The organisation of the event shows some accomodation suggestions, quite well priced in its website.

So… just as a reminder of the main documents to be checked when buying a house are:

1. - Horizontal division deed and statutes of the Community of owners.

2. - Land registry updated information (all loans and encumbrances will be shown there)

3. - Draft of the house

4. - Quality specifications

5. - Work License and first occupation license

6. - Last paid receipt of IBI (property taxes)

7. - Last paid receipt of the Community of owners

8. - Receipt of tax on the increase in Value of Urban Estates.

The deposit contract, ( see related article here) is for the reservation of the property out of the market and is generally an advanced payment which is then subtracted from the price to pay. It is a compromise, but not definitive. If the operation is discontinued, the deposit amount will work as a penalty. It is always more advisable to sign a deposit contract than an option to buy contract, as the deposit works better if the business is broken as a penalty.

And…. well… what can we say which is not already known regarding the 57/68 law guarantee if quantities are delivered in advance....

( to be continued...)

Maria

www.costaluzlawyers.es

See Costaluz related services here

Catalan Pyrenees by Rauxa i Seni at Flickr.com

0

Like

Published at 11:29 AM Comments (0)

0

Like

Published at 11:29 AM Comments (0)

Legal tip 150. Publicity is part of the contract´s win.

Tuesday, September 22, 2009

A couple of Court decissions received today in our Law Firm where judges very correctly apply what we all know now: Publicity is part of the contract. Good for consumers oriented judges in Spain.

We will be celebrating... you can celebrate with us!

Best,

Maria L. de Castro

Autumn in Spain by Victor Nuno at Flickr.com

0

Like

Published at 3:35 PM Comments (0)

0

Like

Published at 3:35 PM Comments (0)

Legal tip 149. Responsibility of the administration of justice for undue delays.

Tuesday, September 22, 2009

It is true that the much hyped financial and real estate crisis in our country has packed the courts but.... Should we be content with things as they are? Can we, lawyers, do something about it? Should we go to liability claims against the administration for delays in the administration of justice?

After a moment of reflection this morning, before our daily team breakfast with our guest these days, Rachael, the daughter of a customer who came to see how we work for a couple of days-thanks for your visit Rachael!; and before getting into the beautiful vortex of daily work, I conclude that everyone must deal with improving what is within their professional scope and potential, being realistic and maverick at the same time ... which, hum! It is not easy at all. That is maybe why it attracts me… fatally.

To lawyers, in defending the interests of our clients, is necessary to review the functioning of the judiciary, especially in this global world we live in now, where our foreign customers encourage us to overcome the “status quo” and aim for the best.

It is a difficult subject, but that's why we can not stay idle: the responsibility of the administration of justice for undue delays.

Let’s see what our Spanish Constitution (dated 1978) states in different related articles:

Article 24.1:

1. All persons are entitled to effective protection of judges and courts in the exercise of their rights and interests, without, in any case being victim of a lack of defence

Article 106.2:

Individuals, on the terms established by law, shall be entitled to compensation for any damage they suffer in any of their property and rights, except in cases of force majeure, whenever such damage is the result of the operation of public services.

And Article 121 states:

Damages caused by judicial error as well as those arising from irregularities in the administration of justice, shall be entitled to compensation from the State, according to law.

The high points of the entire task of requesting accountability to the judiciary by undue delays are four:

1* The determination of what constitutes "abnormal functioning" this has not been clarified by the Act and therefore must go to the specific case, its complexity, the performance of the parties ... and Case Law applicable.

2* The damage can be inflicted upon any type of property and rights, comprising also the moral damage.

3* There must be a clear cause-effect relationship between the activity of dispensing justice and the damage suffered by the litigant.

4* And the million-euros question: When is there a “ material impossibility” to act more effectively and expeditiously?

The best legal doctrine about the just-mentioned point (number 4) says that although it is true that in some cases there is an overwhelming overwork in court, this can not deprive the citizen's right to compensation if it causes damages.

We must not forget that the legal order assigns to the judiciary the duty to "promote all the necessary means" to exercise its function.

What is the procedure for these claims?

The request for compensation needs to be done before the Ministry of Justice under the regulations established in Articles 139 and following of the Law 30/1992 of November 26, amended by Law 4 / 1999 of 13 January, and Real Decree 429/93 of 26 March).

The claim deadline expires one year after the date the damaging event occurred or caused its negative effects.

Appeal against the decision of the Administration of Justice can be done before the Administration itself, if decided, and of course before Courts that prosecute the action of the government: the Contentious- Administrative Courts.

Applicable regulations

*Spanish Constitution, articles 24, 106.2 and 121.

* Law 6 / 1985 of 1 July, on the Judiciary: articles 292 to 297.

*Law 30/1992 of 26th of November on the Legal Regime of Public Administrations and Common Administrative Procedure, as amended by Law 4 / 1999 of 13 January.

*Royal Decree 429/1993 of 26 March, approving the Regulations of the Procedures for Public Administrations in terms of financial liability.

0

Like

Published at 3:23 PM Comments (0)

0

Like

Published at 3:23 PM Comments (0)

Legal tip 148. The hard life of the Anticorruption prosecutor in Spain

Tuesday, September 22, 2009

The attorney general, Candido Conde-Pumpido, said yesterday that the number of prosecutions of the anti-corruption prosecutor doubled in 2008 to the demands of society to 'eradicate corrupt behaviour wherever they come, whoever the perpetrators'.

This was said yesterday during his speech at the opening ceremony of the judicial year, where he highlighted that a democratic society built on thirty years of constitutional life requires "this effort, not always pleasant." A total of 1724 communications were received and 24 investigation proceedings were initiated (16 in 2007) and 15 of informative character (6 in 2007).

In his yesterday’s report, he also detailed that 422 people were charged in 2008 with a crime against the rights of foreigners for entering illegally in Spain more than 4,200 people by rickety boats, hidden in motor vehicles or with falsified documentation

(New translated from Financial Gazette: Cinco Días 22-09-2009)

Autumn scenary in Cataluña by Paco CT at Flickr.com

0

Like

Published at 2:47 PM Comments (0)

0

Like

Published at 2:47 PM Comments (0)

Legal tip 147. Two refunds today... and "to all lights"

Monday, September 21, 2009

Yes, well, we are sending a couple of cheques of refunds to clients today.... I wanted to post this just to alleviate those afflicted by our lost last week... as it has been a very much read post!

We are determined to go to appeal before the Provintial Appeal Court in Malaga and to the Supreme Court in Madrid, as the amount of the trial object allows us to appear before the High Tribunal in the capital city

It is, " to all lights" ( direct translation of "a todas luces": spanish expression which means evident from every angle you look at it) an unfair decission with no room for consumers rights and protection already awarded by Law and Case Law.

The Judge in Marbella wants our client had signed without First Occupation License! and still do not know ( even being law since 1977) that publicity is part of the contract.

We will keep you posted on this as the case advances. If we need to go to the Supreme Court, it will be very challenging as it will bring to us the oportunity to ask the high honorable Judges what is the interpretation of some articles of the popular law 57/68. There is no previous doctrine by the Supreme Court on this yet.

Have a good night!

Maria

Ps.- I am now addicted to these fights! You are guilty of this!

Autumn in Caleau ( Asturias), Spain by Caliateu at Flickr.com

0

Like

Published at 9:49 PM Comments (3)

0

Like

Published at 9:49 PM Comments (3)

Legal tip 146. A guide for successful house-buying.Part I

Monday, September 21, 2009

Yes! Now is the time to buy, but being fully-informed and with all rights at hand and paper:

1. - The rule of the rules: do not rush!

As it is a buyer’s market and will be for many years ahead, do not rush into anything!: take your time and choose the house that really meets your needs and your pocket... there are many wonderful places and they do not need to be expensive at all.

Look beyond what used to be the golden circles, such as the Costa del Sol because prices are more reasonable and urbanisation has been less aggressive and better regulated during the last decades.

You may be able to find places where people are welcoming of foreigners and you will find it easy to integrate and share our culture and values. There are plenty of them.

2.- Pay important attention to:

-Location: noises, public transportation, facilities, schools, hospitals, market, leisure, parking…

-Orientation (south, north)… there are important differences on temperature, light... depending on which way the house faces

-Legal utilities (gas, light, phone…) and isolation conditions.

-Price: make your haggling as these days buyers are almost putting the prices to the houses. And do not forget to always take into account that together with unit price, there are other unavoidable and attached expenses such as: notary, registrar, taxes, legal advice…

( part 2 of the guide on progress)

0

Like

Published at 3:52 PM Comments (0)

0

Like

Published at 3:52 PM Comments (0)

Legal tip 145. Franchising: a good option in Spain

Sunday, September 20, 2009

According to the business gazette "El Economista" , it is possible to start a business or becoming a self-employed person with only 6,000 euros. It seems that the franchising sector, despite the precarious economic situation, it remains as one of the most viable employment options in Spain.

In fact, according to this newspaper, despite the crisis, in 2008 these micro-companies billed by 0.5% over the previous year. Importantly, according to an annual report on the sector the total number of franchise chains operating in Spain grew by 7% last year reaching 968.

In many cases, the key is to find the right kind of franchise.

Catering trade: At present moment in Spain, there are about 7,200 Spanish franchises of catering trade. It is expected that during 2009 the sector has a moderate growth of around 1.5%, attracting a total investment of around 1,430 million euros.

Previous experience, quality at competitive prices and specialization are the main keys for a succesful choice.

The number of franchises in Spain is still much lower than in the UK or the US, so it is also a good possibility for franshisers.

www.costaluzlawyers.es

See related Costaluzlawyers services

Garganta la Olla, Cáceres ( Extremadura), Spain by Xavier Fargas at Flickr.com

0

Like

Published at 9:25 PM Comments (0)

0

Like

Published at 9:25 PM Comments (0)

Legal tip 144. We lost a case today

Friday, September 18, 2009

Yes, we did. A judge in Marbella thinks that our client should have completed ( with no First Occupation License) and that as the Golf Course was not mentioned in the contract document ( just in publicity), it is therefore not part of the contract agreement.

Very much against Land Act in Spain regarding planning licenses and estate transmission and also against the doctrine of our Supreme Court regarding the linking character of publicity.

The best reaction to this has come from a colleague ( I am ommitting his name in respect to his right to a good week-end  ): "do we have the judges we deserve?" ): "do we have the judges we deserve?"

We are determined to go all the route through till Supreme Court, we mainly pursue clarification of what these two articles, contained in Law 57/68 means:

Art. 2.- In those contracts where the parties agree on anticipated amounts the developer must expressly state:

a) That the developer will give back to the buyer all the advanced mounts plus the 6%, in cases where the construction fails to tart or end within the agreed deadline, or the certificate of habitability is not granted.

b) Reference to the bank guarantee or insurance contract, indicating the name of the Bank or the Insurance Company.

c) Specification of the Bank or financial institution and the account number where the buyer's money is deposited.

At the signing of the contract, the developer will give the buyer the document that contains the guarantee (the Aval or the Insurance contract) and the document must have a reference to the amount that is anticipated.

Art. 3. - If the deadlines for starting or finishing are not met, the buyer can choose between cancelling the contract with the devolution of advanced amounts plus legal annual interests, or to concede a time extension, which will be stated in an additional clause in the contract, specifying the new deadline with the date for finishing the construction and completion.

Come on !

Maria

www.costaluzlawyers.es

By SantiMB.jpg)

Neglect among trees.Cercs, Barcelona, Spain by SantiMB at Flickr.com

0

Like

Published at 6:54 PM Comments (3)

0

Like

Published at 6:54 PM Comments (3)

Legal tip 143. Bargains in Spain for two years more

Thursday, September 17, 2009

Are you still interested about a second residence in Spain now that the buying hustle and bustle is much over and we are not yet recovered from the big collapse...?

Yes, it is the time to take advantage of our weak and unbalanced situation... and at the same time, we need you to recover from this big crash. So, again a win-win scheme.

The housing prices will continue to fall for at least two more years and by the end of 2011 will have a cumulative adjustment average of 22% since the crisis began in the sector, however, it will not start to excel until at least 2013, according to the yearbook of the housing market statistic company RR Acuna & Associates who has been presented today.

It estimates that in 2009 the lowering of the price of flats will reach 9.55% and will start tempering in coming years, with declines of 9.32% and 4.81% in 2010 and 2011, respectively.

The report considers that the housing sector still requires a period of between six and seven years (until 2015 or 2016) to "reactivate and begin to exert positive effects on the overall economy."

According to their study, this is the time required to rectify the currently existing "gap" between supply and demand. The firm raises to 1.7 million flats the 'stock' of unsold flats, compared with a total estimated demand of 218,428 homes this year.

Regarding flats without buyer, almost one million are in the hands of developers, adding those finished houses with no buyer(about 507,000 units) and those currently under construction (469,234 flats). The other 582,800 are used flats and some 110,000 remain owned by banks.

The firm also warns that "the problem is compounded" when analyzing the portfolio of available land to build housing that now exists, comprising some 2.40 million flats more. "This indicates that there is ground for nine years, coupled with the already existing 'stock', implies a market of housing and land for the next fifteen years," the report warns.

The study also predicts that the greatest negative impact of the economic sector in general "is coming" and will be felt mainly in the second half of 2010, for when even predicts unemployment rates of 25%.

In the same vein, predicts that 2010 and 2011 will be the main exercises in terms of "developer companies drop" given its "critical situation". " They are facing increasing difficulties for refinancing because their assets are not sold or are mortgaged, and increasingly devalued,".

Therefore, estimates that in 2013 when the sector begins to recover its size and capacity will be of about a half of what it was before the change in cycle, and that before the sector will even reach minimum representing only a quarter of what it was.

So… you foreigners… are coming to the Spanish 1.7 millions unit property street market? I would certainly look first at the Banks´portfoliios. Interest rates are low now and it is a buyer´s market....! and as always we offer sun, lifestyle, siesta and gastronomy all included!

What do you think?

Maria

0

Like

Published at 11:25 AM Comments (4)

0

Like

Published at 11:25 AM Comments (4)

Legal tip 142. No win, no fee in Spain

Tuesday, September 15, 2009

How are lawyers fees calculated in Spain?

Lawyers fees depends on the rules adopted by the Bar Association, which establishes minimums, and the circumstances of difficulty, time and effort to raise each case, together with the economic interest of it.

Is it possible to have a "no win-no fee" agreement with your lawyer in Spain?

The " quota litis or no win no fee" agreement is one agreement between the attorney and his client by which the latter undertakes to pay a percentage on the outcome of the case.

This is a fee agreement concluded before the end of the case on a percentage of the profit realized by the end of the process. This agreement of "case quota" between lawyer and client was prohibited until last 4th of November 2008, when the entire Court of Administrative Law of the Supreme Court agreed to cancel the ban agreeing with the consideration of the claimer lawyer who defended that the prohibition undermined free competition.

The General Council of Spanish Lawyers (CGAE) brought an appeal for annulment against the Supreme Court ruling that allows the payment of “ case quota” CGAE believes that the vast majority of Member States of the European Union do not regulate the pact " case quota” because "it is contrary to good administration of justice in so far as it encourages speculative litigation and promotes the lawyer becoming a partner of the customer, at which point it loses its independence. "

I am with the CGAE at this. When a good lawyer decides to undertake a case is because he/she believes is worth pursuing and his whole work needs to be paid, we lawyers committ to good study and defence of cases but cannot committ to results as it certainly finally depends on the Judge, obviously.

To act under the no win-no fee scheme seems to me like turning into a merchant of the legal defense and a lawyer is not an agent but a honorable seeker of justice ( regardless the Judge finally agrees with him/her or not). Actually, his fees are called " honorarios" ( refering to honour) in the Spanish language.

It does not mean that there are cases that can be taken and conducted ( for different reasons) with a minimum provision of funds and with the agreement for the rest of the fee to be paid at the end. Or that a lawyer can do a good discount on fees, considering specific circumsntances, or that the payment can be done in several instalments... or any other possibility than imagination and good will can offer but.....

please... let´s not lose our values and our identity!

Cazorla (Jaen) autumn by Maximo Lopez at Flickr.com

0

Like

Published at 5:56 PM Comments (12)

0

Like

Published at 5:56 PM Comments (12)

Legal tip 141. You and the Judge... alone.

Tuesday, September 15, 2009

Article 31 of the Code of Civil Procedure states that litigants will be led by lawyers who are qualified to practice in the court that is hearing the case.

One of the exceptions to this general rule is for oral proceedings which shall not exceed nine hundred euros.

So you can have cheaper legal representation for these cases if you can get legal advise and stand in Courts by yourself.... would you...?

Cartuja Monastery. Jerez de la Frontera ( Cadiz)

0

Like

Published at 3:12 PM Comments (0)

0

Like

Published at 3:12 PM Comments (0)

Legal tip 140. Spain: the property street market for europeans

Tuesday, September 15, 2009

Good news!:

Spain remains at the tail end of the group of the European economy. Only one among the big EU states to keep negative growth figures during the fourth quarter of this year. The economy will contract 3.7% this year.

Brussels explains with crystal clarity the reasons of the Spanish economic situation in the title heading the brief description of the situation in Spain: "Slower pace of adjustment due to structural unbalances”.

So, come and see... bargain (-30%) sunny properties everywhere, consumers rights well protected ( no developer/agent linked lawyers anymore), low interest rates... is it not nice?

Is it not the time for stronger European economies to come and see and buy?. Yes, we will include the sun and the siesta in the package.... they are not part of our "structural unbalances".

Is it not time for stronger European economies to come and set businesses here? Labor prices are quite reasonable in Spain compared to northern neighbours. That will somehow stop the force of Spain as the main employment destroyer country of Europe.

We are an Union... let´s play it out... let´s look for win-win schemes.

What do you think?

Maria L. de Castro

www.costaluzlawyers.es

El ultimo de la fila de Revenque at Flickr.com

0

Like

Published at 11:47 AM Comments (0)

0

Like

Published at 11:47 AM Comments (0)

Legal tip 139. Mortgage relief: is it of interest anymore?

Monday, September 14, 2009

Through the Official Credit Institute (ICO) there is the possibility of a temporary and partial deferral of the obligation to pay the 50% of mortgage payments in the period from March 1, 2009 to 28th of February 2011 with the following requirements:

I) At minimum of 500 euros a month and a maximum of 12,000 euros.

II) In favour of certain groups:

• Employed person in legal unemployment, being under this situation, at least during the three months immediately preceding the request and being entitled to unemployment benefits, contributory or non-contributory.

• Self-employed person who has been forced to stop his business, remaining in that position of termination for a minimum period of three months.

• Self-employed person stating full income lower than three times the monthly indicator Public Multiple Effect Income (IPREM), for at least three months.

• Be a survivor's pensioner on death occurred after the conclusion of the mortgage, and in any case, dated after September 1, 2008.

III) Holders of a mortgage established for the purchase of your habitual dwelling , which has been signed before 1st of September 2008 and for an initial amount not exceeding € 170,000.

IV) And that the Customer is not in arrears

The deferement of contributions is implemented through a contract between the client and the same credit institution which was initially formalized the mortgage with, keeping the duration and conditions of the initial mortgage.

I am wondering if with the new prices of mortgages, due to fall of interest rates, these deferements are of interest anymore for variable interest mortgages?

Any answers there?

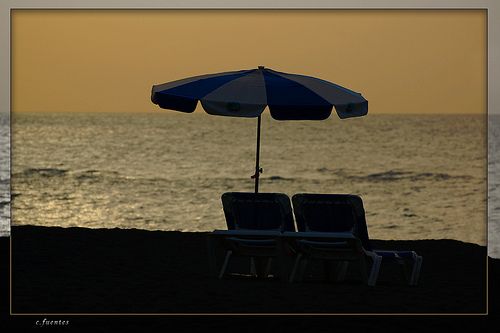

End of summer by C.Fuentes2007 at Flickr.com

0

Like

Published at 11:34 AM Comments (0)

0

Like

Published at 11:34 AM Comments (0)

Legal tip 138. The restore action

Friday, September 11, 2009

If you are in the middle of an off-plan contract cancellation action or are thinking of claiming.

There are many things to be done depending on how the finantial/economic situation developer in the comiong months.

First thing to bear in mind is that this is going to be a buyers market for many years ahead, and with that no-pressure by sellers and buyers running the show....

-You can buy with good price and excellent interest rates

-You can rent with an option to purchase, with a fixed price in advance.

-If you are pursuing cancellation ( action that can also be called: "restore action" as it put balance in the contract after an abusive contrat") You have got several finantial assets:

-A potential credit against a developer for the refund of x plus legal interests.

- Buying rights on the property in between ( the developer cannot sell to anyone else till the contract is effectively cancelled and your money refunded).

- A better position within the creditor´s meeting ( if that ever happened)

So... it is not just a matter of contract cancellation at whatever cost, it is a matter of re-establishment. Many of the clauses of many of the contracts I have seen duting the last 3 years and a half are corrosively abusive. Repugnant.

I am enlisting some of the games you can play with the above mentioned assets at hand ( but I am not a finances expert.... so please, make your conmtributions! ):

- You can negotiate a great price reduction with the developer along the judicial proceeding and complete on the property at a much reduced price and with much reduced interest rates

- You can sell your buying rights to someone else and withdraw the claim, negotiate with both developer and new buyer on the payment of the judicial costs ( it seems German and Norwegian have already some money to look for some sun).

It is all a matter of some fluctuants, not rigid factors such as:

- Evolution of the market

- Flexibility of developer

but the possibilities are there ( together with many other ones, I am sure)

that.... together with the awesome sensation of being back in control of the situation or at least of a great deal of it. What do you think?

Could we all together transform the current situation in a win-win scheme?

Please send your ideas and have a great weekend.

Maria

Related services by Costaluzlawyers

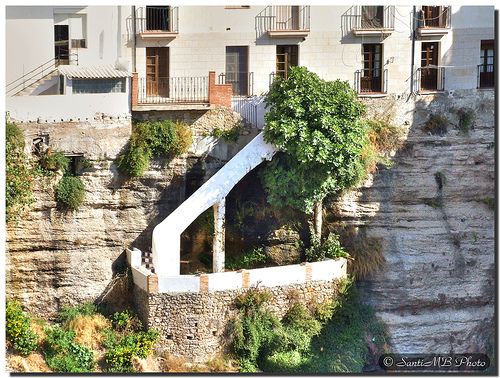

Craggy garden. Ronda. By SantiMB at Flickr.com

0

Like

Published at 12:24 PM Comments (4)

0

Like

Published at 12:24 PM Comments (4)

Legal tip 137. Bank Bargains. Do I hear more?

Thursday, September 10, 2009

Many Banks offer better conditions to those clients changing from another Bank to them than to new clients. Why is it? Well, it seems it is just because they take into account that initial financial solvency of the client.

Some bargains: I love Banks offering bargains!

· Caja España: "Hipotecambias" has an interest rate of Euribor + 0,25%. The mortgages need to be of 5 or more than 5 years and on the habitual dwelling. You need to have your payroll paid direct through the Bank and the salary needs to be higher than 600 €. You also need to hire a retirement product depositing at least 600 € yearly. If you fail in any of these requirements, the rate will vary into 0,50 points or even to 0,75. There are no expenses: no opening commission, no Notary, Registry expenses . Time frame: 30 years. Just pay attention as there is a mortgage floor and ceiling of 2,95% and 12,50% respectively.

· Oficina Directa: Euribor + 0,39% . You need to have payroll and two bills paid direct through the Bank. They manage the mortgage change directly from the source Bank.

· Deutsche Bank: "Hipoteca Rompedora Cambio de Banco" ( Innovative Change of Bank Mortgage) interest rate of 2,49% during the first year and Euribor + 0,27%, after the first year. No opening commission. If payroll and three bills are paid direct through the Bank, the Bank deposits 1.000 net euros into the client´s account.

· Barclays: the "Change of Bank Mortgage" offers Euribor + 0,35%. Timeframes up to 35 years/old , no opening comission and the 80% of the estate value is financed .

· Openbank: Euribor + 0,38%.

· Banesto: Markets the "Hipoteca Smash", no expenses and negotiated conditions.

Do I hear more?

Cadiz Beach by Bigeoino at Flickr.com

0

Like

Published at 7:05 PM Comments (0)

0

Like

Published at 7:05 PM Comments (0)

Legal tip 136. Consumer wins against an unfair penalty clause

Tuesday, September 8, 2009

The refund of 100% of the deposit has been awarded by a First Instance Judge to a consumer who was challenging the clause by which the developer was keeping 50% of his amounts as a penalty clause.

The argument given by the lawyers to the Judge were mainly based on very basic and general principles of Contract Law such as reciprocity, balance, proportion... : out of almost commun sense I would say....

the developer is keeping the house, why is he also entitled to the 50% of the deposit too?

This Consumer Law discipline is so challenging and down-to-earth!

It is actually the Law of these new times.

North Africa from Atlanterra, Tarifa, Cádiz by Al S at Flickr.com

0

Like

Published at 2:45 PM Comments (1)

0

Like

Published at 2:45 PM Comments (1)

Legal tip 135. Reduced expenses for mortgage operations

Tuesday, September 8, 2009

Less Notary and Registrar Costs

Along with the reduction of commissions, this 4/2007 Act provides for a reduction of the notary and registration costs when cancellations, novations and subrogations of mortgage loans or credits.

Notaries´ fees of these type of deeds, needs to be considered as “documentos sin cuantía “(non amount based documents) which have a fixed fee of 30 euros.

Registrar fees will be reduced in a 90%

These measures have reduced expenses for these types of businesses (Novation, cancellation and subrogation) in a 40%. For instance, a typical cancellation of a mortgage of 120.000 € costs now around 42 €, when the cost was 240 € before the Act.

Tax reduction for time extension of mortgages

Oh yeah..... more savings.......: as a reminder:

From May 2008 to April 2010, the extension of the term of the mortgage loan is not subject to the tax established in article 31.1 of the text of the Law of the transfer tax and Stamp Duty of individual deeds.

Please keep the offer!

.jpg)

Atlanterra beach, de Scooterjec at Flickr.com

0

Like

Published at 1:58 PM Comments (0)

0

Like

Published at 1:58 PM Comments (0)

Legal tip 134. Should I pay the bank´s property valuation?

Monday, September 7, 2009

You are passing your mortgage to a new Bank or you are finally getting financiation from a lending institution, you have got a property valuation of the house dated 3 months ago and made by an official surveyor. Is it not of use? Can the Bank make you have a new one and... pay for it?

The answer is no: according to provision 5 of Law 41/2007, if you have your own property valuation, made by an official surveyor, not older than 6 months, the Bank cannot make you have ( neither pay) a new one.

Stop the banks! How I enjoy it!

Bolonia scenario by Indrasensi at Flickr.com

0

Like

Published at 4:12 PM Comments (1)

0

Like

Published at 4:12 PM Comments (1)

Legal tip 133. Developers, water and Consumers Law

Friday, September 4, 2009

1.Several people bought a home and had to pay 230 euros in concept of connection of water and sewerage, according to what it was established in the contract.

2.Once paid, they submitted the matter to Court as they considered it an abusive clause.

3.First section Asturias Provincial Court declared the clause null and void as these rates are deemed to be included in the price the buyers are paying for an habitable house.

4.The ruling ordered the seller to repay the connections fees and legal costs involved to the buyer.

5.Consumers coming!

0

Like

Published at 11:37 AM Comments (9)

0

Like

Published at 11:37 AM Comments (9)

Legal tip 132. Less charges by Banks when change of entity and early repayment

Thursday, September 3, 2009

Banking Law in Spain has already been reducing the rights of banks that did not have any economic basis and therefore is setting good precedents for a good pro-consumer era.

Costs by (1) change of entity and (2) early repayment of part or all the capital.

1) Due to change of entity or lender subrogation (1)

The origin entity will charge a fee for the withdrawal of the client. This amount, according to the law, can never be greater than:

Mortgage Loans formalized until the April 27, 2003

1% of outstanding capital for mortgage loans with variable interest

Mortgage Loans formalized between the 27th of April 2003 to December 9th , 2007

0.50% of outstanding capital for mortgages with variable interest

Mortgage loans or credit formalized by an individual after 9 December 2007:

If within the first 5 years of mortgage: 0.5% of the outstanding capital.

If it is after the first 5 years of mortgage: 0.25% of outstanding capital.

2) For partial or total early repayment within the entity

Mortgage Loans formalized before December 9, 2007

The commission will be negotiated with a limit of 1% if interest is variable, there being no limit for fixed interest operations

Mortgage Loans or credits formalized from December 9, 2007

If within the first 5 years of mortgage: 0.5% of the early repaid capital.

If it is after the first 5 years of mortgage: 0.25% of early repaid capital.

As for other amounts that Bank charges for interest rate risk, the Act 41/2007 established that this amount will be charged only if the origin entity does not generate any capital increase following the operation. In addition there will be no entitlement to this charge if the change of entity or the total or partial early repayment occurs within an interest review period which duration does not exceed twelve months.

0

Like

Published at 12:05 PM Comments (0)

0

Like

Published at 12:05 PM Comments (0)

Legal tip 131. My bank refuses to relax my mortgage... what can I do?

Wednesday, September 2, 2009

My bank is refusing to relax the conditions of my mortgage ... what can I do?

The same as with laundry detergent: Search, compare and if you find something better, just say “goodbye”.

You have the power to demand from the bank the "due collaboration”(according to Supreme Court Case of 2003) if another Bank offers to you a better offer.

The Bank, which is offering to you such improvements in the interest rate, the term or both, must issue in writing:

1 .- An offer to you: the conditions offered will be binding. This "binding offer" is the beginning of the process of subrogation.

2 .- The intent of subrogation to the current lender: communication which needs to be performed through a notary.

The current lender is obliged to submit a “certification” of outstanding debt within seven calendar days.

If the current Bank reacts and improves or meets the offer, it must:

1 .- Express this decision before a Notary Public within fifteen calendar days.

2 .- Communicate to you your own "binding offer" within 10 working days.

Now you have got two banks at your feet! Is it not great?

Valdevaqueros beach ( Tarifa, Cádiz) by Indrasensi at Flickr.com

0

Like

Published at 12:31 PM Comments (0)

0

Like

Published at 12:31 PM Comments (0)

Legal tip 130. Can I change the terms of my mortgage?

Tuesday, September 1, 2009

Can I change the terms of my mortgage?

Yeah, sure you can ... like everything in life, a financing contract must be elastic within certain margins and mostly within the clear will of payment of the debtor.

This requires either an agreement between the lender and you or that circumstances exist which requires the bank to do so (miscalculation of conditions, violation of Law applicable at the time of signing the deed of loan or mortgage ...). It is advisable to have clear idea of the legal frames regulating these sort of contracts.... so here you got:

First chapter: what changes can be performed?

The change may refer to the following:

1 .- An increase or reduction of capital

2 .- Deadline.

3 .- Interest rate.

4 .- The amortization system and any other financial terms of the loan

5 .- Provision or modification of personal guarantees.

(To be continued tomorrow).

0

Like

Published at 3:30 PM Comments (0)

0

Like

Published at 3:30 PM Comments (0)

Spam post or Abuse? Please let us know

|

|