How to claim Spanish mortgage expenses from banks

Friday, February 24, 2017

It is not widely known that the Supreme Court in December 2015 declared certain mortgage clauses as abusive. Most banks imposed on their clients the payment of all expenses of formalization of mortgages, when it was deemed that banks should assume at least a part, since it is reasonable that also the banking entity is equally interested in registering the mortgage deed. The banks are evidently feeling the pressure, since some of them, such as BBVA, Banco Santander, CaxiaBank, Banco Sabadell, Bankia and Ibercaja have already modified their clauses to assume part of these expenses, although they have not yet officially announced it. Several campaigns are under way to claim these mortgage settlement costs. The first step is to go to the Client Service department of the client of the corresponding bank, which in practice means asking for the "libro de reclamaciones".

The actual text of Decision 705/2015 of December 23 of the Supreme Court is as follows (non-professional translation):

"All taxes, commissions and expenses incurred in preparing, formalizing, correcting, writing, altering, including division, segregation or any change that implies alteration of the guarantee - and execution of this contract, and for the payments and refunds derived therefrom, as well as for the constitution, maintenance and cancellation of its guarantee, as well as the premiums and other expenses corresponding to the insurance of damages, which the borrowing party is obligated (by the bank) to have in force" .

This clause continues, authorizing the borrower to charge the Bank with:

- registration of the mortgage in the Land Registry

- notary expenses

- accountancy (Gestor) expenses

In case of non-payment by the bank, the decision also allows for the judicial or extrajudicial claim of the debt, including attorney and attorney fees.

Similarly, and in some cases identical, this clause is written in almost all mortgage loan agreements.

What is the way of proceeding if you were required to pay all expenses, commissions and taxes of the mortgage loan?

In the first place, a complaint must be made to the Customer Service Department of the Bank or Entity with whom the mortgage loan was contracted, or, if applicable, the new Entity that has merged or absorbed the one to whom it was requested.

After two months from the complaint, whether or not the Customer Service Department has replied, or if the response has been negative, you may proceed to file the corresponding legal action before the judicial party of the domicile of the borrower or of the Bank's registered office.

What must be requested in the lawsuit brought before the Court, will be the "nullity of the abusive clause", and the restitution of expenses paid as a result of that agreement, which must be perfectly documented with their corresponding invoices. For the type of procedure to be filed, it will be necessary to use a lawyer.

What expenses, taxes and commissions can be claimed?

Assuming that only the restitution of the costs corresponding to the formalization of the mortgage, and not of the sale, can be requested, the following will be object of claim:

- Notary's Invoices and Property Registry. The Supreme Court says in its ruling that, "with regard to the formalization of notarial deeds and registration of the same (necessary for the constitution of the security right - that is, the mortgage), both the fee of notaries and the notary of the registrars of the property, attribute the payment obligation to the applicant of the service in question or to whose favour the right is registered. And it is undoubtedly the lender who has the main interest in the documentation and inscription of the deed of mortgage loan, because he thus obtains an executive title, constitutes the real guarantee, and acquires the possibility of special execution". In other words, the Courts are siding with the borrower since it is deemed s/he had the weakest negotiating position, therefore the registration expenses need to be borne by the strongest party.

By not allowing a minimum reciprocity in the distribution of the costs incurred as a result of the notarial and registry intervention, making all the debtor pay, an imbalance is generated to the consumer, reason why the clause is abusive.

- Tax of Documented Legal Acts. According to the Law that regulates the Tax on Patrimonial Transactions and Documented Legal Acts: "the acquirer of the property or right and, failing that, the persons who request or request the notarial documents or those in whose interest they are issued"

The Supreme Court understands that in reference to the Tax on Documented Legal Acts, the payer of the tx is the Bank or lender. So it is advisable to include these in the claim.

What documents do I need to collate for the initial complaint to the Bank?

- The title deeds (look for "Escritura de Compraventa")

- Invoices by the Notary office

- Invoices by the Gestoria, ideally detailing the tax paid and specifically look for the initials "AJD" which stands for "Actos Juridicos Documentados")

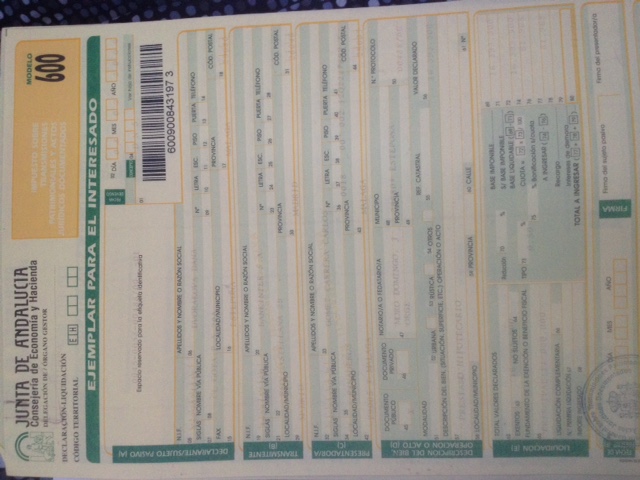

- Model 600 form which shows the actual tax paid. It is a yellow form, an example of which you can see below:

If you want to employ the services of a Gestor to draft your complaint you can search for "gestorias reclamar gastos hipoteca" and you will get a selection, hopefully in your area. In case you want to draft it yourself at this initial stage, here you can download a sample document in Spanish to make your claim.

What is the deadline for requesting the nullity of the clause and claiming the return of the amounts paid?

The term for those mortgages that are still in force, is 4 years to be counted from the day following the date of the Judgment of the Supreme Court, i.e. that term will end on December 24, 2019; And for those mortgages that have been fully paid, the claim can be made if your total payment was made within the 4 year period between December 23, 2011 to 2015.

Hope the above helps as a start. Remember, there have been around 80,000 claimants already according to consumer associations, so there are a lot of claims pending without final decisions. It remains to be seen how this judgement will be applied.

And remember: this is a blog of an interested party - NOT legal advice! :-)

0

Like

Published at 12:40 PM Comments (5)

0

Like

Published at 12:40 PM Comments (5)

Cash is king in Spain when it comes to property

Tuesday, February 21, 2017

A couple of statistics caught my eye this week and they are related to the "how" of buying a property. In previous posts I talked about the "who" (British decreasing, other Europeans increasing) and the "when" (2016 a stellar year for both quantity and price). But how do buyers finance the buing of their Spanish property?

In 2016 a whole 32.8% of purchases were transacted in cash. That is 1 in 3 buyers did not require a mortgage. An inference from this could be that people with money on the sidelines, who have waited until the signs were clear to them, have decided to get back in the Spanish property market. So with that in mind, I researched another statistic, the number of buyers who bought as an investment (i.e. not for holiday and not as a main residence). For 2016, 28.02% of transactions were by investors, compared to 24.65% in 2015 - a 13% increase over 2015 (not 13 percentage points, 13% over the 24.65 value, which is the number that helps identify the strength of the trend).

Before rushing to conclusions that the "smart money" has decided the time is ripe for property, I offer another statistic which i consider relevant: the amount of negotiating margin when it comes to closing the deal. The range of price change before a sale in 2012 was 14%, and in 2016 this has dropped to 6.2%. This item has no official source, since it relies mainly on website/advert numbers compared to final selling price, however it does fit in with my previous post on a large number of sellers increasing their selling price versus those decreasing it. This might indicate tightening conditions from the point of view of the owner, and that the seller's market might not last for long.

In conclusion, we cannot objectively say that the market has put in a bottom, however investors do not buy without good due diligence, and they are usually the first movers. So this is another data point that might indicate more demand in the works for Spanish property.

PS: the majority of data has come from Registradores.org

0

Like

Published at 5:33 PM Comments (3)

0

Like

Published at 5:33 PM Comments (3)

Spanish banks load up (more) debt - sign of optimism or bad news?

Thursday, February 16, 2017

In January 2017 Spain’s three biggest banks, Banco Santander, BBVA and Caixa Bank, have issued bonds for 8.6 billion euros. This is a huge increase compared to January 2016. What do they know that we don't?

First of all, let's clarify that january is a usual month for debt issuance by banks and other companies. So there is nothing unusual about the timing per se. Although I will come back to this in a moment.

So let's focus on the emount. The total amount of debt issued by bankds and corporations in 2017 so far is almost 50 billion euros, therefore the 8.6 billion by the big banks doesn't look to be out of order compared to the rest of the company sectors. However, if we compare this number to the equivalent in 2016 it is almost double! I.e. all European companies have gone on a borrowing binge in 2017! I do not know as to the why, I can only speculate. But I do like to speculate, especially if it has the potential to affect property sales on the Costa del Sol or my house's value.

One reason is the low cost of borrowing. The ECB has maintained interest rates low for a while now while also buying corporate bonds, and over the last few weeks rates have fallen even more. For example Santander has issued a 1.25 billion euro bond with only 0.875% coupon. If only we could get a mortgage with that rate! So one reason could quite legitimately be that banks believe they won't get a better financing deal anytime soon. On the other hand, this could equally mean that they believe rates will rise soon because inflation is rising, so maybe we need to watch our side of interest rates for signs of increases.

Another possible reason could be something more sinister - perhaps they see instability in 2017. Perhaps the actual Brexit or the unpredictability of the Trump government or French/Italian elections etc, have caused them to increase their financial cushion. Santander effectively stated as much when it laid out its financing plans to 2018, in order " to meet the new requirements for loss-aborbency and capital".

I left the most optimistic reason for last. When companies (and banks) increase their borrowing and they do not use it to buy back their stock, it is a classic sign of positive expectations in the economy. The economic theory says that they want to be ready to expand, to grab a bigger share of their markets, and in the case of banks, to lend to more people than their competitors. As I said, all the above is speculation but increased borrowing by virtually the whole of the EU corporate world is a textbook indication of forthcoming expansion.

In conclusion, we simply need to watch for more signs, especially if interest rates stay low while the economy improves. That would be very beneficial for real estate markets in Spain. Watch this space and thanks for reading!

1

Like

Published at 1:25 PM Comments (4)

1

Like

Published at 1:25 PM Comments (4)

Update to post-Brexit analysis relating to property purchases in Spain

Tuesday, February 14, 2017

Further to my previous post https://www.eyeonspain.com/blogs/spainstatistics/16972/post-brexit---how-much-exactly-is-costa-del-sol-real-estate-affected.aspx some more data has come out, which I present below.

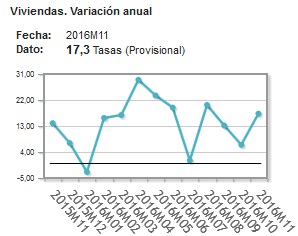

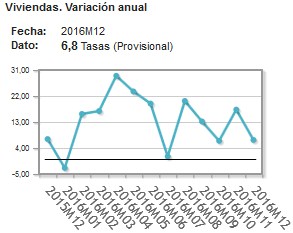

The first relevant graph I used was regarding the total property transactions in 2016 upto November:

We now have the December numbers added, which show a dip, albeit shallow.

The year 2016 has closed with more than 400,000 registered sales (403,743), something that did not happen since mid-2011. Again, the above data is for the whole of Spain, so let's check what can we deduce for the Costa del Sol. Registradores.org has already published the full 2016 year results, so we now know that the 5 provinces with the largest property purchases are:

| Madrid |

58,752 |

| Barcelona |

46,415 |

| Alicante |

29,688 |

| Málaga |

26,436 |

| Valencia |

21,963 |

So we may conclude that Malaga/Costa del Sol is one of the most popular regions at the trimester and yearly level.

Unfortunately price data is not out yet, but an interesting datapoint is the percentage of foreign buyers: 13.5% of property purchases in 2016 were by foreigners. British buyers were lower compared to 2015, as expected, from 23.9% to 16.4%, however still ahead of German and French buyers at 9% and 8% respectively.

So in short, I personally do not see any strong signals of Brexit-related worry judging from the only actions that matter, those of the wallet. Nevertheless, one has to acknowledge the dip in the British-originated purchases in the last month of 2016. Still pending are the price data, which I will inform you on as soon as they are out.

0

Like

Published at 8:41 PM Comments (0)

0

Like

Published at 8:41 PM Comments (0)

Location, location - which Costa del Sol areas are currently performing best

Sunday, February 12, 2017

A good number of people interested in the Costa del Sol don't necessarily know (or mind) which areas they would like to live in. Apart from the obvious considerations of facilities, proximity to beach etc., there is always the question of which area has offered the best investment potential in the past, in order to use that as guidance for the future. I'm sure you have noticed my carefully worded lawyer-speak there :-)

So I have decided to look at some data over the last 4 months and compare locations on the Costa del Sol in terms of the average price of properties. I have chosen to show you here results for 2 bedroom apartments, even though I have ran the reports for various other types with similar results.

The first graph shows as many as possible areas of the Costa del Sol with a large enough sample to avoid data distortion, i.e. where talking of average price of 2-bedroom apartments is actually meaningful. The data shows the ratio of each date's price compared to the price in mid-October 2016:

Initially when running this report I had not included La Campana in the results, but I have left it in to demonstrate the effect of outlier data in a small sample. At first sight it looks like if you had invested in La Campana apartments 4 months ago you could be opening the bubbly right about now! However, if you are a data addict like me you would know that this is probably the effect of perhaps a new pricier development coming to the market, or many cheaper properties having been bought, leaving the pricier ones still in the market. So that would leave Ojen as the best performer at a more reasonable 5% appreciation since October, and San Pedro the lagger with 9% depreciation.

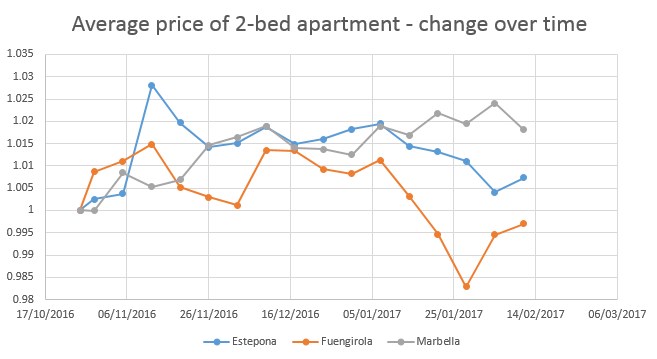

The central bundle of data is worth a closer look, and I have chosen for this report to show Marbella, Estepona and Fuengirola, as the locations with most dense property statistics. (I have included other locations with not significant comparison results, but I'd be happy to share them if you PM me).

Here is the graph showing the more detailed view of Marbella, Estepona and Fuengirola 2-bedroom apartment average price change:

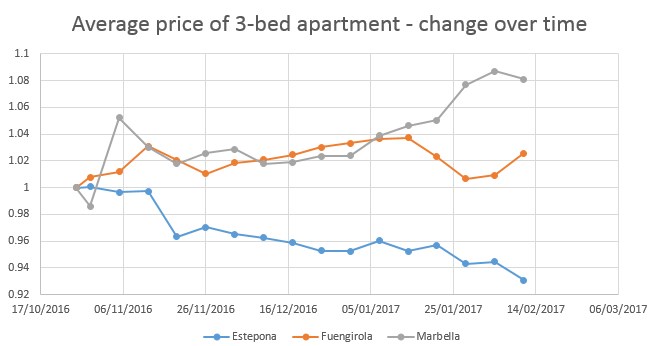

Perhaps you will agree that Estepona and Fuengirola are essentially flat, after a few gyrations, and Marbella shows what could be a steady trend in increase in average property price. I proceeded to inspect more combinations, for example 3-bedroom apartments, shown below:

Fuengirola continues flat, Estepona is in a downtrend, but Marbella still shows that property prices for apartments in general are on the uptick. I repeated the search for townhouses and villas, where the sample is of course smaller so the fluctuations are larger, with very similar results - Marbella moving upwards.

So as a conclusion, I would dare say that when it comes to considering location, Marbella properties seem to be outperforming their peers at this moment. Normally these are the signs of a recovering market where the first properties to be bought are the most "desirable" ones, but my usual disclaimers apply: these are sale offer prices not final purchase prices, and trends should not be considered stable until after 6 months. The above 4-month data though enables us to anticipate events by showing that Marbella properties are showing strength relative to other Costa del Sol locations.

For more data as always you can visit: https://hbcostadelsolproperties.com/property-search/

0

Like

Published at 1:02 PM Comments (2)

0

Like

Published at 1:02 PM Comments (2)

Demand for Costa del Sol properties - what is it really doing?

Wednesday, February 8, 2017

For a few months now we have, anecdotally, felt that quite a few sellers are calling in and asking for their property price to be increased. This is normally a sign of a seller's market where demand is strong. But as you may have guessed from my last post, I don't do "anecdotal" :-) So I went to examine the real data for the truth (all data below are for Costa del Sol properties).

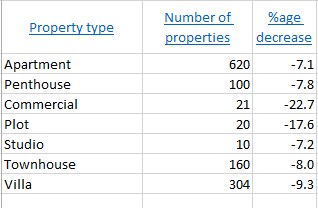

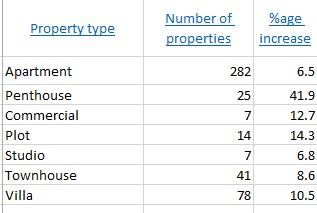

First of all I went to get totals for the year: how many properties have had their prices increased after a while, compared to how many decreased. The data below is grouped by property type for year 2016, showing the number of properties that have had their price changed, and the percentage change over the original price:

Decreased:

Increased:

It seems that approximately between 25% and 33% of price changes are increases, a respectable number. I personally didn't expect it to be that high. It has certainly been lower in past years, unfortunately I cannot prove it to you on this post as I do not have data from 2015. However, I set out to discover if there's a trend within 2016, so I grouped the data by trimester. For the sake of brevity I will not display the data here, but there is no trend neither increasing or decreasing. It's around a stable 7-9% of properties on the market at any one time.

However, what I found interesting was the time between the day a property went to market and the date it had its price increased: this was steadily reducing. On average, the days between on-market day and price-increase day were:

| Q1 |

Q2 |

Q3 |

Q4 |

| 111 |

108 |

87 |

81 |

Again, I would like to point out that a trend is something that can turn in a second, and also these are not actual notary prices, nevertheless it seems that sellers of properties on the Costa del Sol are more keen to raise their property's price than they were 12 months ago. Welcome news to my ears at least.

I would be curious to hear other people's thoughts, maybe even from other areas of Spain. Thanks for reading!

PS: if you are interested in viewing time variations of property prices, or how many properties were on the market in a given area, perhaps you will find our "different" way of presenting properties interesting: http://hbcostadelsolproperties.com/apartments/ Click on the link of the column "Time series" for your area of interest.

1

Like

Published at 6:40 PM Comments (3)

1

Like

Published at 6:40 PM Comments (3)

Spam post or Abuse? Please let us know

|

|