A good number of people interested in the Costa del Sol don't necessarily know (or mind) which areas they would like to live in. Apart from the obvious considerations of facilities, proximity to beach etc., there is always the question of which area has offered the best investment potential in the past, in order to use that as guidance for the future. I'm sure you have noticed my carefully worded lawyer-speak there :-)

So I have decided to look at some data over the last 4 months and compare locations on the Costa del Sol in terms of the average price of properties. I have chosen to show you here results for 2 bedroom apartments, even though I have ran the reports for various other types with similar results.

The first graph shows as many as possible areas of the Costa del Sol with a large enough sample to avoid data distortion, i.e. where talking of average price of 2-bedroom apartments is actually meaningful. The data shows the ratio of each date's price compared to the price in mid-October 2016:

Initially when running this report I had not included La Campana in the results, but I have left it in to demonstrate the effect of outlier data in a small sample. At first sight it looks like if you had invested in La Campana apartments 4 months ago you could be opening the bubbly right about now! However, if you are a data addict like me you would know that this is probably the effect of perhaps a new pricier development coming to the market, or many cheaper properties having been bought, leaving the pricier ones still in the market. So that would leave Ojen as the best performer at a more reasonable 5% appreciation since October, and San Pedro the lagger with 9% depreciation.

The central bundle of data is worth a closer look, and I have chosen for this report to show Marbella, Estepona and Fuengirola, as the locations with most dense property statistics. (I have included other locations with not significant comparison results, but I'd be happy to share them if you PM me).

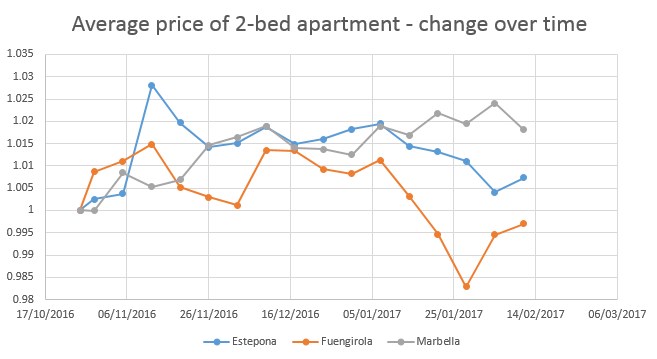

Here is the graph showing the more detailed view of Marbella, Estepona and Fuengirola 2-bedroom apartment average price change:

Perhaps you will agree that Estepona and Fuengirola are essentially flat, after a few gyrations, and Marbella shows what could be a steady trend in increase in average property price. I proceeded to inspect more combinations, for example 3-bedroom apartments, shown below:

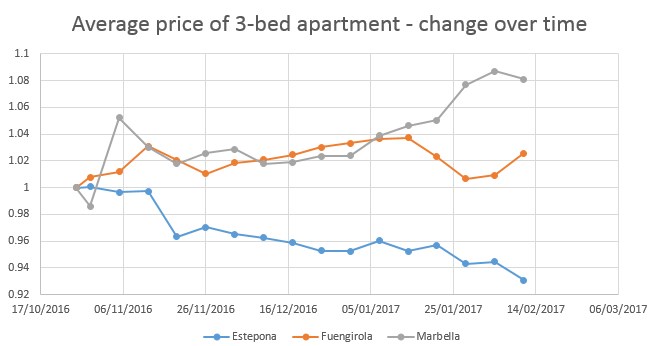

Fuengirola continues flat, Estepona is in a downtrend, but Marbella still shows that property prices for apartments in general are on the uptick. I repeated the search for townhouses and villas, where the sample is of course smaller so the fluctuations are larger, with very similar results - Marbella moving upwards.

So as a conclusion, I would dare say that when it comes to considering location, Marbella properties seem to be outperforming their peers at this moment. Normally these are the signs of a recovering market where the first properties to be bought are the most "desirable" ones, but my usual disclaimers apply: these are sale offer prices not final purchase prices, and trends should not be considered stable until after 6 months. The above 4-month data though enables us to anticipate events by showing that Marbella properties are showing strength relative to other Costa del Sol locations.

For more data as always you can visit: https://hbcostadelsolproperties.com/property-search/