| The Comments |

It is a fact of life that taxes are inevitable in most countries, Spain is no exception.

It is the responsibility of new owners to research all taxes and other costs before they buy.

But like many, we fell foul and we too were surprised at the 4 year delay in working out our IBI.

It caused no hardship, but we chastised ourselves for not anticipating the amount.

The problem that we now have, is that on our Urb. everyones IBI has increased by 63%.

We consider this to be excessive and many wonder if it is related to the recent corruption exposed in the Estepona Ayuntamiento.

We are back at the Urb. in two weeks time.

Does anyone have any advice as to who we should speak to in Estepona offices to query this huge increase.

Or perhaps it is general through C de S.

Cheers

Leo

0

Like

0

Like

|

Wow an increase of 63%, in our area there's normally an outcry if it goes up by 5%.

I think I'd also ask for advice in the legal section (Spanish Solicitors) perhaps they might be able to point you in the right direction.

0

Like

0

Like

|

I did read somewhere recently about Estepona increasing their charges. 63% is indeed outrageous, but I think the problem arises because for years the Valor Catastral (rateable value) is not reviewed. When the council do get round to doing so, it invariably leads to a huge hike in rates. But when you bear in mind that most bills increase year on year, and your IBI probably hasn't changed in several years, you can perhaps console yourself with the knowledge that you've been able to keep your money in your own account longer, possibly gaining interest.

We had a similar situation with our community charges, which had been the same for 3 years. We then had to put them up by about 20%, and some people complained that this was way above the rate of inflation, until we pointed out that in previous years they had got away with, in real terms, a reduction.

I'm still amazed every year when I hear about the UK budget, and road tax going up another (how much?), while for the last FIVE years I've been paying exactly the same amount - €80 per year! How long can it last?

_______________________

"Get your facts first, then you can distort them as you please"

Mark Twain

0

Like

0

Like

|

IBI in our area, Manilva, has apparently (and I state that from information given to me only as we were not liable to pay this for 2007) risen over fifty percent. Apparently, there has been, generally, an increase of over fifty percent in the Manilva region and from what I have read the same in Estepona also.

I think, regardless, we are all governed by prices worldwide which have increased and we have to accept an increase in the basic commodity prices! We can all start arguing the toss when the markets start to correc themselves and prices start to reduce! Hopefully!!

0

Like

0

Like

|

Hi all

I have just read all of the posts, I cannot believe how much Robmet has to pay.

I have just received a bill from Suma and they are asking €109.09 for 2007. I do have a fiscal rep and they are also asking for €87.97, both need paying in October. What I am baffled about is that my neighbours, didn't need to pay for 2007 as there was no street lighting, post boxes, bins or street cleaners. Can anyone tell me if this is true? Although, I believe my neighbours, I cannot understand why we got a bill for last year, only today and why our fiscal rep, didn't mention last years bill before. I am trying to get the answers from the solicitor, but as people say, they want your money, but they don't tell you everything that needs paying when you purchase a new build!

We completed in Dec 2006, but moved in November 2007. We only got our residencia certificates 2 months ago.

Our solicitor is claiming that because we received the residencia certificate just this year, that we are also liable for the wealth and income tax. It appears next year we will not pay this as we are residents this year! Strange!

Thanks in advance for any help.

_______________________

R & R No.8 Phase 2

0

Like

0

Like

|

Wealth Tax/Renta is paid in arrears so this year you will be paying for Jan/Dec 2007.

I bought in Oct 2003 and had to pay a full years Wealth Tax but only part of the Renta. Whether you will also have to pay for 2006 because you completed in December 2006 I couldn't say perhaps someone else was in a similar situation.

From January 2008 Wealth Tax has been abolished for residents and non residents but Renta hasn't, as you applied for Residencia November 2007? you will not be liable for Renta in 2008 as it's your main residence.

As to the Suma question then the only thing I can suggest is to go to the Suma or ring them. I believe there is a number you can ring on certain days where you can speak to an English Operator. Maybe there has been a misunderstanding and someone can explain this to you.

0

Like

0

Like

|

Thanks for replying. I have been doing some research on the net, I take it that everyone has to pay this tax for previous years then. I don't think I have to pay for 2006 as there is no mention of that.

We don't have to pay Renta, I guess this is for non-residents as I have never heard of it, until I read some posts.

I have looked on the bill, which is issued from the Suma Office in Orihuela. I don't mind going there to find out, but living where I am, there won't be any English speaking people.

Do you have a english speaking number for Suma?

I have a feeling that regardless of community services i.e. lighting etc, all property owners have to pay for the ibi from when they purchased.

_______________________

R & R No.8 Phase 2

0

Like

0

Like

|

Residents and Non Residents who own two properties are liable for Wealth Tax on the second property and Renta Tax. A lot of people get confused with the name Renta and think they shouldn't pay this tax because they are not renting out the property. This has been explained fully on this thread by Roberto.

You say you didn't move into house until Nov 07 so where were you living before that? If you owned another property then you will have to pay for both taxes.

I don't have a number for Suma, I think it may be printed in the free English papers or Costa Blanca News in the section marked useful telephone numbers.

You may be right in your last paragraph, only thing I find strange is that you have received a bill for last year without receiving a bill for this year. Suma bills are issued in September each year. It made me think that the bill you've received might be for this year?

0

Like

0

Like

|

semijubilada

No I don't own 2 properties, just the one is enough! We moved from the UK in November 2007.

I will look in the papers for the number then.

My solicitor has just confirmed:

'By law in Spain you have to pay for the local rates from the 1st Janaury that you owned the property which in your case was 2007. The builder had handed the area to the local authority who had accepted it and hence the bill was issued.We cannot force you to pay it we can only advise that non payment will eventually force Suma to place an embargo on your property.

The bill for 2007 was due to be paid earlier in the year.

The first local rates bill can be issued up to 5 years after completion and is backdated which is why you have received the bill in 2008'.

My solicitor has got the 2008 bill and we have received the 2007 one. Very weird I know, I can only now believe what they are saying and pay for both. What I am confused about is that neighbours who completed/moved in way before us, have no bill for 2007, they are claiming there was no services in the area and we were not registered so they are not going to pay the 2007 bill even if it arrives eventually.

I needed a second opinion from outside the community, as I am confused with who to believe!

_______________________

R & R No.8 Phase 2

0

Like

0

Like

|

I'm a firm believer in a second, third and forth opinion, then you can sort out the wheat from the chaff

I've owned a property for nearly 5 years now and at first I believed all that I was told, after a while I realised that I needed to find out what was fact and what was fiction.

I'd already bought "Buying a house in Spain" when I was searching for a property and then decided I needed extra help so bought "You and the Law in Spain" from a local English bookshop in Torrevieja. A lot of information to read but well worth the money. Also recommend getting the book on Driving in Spain as well.

As to your IBI bill for 2007, if you've received one delivered to your house then so will your neighbours. Stange that you didn't receive it earlier this year but every house is liable to pay it, failure to pay within the stated time will result in penalty payments being added to the amount shown as due.

My advice to your neighbours would be to go to the Suma, who can print off the bill for them to take to their bank for payment. Their bank can then set up a direct debit for the bill to be paid automatically every year.

As to the Wealth/Renta tax due for 2007.

I think I mislead you in my previous reply. Perhaps if we say that prior to November 2007 your main residence was in UK. You then moved to Spain and applied for Residencia straight away. Take away the owning two properties, I was talking about owning one in UK and one in Spain. Not knowing your situation you may have rented so I was trying to cover that as well and totally confused you.

I'm not sure how the law governs that situation so I think that you would be wise to pay your Solicitor 87.97 to prepare your Wealth/Renta tax form for you. They can also deal with the IBI bills for you saving you a bit of time queueing to do it yourself. Dont forget to add some extra euros for the 2007 bill as the has been a delay in paying it.

I think you'll find that even if you didn't own two properties in 2007 as a non-resident in that financial year you will still be liable to pay the Wealth/Renta tax.

To put another spanner in the works, if your home is held in joint names then you will both have to submit a form so expect to pay double that amount. Only good thing to say about it is that it will only be a one off payment as you are liable for 2008 onwards.

0

Like

0

Like

|

Yes me too. I never believe one or two opinions.

I am going to the Suma tomorrow and will find out why I am the only one with a 2007 bill. Everyone is adamant they have no bill for 2007 and that it isn't necessary for us to pay as the area was not registered.

We have never rented here or in the UK. We sold our house in the UK and drove here, lock, stock and barrel!! Yes, prior to that we did own 2 properties, one here and one in the UK.

It seems that we do need to pay the wealth tax, but I want to sort the 2007/8 bills for the local rates first. My solicitor now claims they don't have a bill from Suma for the local rates 2008, Yet they know the amount is €87.97. The wealth tax they are asking for €222.

Yes our property here is in both of our names. Maybe the €222 is for both of us. Without any paperwork I don't know. The solicitor only sent us an email which outlines costs payable. They have not produced any official docs from Suma or any other office!

I could only apply for residencia this year as we was waiting for the padron, which we managed to get last dec. I didn't get an appt for the residencia til July! There was a huge waiting list!

Yes the Suma bill (2007) for the local rates I have, definately has a penalty on it as its for €109, the 2008 payment is for €87.97.

_______________________

R & R No.8 Phase 2

0

Like

0

Like

|

Be interested to hear how you get on at Suma.

You shouldn't pay any more tax for joint owners than a single, you'll both pay 1/2 each, the only extra cost is that normally the gestor/solicitor charges you twice as they are completing 2 sets of forms. Maybe your solicitors are being kind and only charging you once, after all the forms would be duplicate copies of each other and the only thing which changes are your individual NIE numbers.

I've just pulled off my spread sheets for what I've paid since 2004 and my suma started at 166.04 and last year I paid 213.04. My wealth tax was 221.04 and this year was 328.41.  I'm hoping the Valencia region will follow the legistation. Still not heard that they have.

I only have a small terraced house, can't say what the cadastral value is as the suma bills are in Spain. Just thought I'd let you know what you might have had to pay if your house came under the Torrevieja area.

It used to be that my entire expenditure for the house was just under a £1k a lot less than my yearly council tax.

0

Like

0

Like

|

Hi All

Just been reading the thread with interest ..

Rashmi

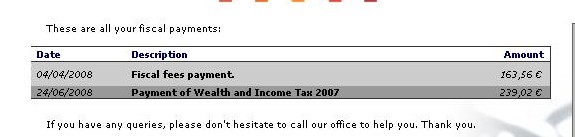

Hi, here is a copy of what we have paid to date on the same complex as you.I think I was told that this is to be paid every May for previous year. Our solicitor did it for us obviously for a yearly fee. Hope this Helps

_______________________

Kev & Jess

0

Like

0

Like

|

Hi Kev, I've always paid my Wealth/Renta in May and IBI in September.

Have you received last years IBI bill?

If not perhaps you'd better ask your solicitor why Rashmi has his figures for both years. It will be interesting to find out where the bills for 2007 have been!

Most non-resident owners of new properties leave their affairs in the hands of the solicitors as the fiscal reps. The IBI bills do mount up and my friend paid 3 years in one go. Her solicitor emailed her of the amount that was due to be paid so that she could arrange for the amount to be transferred into her Spanish Bank account.

0

Like

0

Like

|

Hi Semi,

I will email solicitor and see what they have to say, probably won't have a response for a while (normal manana) but as soon as I do I will post. Have never recieved any bills to date, what are the Fiscal Fees for, is that just the service solictor provides?Don't want to get landed with a big IBI bill in the future.

Cheers

_______________________

Kev & Jess

0

Like

0

Like

|

I pay my Solicitor each year to calculate my Wealth/Renta tax and IBI. It used to cost 71.34 but this year it was 82.94. I see that you paid 163,56 (81.78 each as you are joint owners)

I'm not sure how they sort out my IBI, as I said my friend had to wait 3 years before her first IBI became due. I bought a resale so I started to pay from the following year of purchase. I'm unsure whether they set up a direct debit for you once they pay the first years (or in your case the first IBI bill received) and after that it sorts itself out.

I rang my Solicitors office on Monday as I moved Banks last October and as yet haven't had an IBI payment taken from my account. As I pay them to look after my financial (fiscal) affairs I expected them to sort this out for me. When I rang I was told that the lady who deals with the Suma was at the Suma office and would ring me back, I'm still waiting for the call.

The Suma notice is in my post box when I arrive in October and it has my Bank details on it but I won't know until this year whether it was done automatically by direct debit or by the solicitors.

As I said earlier I'm still waiting to hear if the Valencia Region will cancel the wealth tax. I've just read Round Town News on-line and Jennifer Cunningham said that the local newspapers stated the Valencia Government have a budget deficit of 276 million Euros. She was referring to Healthcare for all expats but it doesn't look good for us, can't see them willingly give up this extra source of income.

0

Like

0

Like

|

Hi Semi

Have mailed solicitor,see what response I get, How long have you got your property in torre, have you ever recieved IBI bill. I would hate to get a large bill in a few years time would rather keep on top of it if possible......

Cheers

_______________________

Kev & Jess

0

Like

0

Like

|

Kev - I thought you lived on the same urbanisation as rash29, if so your IBI bill should have been produced at the same time. Hopefully he will have something to report tomorrow after his visit to the Suma Office.

Suma is the organisation who deal with IBI payments and Car Tax.

As to your other question I bought in Oct 2003 and started to pay IBI in 2004. IBI is calculated from January to December and whoever owns the property in January of that year pays the bill in September. This is explained by Rash's solicitor in his post @ 11.47

0

Like

0

Like

|

Semi,

I am a non resident and have a place on the same urb. as Rashmi (she by the way). Got a response from solicitor and it looks like there isn't an IBI bill for our urb yet although maybe because there are 3 phases on our complex, all built at seperate times, my phase isn't yet ready for the IBI as was built aprrox. 2 years after the the 1st phase. Hopefully Rashmi will have some info once she has spoken to our local suma office.

Here is a cut from email recieved this morning from my solicitor.

"Wealth and Income tax is paid annually each year by all non resident a year in arrears it is calculated from the escritura value of the property and the rateable value of the property.

Local rates ( IBI ) can take up to 5 years to be issued on a new property and then they are backdated. The local rates for your property have not yet been issued.

The Wealth tax portion of the Wealth and Income Tax declaration has been abolished and it is with effect on taxes due for the year 2008. As taxes are paid a year in arrears this year you still have to pay for 2007 however in 2009 this will change."

_______________________

Kev & Jess

0

Like

0

Like

|

Semijubilada

Today I went to the Suma office and it appears that everyone on the forum and the internet were correct. As my Husband and I completed Dec 2006, we are liable for the Suma IBI bill for 2007 now. It so happens that a lot of the neighbours have been sent a bill, but they either don't know or have paid and not told anyone else about it.

Apparently, the minute you sign for the property and the builder hands over to the local authority, if in my case it ends up being before January 2007, then we have to pay both bills for 2007 and 2008. Fortunately for some people, the builder handed over after Jan 2007, so the lucky ones who completed after us, don't have to pay for 2007! We got stiched up for the bill by 1 month!!

Thanks for your help so far!

Kev K

Bear with me as I am going to be sharing my experience and research on our own message board.

I think you are going to be the lucky one as you have bought a property on phase 3. At the moment, I think only our phase is going to be affected.

_______________________

R & R No.8 Phase 2

0

Like

0

Like

|