| The Comments |

Had the following news headline. First I have heard of this so has anyone been contacted by their banks .

Warning: all bank customers in Spain are required to register their signatures in person by 28th April.

0

Like

0

Like

|

I read this headline earlier tonight on Murcia today too and was worried we go back on the 29th so will miss the deadline, so i went on our banks website Sabadell and there is nothing on there about it. we have received no mail about it either and they do have my english address, so we are also concerned as to what we do?

0

Like

0

Like

|

Apparently it's a requirement that everybody with a bank account has to provide details. I haven't had any messages from my bank (Bankia) but others are saying they have a message every time they log on with the internet. Passports and DNI (for Spanish) plus a "proof of income".

This article says he was also asked for a wage slip or tax return as well.

I shall be popping into my bank tomorrow to check on this.

0

Like

0

Like

|

I asked in the Santander, and was told we have no need to do this

Anyone else been to their Santander bank?

0

Like

0

Like

|

Cinco Dias reports here that banks are rushing to update customer information before the deadline on the 28th April - this is mainly due to some of them not having done this since 2010 when the original law was put in place.

I'm off to my bank now, lets see what they say.

_______________________

0

Like

0

Like

|

Bankia said I didn't need to do anything as I had updated my passport details in 2011 when I got a new one.

0

Like

0

Like

|

Is this requirement for banks in Spain or does it include bank accounts in other countries?

0

Like

0

Like

|

Santander say they have my details from when l opened account 10 years ago Since then I have renewed my passport (different number) but I didn't tell them that!

0

Like

0

Like

|

Camposol

It's only in Spain Ley 10/2010

_______________________

0

Like

0

Like

|

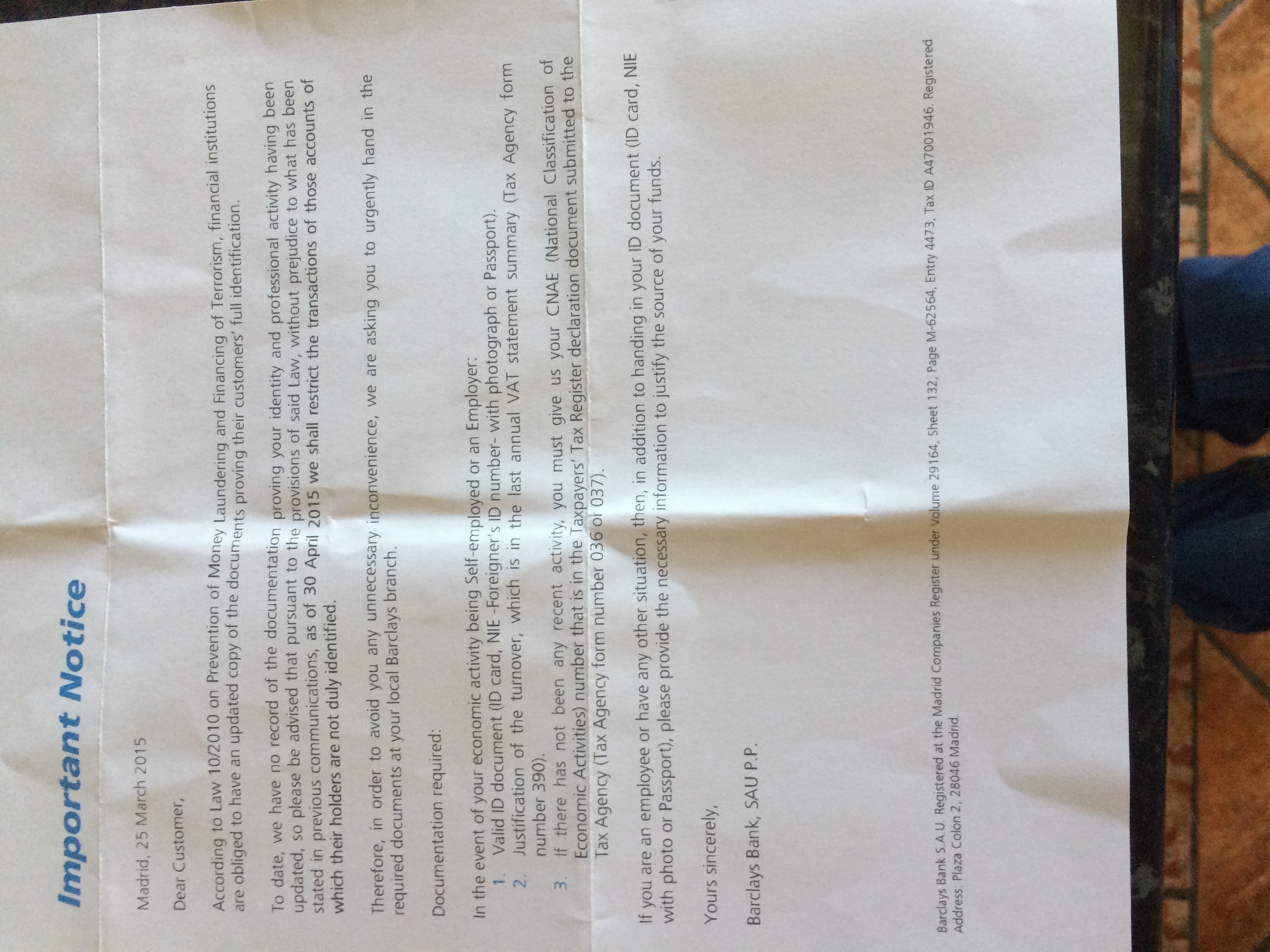

Amazing coincidence, the postman has just delivered this.

It seems to me that Santander are being a little to laid back about it, Barclays/La Caxia are threatning parcial or full embargo for non compliance

_______________________

0

Like

0

Like

|

Are you referring to Barclays in Spain, thought they were no longer here ?

0

Like

0

Like

|

Yes, Barclays Spain. Retail operations taken over at the begining of the year by La Caxia but branches still running under the Barclays brand for the next few months while the network is being merged

_______________________

0

Like

0

Like

|

Barclays sold the retail operation to CaixaBank making a £500 million loss, UK banks have had a torrid time, too many fingers in too many pies.

_______________________

I'm Spartacus, well why not?

0

Like

0

Like

|

Team GB.

Same letter as I got early February...(Sabadell)... Emailed over what they wanted, got acceptance back next day, think it also mentioned a deadline date to do as well.

0

Like

0

Like

|

Baz

I hadn't heard a thing about it until the OP started the thread, it appears that the main requirement is to have up to date id information.

However the self employed have to present their VAT statement and their job classification number, no doubt they (tax office) would be expecting to see income received in line with the 21% VAT paid over!

The letter finishes by saying.

If you are an employee or have any other situation, then in addition to handing in your ID please provide the necessary information to justify the source of your funds

I sold a car last month and had a few thousand transfered in to the account, not sure if the bank will ask to see the purchase invoice in this instance or if they will ask to see evidence of source from every account credit, could be a problem for some I fancy

_______________________

0

Like

0

Like

|

Team GB.

I recon we get different letters you being in Spain me UK, or it's just the different banks ways, my letter says nothing about any source of funds going in, it does say the cut of point is before the 9th March 2015, as said also if you don't do what they ask the account would be restricted.

My UK bank did ask in the past, only the once though, where some of the amounts of cash I paid in came from, cheques and D/D have the paper trail as we know. The governments have to know where you get money from these days.

I stopped paying in cash to this bank, opened up a building society account, pay cash into this, and to this day they have never asked where it comes from.

0

Like

0

Like

|

Do expats in Spain have to do anything about their banks in UK regarding this proof of ID

Haven't heard anything about it from Barclays UK

0

Like

0

Like

|

This is purely a Spanish law, not EU wide. Wouldn't apply to any account you already have in UK.

0

Like

0

Like

|

Apparently it is an EU Directive

0

Like

0

Like

|

Ley 10/2010 of the 29 April 2010 to combat money laundering and the finance of terrorism. This actual law is unique to Spain but does comply with EEC directive 91.308 of June 1991. All countries have put in measures to comply with this. For example, the no cash transactions over €3000, proof of identity when opening bank accounts and so on. In UK you cannot open a bank account, and haven't been able to do so for some time, without proof of identity and residence. I found this out when my father died and I tried to transfer the account to my mother's name. The account was in his name, the utility bills were in his name and she had no current passport or driving licence. They wouldn't accept a pension payment letter in her name as "it wasn't on the list of acceptable documents". Bank account was effectively frozen until we found a relative who banked with the same bank to complete a form saying they'd known her for x number of years.

You will also need proof of income to obtain a basic debit card in UK as well. However, these regulations have been in force for some time and there is no requirement to do it again for existing account holders.

I think Spain is waking up to the idea that the black economy is costing them a lot of money. It is a way of ensuring the Spanish can account for where they get their money from and that they do declare it for tax purposes. Like Greece, billions of euros a year go under the radar.

No necessity for anyone with a UK bank to do anything, though. After all, it would be all over the papers and news if it were.

0

Like

0

Like

|