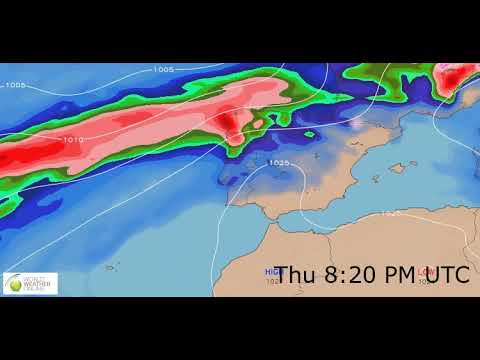

The weather in the whole of Spain is atrocious at the moment, with snow, hail, torrential rain, high winds, black ice and widespread flooding. There are yellow and orange warnings for most of the country. To blame are Alison, Amy and Mehmet, named storms approaching from the West and North.

The weather in the whole of Spain is atrocious at the moment, with snow, hail, torrential rain, high winds, black ice and widespread flooding. There are yellow and orange warnings for most of the country. To blame are Alison, Amy and Mehmet, named storms approaching from the West and North.

[YouTube]

Many businesses, such as hotels and restaurants, livestock farms, olive groves and wine bodegas, as well as private homes have been affected and will be hoping that their insurance provides adequate coverage. Responsibility for damage caused by flooding passes to the Consorcio if insurance policies are in place and fully paid up.

This article explains how to claim from the Consorcio.

Eligibility

The CCS “takes care of compensation always provided that” the property has been previously insured - usually seven days.

The CCS “takes care of compensation always provided that” the property has been previously insured - usually seven days.

For its part, the CCS will cover the damages suffered by the insured persons and properties, including homes, communities, vehicles, premises, and industries.

In addition to material damages, it will also compensate those affected for immaterial damages such as loss of rental income, accommodation expenses resulting from the uninhabitability (sic) of the home, or loss of income due to the closure of commercial, industrial, and service establishments.

[LinkedIn]

How to claim damages from the Consortium of Insurance Compensation

The policyholder can directly submit a claim to the Consortium for both personal and property damages. The CCS provides a free phone number, 900 222 665, although claims can also be processed via their website.

The policyholder can directly submit a claim to the Consortium for both personal and property damages. The CCS provides a free phone number, 900 222 665, although claims can also be processed via their website.

The insured party must promptly provide identifying information such as the policy number, policyholder, and the insured party, as well as their bank account details.

[Money Donut]

Likewise, it is recommended to keep the remains of the damaged goods until the visit of the loss adjuster (perito) and, if not feasible, take photographs; keep the invoices in case urgent repairs need to be made; provide repair estimates and invoices for the damages, and two copies (original and duplicate) of the policy and premium payment receipt.

So, when the damage is caused by floods, the Consortium will be responsible for compensating those affected.

So, when the damage is caused by floods, the Consortium will be responsible for compensating those affected.

But “when the water comes from above,” for example, through leaks in the roof of a building, “it will not be the Consortium's concern, but rather the insurance company's,” explains broker Carlos Lluch.

[CNN]

Leaks or dampness following episodes of heavy rain are actually quite common. In such cases, if the cause is not lack of maintenance or gradual deterioration, the affected party will be indemnified by their insurance company.

However, there are limitations. One of them is that more than 40 litres per square metre per hour must have fallen. Additionally, Lluch points out that there are policies that specify that the adverse weather phenomenon must have occurred “at an abnormal time.”

If the property that has been damaged is a vehicle, “all car insurance policies include coverage against extraordinary risks,” states the Business Association of Insurance, Unespa. They also specify that all owners whose cars have been swept away by floods or damaged by winds exceeding 75 mph will be compensated by the Insurance Compensation Consortium (CCS).

If the property that has been damaged is a vehicle, “all car insurance policies include coverage against extraordinary risks,” states the Business Association of Insurance, Unespa. They also specify that all owners whose cars have been swept away by floods or damaged by winds exceeding 75 mph will be compensated by the Insurance Compensation Consortium (CCS).

[ABC News]

On the other hand, damage caused by hailstones will be covered by the insurance company if the policyholder purchased this additional coverage.

If the weather has damaged a crop, agricultural installation, or animals, the compensation claim must be made through agricultural insurance. It is important to note, however, that anything insured by the agricultural insurance plan does not receive public aid.

Ignacio Lillo, reporter for Diario Sur, Malaga, informs us that with the first week of the torrential rains behind us, the number of claims lodged with the Consorcio de Compensación de Seguros is already close to 500.

Specifically, 463 requests had been registered by the end of the year, according to government sources, from those affected who had current insurance cover.

Most of them relate to problems in homes, businesses, shops, offices, warehouses and damage to vehicles, all affected by the floodwaters.

Most of them relate to problems in homes, businesses, shops, offices, warehouses and damage to vehicles, all affected by the floodwaters.

However, the number of claims is expected to be much higher, as many of those affected are still clearing away the mud and assessing the losses they have suffered, particularly in terms of furniture and household goods.

Flood damage in Malaga [NPR]

In addition, the Consorcio's assessors and loss adjusters ('peritos') are still working on assessing the damage on the ground, a task in which they have been immersed since the day after the catastrophe.

The aim of this agency, which reports to the Ministry of the Economy, is to be able to start paying out the first compensation settlements from the cases already processed.

How to file a claim

The Spanish government's Directorate of Consumer Affairs has clarified how those affected can submit a claim for compensation to the Consorcio.

This covers both material damage caused by the flooding and non-material damage resulting from the flooding, eg loss of rental income for property owners, costs for alternative accommodation when your home is deemed inhabitable, loss of business income due to inability to trade and so on.

The only requirement for access to Consorcio cover is that the person or property affected is insured and that the insurance was in force at the time the extraordinary flooding occurred, which must be vouched for in the application for compensation.

requirement for access to Consorcio cover is that the person or property affected is insured and that the insurance was in force at the time the extraordinary flooding occurred, which must be vouched for in the application for compensation.

[La Razon]

The Consorcio will compensate in accordance with the sums insured and the clauses within the insurance policy of the affected person, which is confirmed by the private insurance company with whom the insured has the policy(-ies).

To start the claim process, simply call the Consorcio's call centre (freephone 900 222 665) and provide the identification details of the insured person and of the damaged persons or property, if they have insurance. This information can also be completed online at the Consorcio's website.

To start the claim process, simply call the Consorcio's call centre (freephone 900 222 665) and provide the identification details of the insured person and of the damaged persons or property, if they have insurance. This information can also be completed online at the Consorcio's website.

[EuroWeekly News]

The government added that the Consorcio will log and manage all compensation claims received by insured persons, even if the seven-day period has elapsed since the damage occurred, as stipulated in the insurance regulations.

Endword

So, there you have it. I've made several claims to the consorcio and it's always been straightforward and they've paid out without a quibble.

As for insurance companies, they're another matter - they try to wriggle out of everything!

Links

Eurythmics, Annie Lennox, Dave Stewart - Here Comes The Rain Again (Remastered) - YouTube

"The Rain in Spain ....." - Eye on Spain

© The Crazy Guy (Paul Whitelock)

Pictures:

ABC News, CNN, EuroWeekly News, La Razon, LinkedIn, Money Donut, NPR, Paul Whitelock, YouTube

Thanks:

Eye on Spain, Paul Whitelock, YouTube

Tags:

112, Annie Lennox, assessor, ABC News, CNN, Carlos Lluch, consorcio, CCS, Consorcio de Compensación de Seguros, David G Stewart, Diario Sur, EuroWeekly News, Eurythmics, Eye on Spain, flooding, "Here Comes the Rain Again", Ignacio Lillo, La Razon, LinkedIn, loss adjuster, Malaga, Money Donut, NPR, Paul Whitelock, 'perito', Secret Serrania, The Crazy Guy, Unespa, Wikipedia, YouTube