"Is the electricity going to go up or is it going to go down?" That's the question that everyone is asking because as of June 1 the electricity bill will be changing. The experts agree that it will not go up but it will go down for those who make a little effort. The Government insists that it was looking for a solution to help change the way that we consume electricity so it can be more efficient and sustainable.

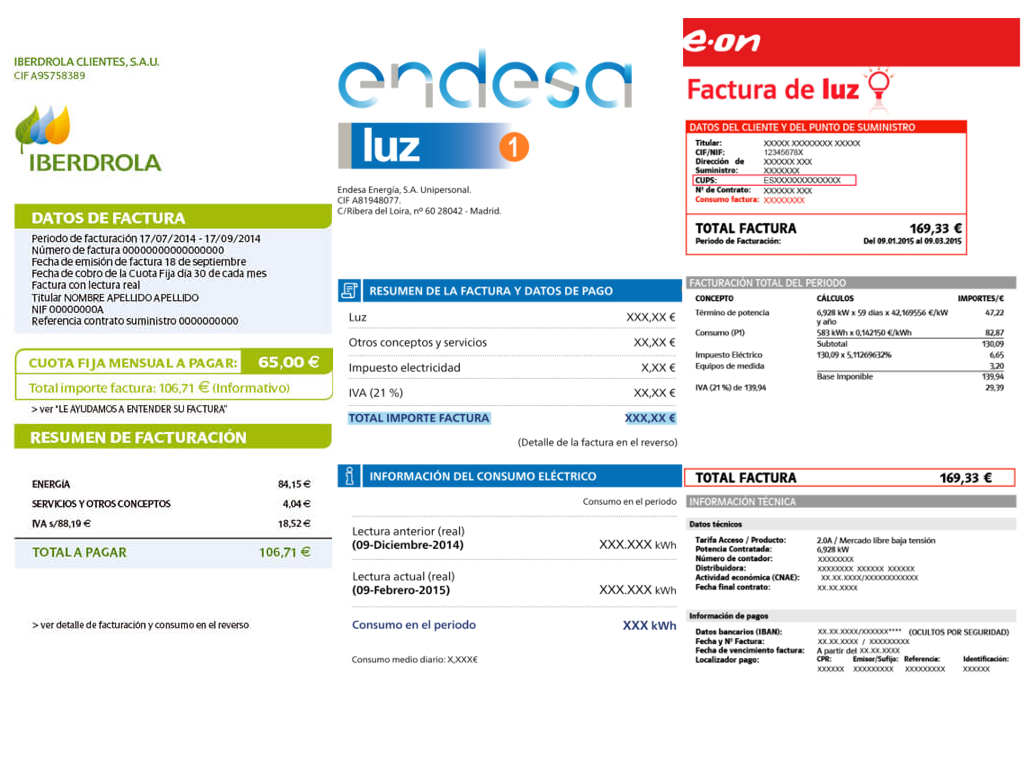

Let's see what this actually means in real life. Will the changes affect everyone? Yes. But not equally or immediately. Those who will notice it first are those who are in the regulated market compared to those who are in the free market. But do you know which market you are in?. It is important to know the difference between the two: what changes is the price that you are going to pay for the energy. In fact, your bill will tell you the answer to that very important question. You will need to identify the company name of your energy supplier. Don't just trust the logo as some companies are in both markets and use the same logo. Here is a table to help you identify in which market your supplier is. If your supplier is not on the list you may need to speak to your company and enquire.

In the past, the entire electricity market was regulated and prices were set by the government.

The market began to be deregulated in 1997. Within this process, 2009 was a very important year:

Since then, consumers have been able to choose who they are going to pay their bill. At the moment, they can choose from almost all companies which sell electricity.

The market liberalisation process is not yet complete, however, and the regulated market still exists. The two markets share two of the three basic parts of each electricity bill:

Access fees: these are set by the government and are used to pay the costs of maintaining the electricity grid and transporting the electricity to your home.

Taxes: Special tax on electricity and VAT.

What is different with the bill is the price charged for producing electricity.

The 10.7 M households that are in the regulated market - PVPC - had up to now six rates. As of June 1, everyone contracting less than 15 kW will go to a single rate. And they will be billed more or less depending on what time of day they turn on the light or turn on the washing machine.

To do this, the day will be divided into three time-bands:

Peak: It will be the most expensive. It will be between 10 am and 2 pm and 6 pm and 10 pm, from Monday to Friday.

Middle: It will have an intermediate cost. Between 8 a.m. and 10 a.m., 2 p.m. and 6 p.m. and between 10 p.m. and 12 p.m., Monday to Friday.

Low: It is the cheapest of the three. It will be established between midnight and 8 a.m., Monday through Friday. On weekends and national holidays.

At peak hour it will be 2.5 times more expensive than the middle tariff and that in turn will be more than 1.5 times the low tariff, according to calculations by the specialized energy consultancy Ingebau.

So does that mean that to save electricity we will have to put the washing machine on at 2 in the morning? Yes. If you don't do anything to change your consumption, the impact on your bill will be neutral. This is designed to shift consumption to periods in the day when there is less demand and ultimately to renewable energy supplies.

These changes are included in the Government's commitment to a green economy, in which the electric car will play an important role. As a result, they are laying the path so that these vehicles can be recharged during the night when the electricity will be cheaper, and as a result, reducing the demand on the network during the working hours of the day. More and more appliances can be programmed these days to be charged at specific times. Also instead of ironing on a Friday, you can iron on the weekend, it will be cheaper.

Additionally, the new bill will allow you to contract two suppliers (up to now only one was possible). One for the peak period and another for the middle or low. For example, a consumer could increase his or her contracted power at dawn to charge an electric car, the cheapest time of the day.

If you do not communicate anything to your company, a single power supply will be maintained, the one you currently have contracted.

In the new bill, the fixed price for power goes down and the variable part goes up, that is, the actual consumption we have every day. All these changes will be automatic for those who are in the regulated market.

But what about those who are in the free market?

Those 16 million households will have to consult with your company and study the prices and packages that are offering. Remember you can always change company.

The invoice that we will be sent out from June 1 will have a new design for those in the regulated market:

It will only have two pages with simplified content to make it much easier to understand. It will incorporate a QR code that will take you directly to the CNMC rate comparer so that everyone can choose the one that best rates according to their needs.

If you want to check prices in your postcode this is the link:

https://comparador.cnmc.gob.es/