Inflation keeps reducing real cost of mortgage

Tuesday, March 28, 2023 @ 10:40 AM

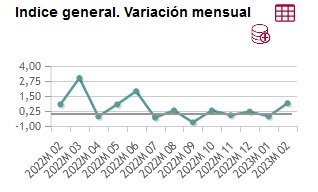

Inflation in Spain (and worldwide) has been undeniably on the rise. Below we can see the monthly evolution which is about to start trending upwards:

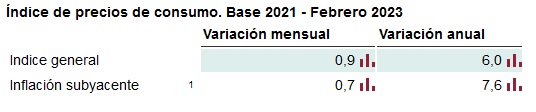

The resulting annual number of price increases (or money power reduction) is calculated at 6 to 7%, depending on the metric used by the Spanish government:

The typical bank fixed mortgage rate today hovers around 4.5% (BBVA for example is offering 3.8% for 15 years), which means you would be effectively having half your mortgage interest paid by virtue of the rising inflation. Of course, the "bet" is that inflation would keep rising. However, it seems that banks are expecting the opposite to happen soon, especially after the recent bank turmoil with Silicon Valley Bank and Credit Suisse.

As a personal opinion, it is still not certain that a fixed rate mortgage would be a no-brainer benefit against the recently rising inflation, given that sentiment can turn on a dime and we get the opposite direction soon. Nevertheless, it is an interesting development since the last blog post, where this effect was just starting.