The banks aren’t what they were. The quill has been exchanged by the keyboard and now there's a button on the street-door and a trickster in the manager's office.

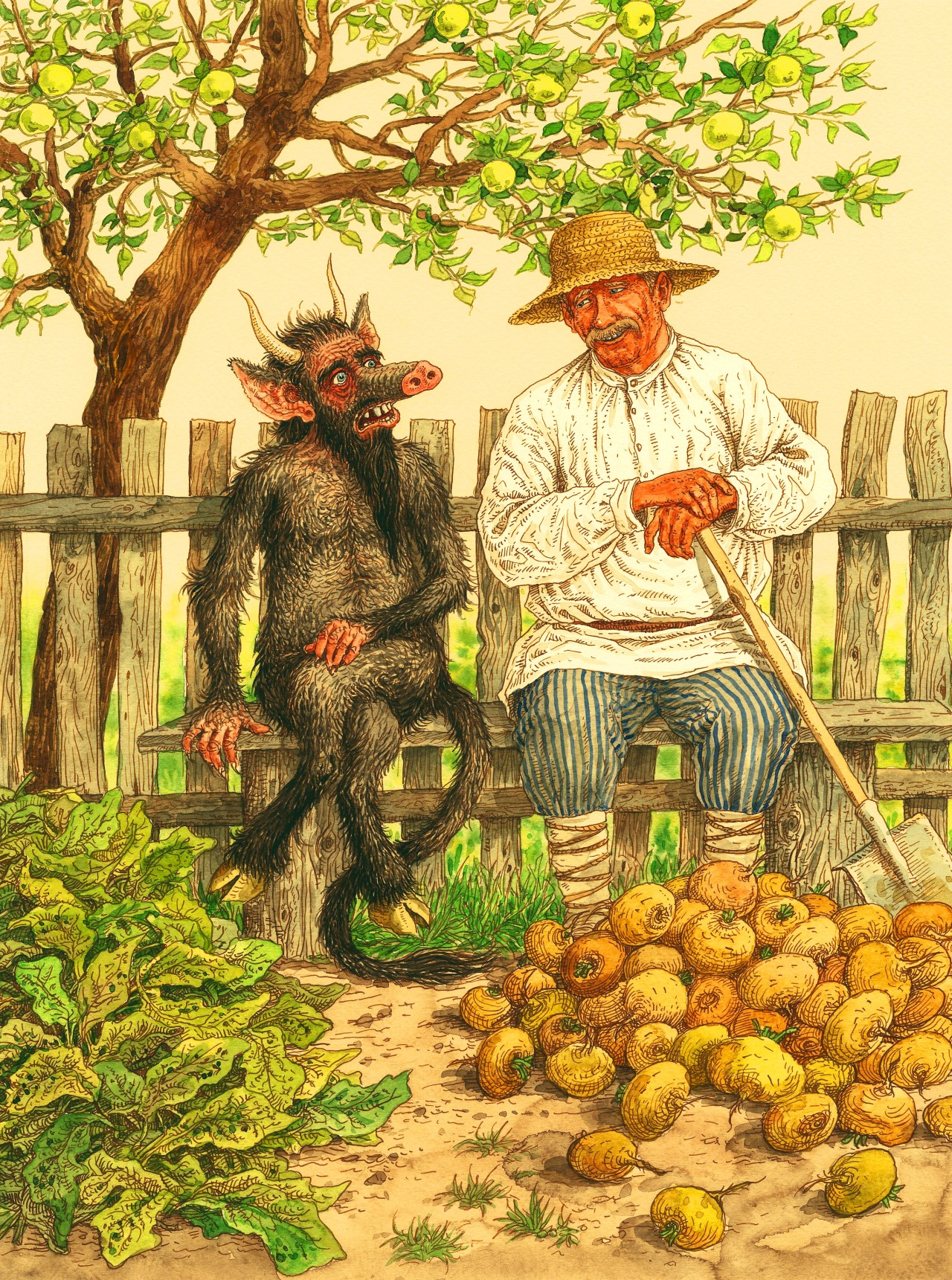

My first encounter with a bank was with un corredor - an agent for the Banco Popular. This was the old mayor of Bédar, who used to keep his useful papers, rubber stamp and a modest wad of cash under his bed in a strongbox. One would be granted permission to enter his boudoir and the business would be done, the mayor sat on the bed and concentrating as he filled a line in his ledger, and a receipt for the petitioner.

Word was, that the books would be transported weekly by donkey to the bank in Lúbrin, a dozen kilometres away.

Back on the coast in Mojácar, we had a proper bank, of sorts, since it wasn’t a bank so much as a savings bank, or caja. These belonged to the Church and in principle they didn’t take commissions. Ours was the Caja de Ahorros y Monte de Piedad de Almería, a kind of low-lender and pawn-shop known to the foreigners affectionately as the Cage of Horrors.

We were treated well there, and at Christmas, the Caja would fulfil tradition by offering their clients a bracer, usually a glass of anís or menta. It probably helped keep their patrons happy.

Later, allied to the Málaga Caja de Ahorros and rebranded as Unicaja, they began to offer sets of crockery to potential customers. A Sterling cheque would take a couple of weeks to clear, but if they knew you…

There was another bank of sorts in the pueblo, the Banco de Jeréz (part of the Rumasa empire), where I kept a company account. The teller, young Marcelo, used to remove a cheque from the back of my chequebook now and again and treat himself to a meal or a bottle of gin or maybe two weeks in the Caribbean until I caught him out one day. The manager returned my missing funds, kind of him, and I don’t know what happened to Marcelo. He’s probably in politics these days. The Banco de Jérez, for its part, went bust in 1992. So, back to the Unicaja for my banking needs and its occasional welcome drop of anís.

Banks grew in numbers and employees with the building boom, which started the day Franco died and continued until 2008. Then came the ‘restructure’ when 88 different high-street banks shrank down through mergers into the ten we enjoy today, albeit with 23,500 less branches and 115,000 less employees.

As for my favoured banking option with the passage of years, the Unicaja Banco (renamed again) has now joined up with Liberbank (an operator from Asturias, Cantabria and Castilla la Mancha) and, keeping its Unicaja Banco name (sorry about that, Liberbank), has turned into something far removed from its halcyon days as a s imple savings bank.

imple savings bank.

But hey, money talks. Any business one might have is not about making things, or deals, or dingbats, it’s about making money – and who is better placed to make money than a bank? Alright, the Royal Mint, but after that… No more bishops behind the door, now they are run by business-folk, or bankers as they call themselves. Indeed, bank staff are now strongly encouraged to sell products to their customers – home insurance, health insurance, house alarms (52,03€ per month with CaixaBank and don't forget to read the small print), investments, Ponzi schemes, crypto-currencies, ostrich farms, precious stones and sundry start-ups while the bank itself invests in property, bicycle teams and volleyball.

If all fails, and there’s the right government in power, then they’ll get bailed out at public expense.

Meanwhile, the Unicaja, having just raised their charges for keeping and investing my modest account to a whopping 20 euros per month, has a sign in our one remaining local office which says that the teller is only there until eleven thirty each morning, and furthermore that (says the sign with satisfaction in a piece of Newspeak) ‘Menos es Más’ - More is Less, and the handy cashpoint outside now does all kinds of tricks as the disgruntled queue to be found there will happily illustrate.

A rival lender across town is only open two days a week (Tuesdays and Fridays). How much do they charge customers I ask?

As for mortgages - and some hard-won advice here: just don’t.

You may be wondering if my bank still offers a tipple at Christmastime to its patrons. A flute of Bollinger maybe. I’ll get back to you on that one.