In an artilce published by Proffessor Vincenc Navarro today in his blog he explains how Central Banks have been purchasing public debt to Greece, Portugal and Irelend at high and abuive interests rates, helped by Public Debt Classification agencies, which made situation appear intentionally worse for obtaining higher interests and more benefits. This is how the risk rate has been increasing. They then started with Spain and Italy.

Payment of this debt, Navarro continues, is importantly damaging the welfare state of these countries, and these countries bonuses are losing their value dramatically. Banks, owner of these bonuses are panicking now: victims of their own greed ( as always). This is why Banks need to recapitalise now, in order to be saved from the collapse they have created.

Same with real estate properties in Spain. They created the bubble, ommitted guarantees to buyers ( liability 1segundo Law 57/68) and want now to be people´s selling friends. Come on Banks! Come to a closer position and you will renovate the situation. Cannot you see it?

Folowing with Navarro, Central Banks and countries: Central Banks are now lending money to national ones without limits/conditions

What conditions? You may ask.

Proffessor Vincenc Navarro, whom I liked in many of his thinking ( not in all though :), says:

Help conditioned to:

- Banks will guarantee credit availability

- Banks will avoid speculative practices

- Banks will buy public debt at reasonable rate interest and not exagerated as now.

BCE does not lend money to States of the European Union, it just lends money to Banks, who, receiving money at 1% lend it to States at huge rates such as 6,7,8 or 12%.

Banks and Markets, Navarro continues, are not alone as causers of this mess. Public Policies which allow these behaviours are designed and approved by political elites of the States. Central Banks are public authorities and their governors are designed by political appointment.

For instance, Fernandez Ordoñez, Bank of Spain´s governor who also sits at the European Central Bank was appointed by Rodriguez Zapatero.

He is the same who has recently reported that Banks have no liability at all when there is no Bank Guarantees for off plan purchases, against what explicitly, a currently in force 1968 Law says: ( the funny irony is that this person oriented Law was made by Franco :)

Instead of helping the Banks, the Central European Bank should have helped States ( this is also a political decission), and, following with Navarro´s article, according to what once said Joseph Stiglitz, that money driven by public banks would have ease credit and economy reactivation.

In my opinion, also Private Banks with the right orientation should and start making pro-person decissions. Why not? We people have the power now: Internet.

This is what Merkel also commented last week after her visit with Pope Benedict XVI: " We have discussed how politicians need to be able to make policies for people instead of operating according to the markets"

(Their crisis: they have yo pay it)

.jpg)

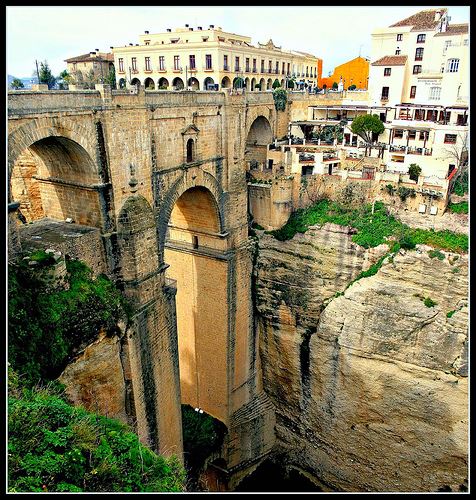

"Ronda Nuevo Bridge", Ronda - Málaga, Spain, by papalars, at flickr.com