Inflation keeps reducing real cost of mortgage

Tuesday, March 28, 2023

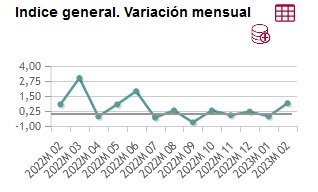

Inflation in Spain (and worldwide) has been undeniably on the rise. Below we can see the monthly evolution which is about to start trending upwards:

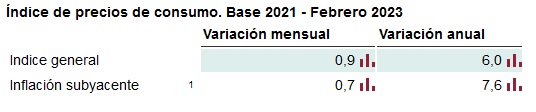

The resulting annual number of price increases (or money power reduction) is calculated at 6 to 7%, depending on the metric used by the Spanish government:

The typical bank fixed mortgage rate today hovers around 4.5% (BBVA for example is offering 3.8% for 15 years), which means you would be effectively having half your mortgage interest paid by virtue of the rising inflation. Of course, the "bet" is that inflation would keep rising. However, it seems that banks are expecting the opposite to happen soon, especially after the recent bank turmoil with Silicon Valley Bank and Credit Suisse.

As a personal opinion, it is still not certain that a fixed rate mortgage would be a no-brainer benefit against the recently rising inflation, given that sentiment can turn on a dime and we get the opposite direction soon. Nevertheless, it is an interesting development since the last blog post, where this effect was just starting.

0

Like

Published at 10:40 AM Comments (0)

0

Like

Published at 10:40 AM Comments (0)

Higher inflation - can luxury real estate protect the value of money?

Wednesday, August 3, 2022

This post is a continuation of the previous entry https://www.eyeonspain.com/blogs/remortgage-refinance/21685/inflation-drives-up-interest-in-luxury-real-estate.aspx where I believe the estimations made have been in the right direction.

Central banks worldwide are now scrambling to raise interest rates to stop inflation. The graph below shows the evolution of the inflation index in Spain, currently standing at 10.8% annualised.

As of the writing of this post, the approximate interest rates set by the major central banks hover around 2%. This means that the banks are currently "paying you" to have a mortgage: the real cost of it is eroded at a 10.8% pace, while you are only required to pay 2-3%. Let's get straight to the point of the headline - would it make sense therefore to actually buy property in this environment? What follows is not financial advice, just a personal opinion of mine from what I observe in the Marbella real estate industry. It would seem that many European and USA clients believe that luxury properties, especially in the Marbella area, with particular features/locations, is a good bet against inflation. The idea being that there is a long way before central banks reach the dizzying heights of 10+% and there is hardly any political will to do so. The table below shows there has been an inflection point in number of mortgages in Spain:

As always, this is all circumstancial evidence, to be dis/proved at the next post :-) Hope you enjoyed it, and see you at the next installment!

1

Like

Published at 12:59 PM Comments (0)

1

Like

Published at 12:59 PM Comments (0)

Inflation drives up interest in luxury real estate

Thursday, February 3, 2022

Referring to my previous post on inflation: https://www.eyeonspain.com/blogs/remortgage-refinance/21536/inflation-in-spain.aspx I think it has aged well! Below is the indication of inflation in Spain:

It has reached the dizzying heights of 6% annual change. The ECB will be under immense pressure now to raise interest rates, just like the USA Fed and Bank of England worldwide, for the same reasons. Property buyers have been well aware of this and it shows: there has been talk in the press about medium-to-high net worth individuals buying luxury properties in Marbella and surrounding area, from 1 to 5 million euros, at unprecedented speed. This indicates that they want to protect their money in the only reliable inflation-proof way in the latest years, buying real estate in unique locations.

The statistics for property sales of this quarter should reflect that, so mark this post as usual to see how well this prediction will age :-) See you at the next post.

0

Like

Published at 9:12 AM Comments (0)

0

Like

Published at 9:12 AM Comments (0)

Inflation in Spain

Saturday, November 27, 2021

In the last episode I commented on how dangerous the inaction by the Bank of England regarding interest rates in the face of rapidly rising inflation. Further confirmation was given by the data for Spain in October, with inflation accelerating at tyre-screeching pace of 5.5% overall. At the base of this were energy prices, which were also transferred to food, heating, and rental costs (especially rentals in the south of Spain). This value for Spain was the biggest increase since 1992, when the old peseta was under pressure by the strong Deutsch Mark. The inflation rate would have been much higher were it not for a reduction of energy taxes by the government. Yet another indication that higher interest rates *will* be coming, as the central banks will not have any other choice - or risk blowing everyone's savings up.

Having said that, the recent scare of the new Omicron variant has caused a big 12% drop in oil price in the markets, which might provide temporary relief to consumers and central banks alike. This would be a very strange phenomenon, a record high inflation rise, followed by record high drop.... Nevertheless, oil prices in the markets are famous for being volatile, so my bet is that interest rates will in fact rise anyway by 2nd quarter of 2022. Mark this post to see how well it will age :-)

0

Like

Published at 3:54 PM Comments (0)

0

Like

Published at 3:54 PM Comments (0)

Bank of England keeps rates low, despite high inflation - effects on Spanish property

Saturday, November 6, 2021

The Bank of England has surprisingly kept interest rates low at 0.1%, despite blatantly obvious inflation (average UK house price hits record £270,027). The effect on the GBP has been negative, reducing purchasing power both in the UK and in exchange rates with other currencies. To add insult to injury, Andrew Bailey, the Bank of England governor has said "I'm very sorry that's happening [the 5% rise in cost of living]". I will allow readers to form their own opinions about banking officials in general, mine was formed already back in 2008 :-) In any case, one wonders what the effects of this would be on Spanish properties. The Spanish market has been relatively boyant and the number of sales on the rise. It remains to be seen whether the loss of foreign-exchange power is higher than the fact there is ample liquidity at low mortgage rates for enabling buying a property abroad. I personally would expect a negative impact on prices for luxury villas like these, especially in high-end markets like Marbella, however this may be a good thing - buyers might grab this opportunity to buy now because again, in the BOE's own words "higher rates are coming by April". As always, I take banker's words with a ton of salt, because we must always watch what they do, not what they say. However, they might indeed not have a choice given inflationary pressures, so perhaps this is really the last chance to buy with low interest rates for a while.

Something to watch closely...

0

Like

Published at 10:52 AM Comments (0)

0

Like

Published at 10:52 AM Comments (0)

German central bank president resigns - the last thing holding interest rates low?

Wednesday, October 20, 2021

Bundesbank President Jens Weidmann has resigned 5 years before his scheduled end of term, citing "personal reasons", which is another way of saying "i couldn't do my job anymore" :-) Weidmann was known for being a "hawk", i.e. he encouraged fiscal discipline and was critical of the mainly southern members of the EU and their policies. With him out of the way, Mario Draghi and Christine Lagarde might very well feel that they can increase the printing press with the usual excuses (Covid, banks, environmental needs, etc) in order to increase liquidity in the Eurozone, even though the risk of inflation is evident already in fuel and food prices. Enquiring minds wonder if this is the moment where interest rates will shoot up in anticipation of deliberate higher inflation - Weidmann's sudden departure strongly hints at this. I personally will surely be watching closely, in order to lock in some fixed rate on my mortgage, if I see signs of the ECB leaning towards loose money standards (again). Or maybe load up on a fat loan and buy a Ferrari or a fancy Marbella properrty :-)

Thanks for reading!

0

Like

Published at 7:21 PM Comments (0)

0

Like

Published at 7:21 PM Comments (0)

Is teleworking a reason for mortgage amounts going up?

Monday, March 1, 2021

Based on the recenly released data on remortgaging in Spain, the number of mortgages on residential properties has dropped significantly. A near 15% reduction over the previous year's period of December. Even more impressive was the fact that the average interest rate payable is 0.6% - I find that number very tempting if you are in a position of thinking about remortgaging, or even purchasing for the first time. Data as follows:

Mortgages on residential properties - December 2020

| |

|

Value |

Monthly change |

Anual change |

| Number of mortgaged dwellings |

|

26,128 |

-9.1 |

-14.8 |

| Average amount (euros) |

|

135,658 |

-0.7 |

9.2 |

| Average interest rate |

|

2.47 |

0.6 |

-1.6 |

Taken from https://www.ine.es/dyngs/INEbase/en/operacion.htm?c=Estadistica_C&cid=1254736170236&menu=ultiDatos&idp=1254735576757

Obviously, Covid is having a continuous effect on the market. But, we see that the total Euro value of mortgages has gone up. Anecdotally, I have learned from a number of estate agents that several property buyers are coming to Spain (and mostly in Andalucia), to work remotely from here. They tend to buy bigger properties (to allow for the extra office space), and that might explain the data above. It would be interesting to see whether the trend continues, and whether teleworking is one explaining factor.

0

Like

Published at 8:26 PM Comments (4)

0

Like

Published at 8:26 PM Comments (4)

Is it wise to load up on a Spanish mortgage right now?

Thursday, April 7, 2011

This is just a thought, usual disclaimers apply. But how about what seems to be the current thinking about the future of the euro: there are 2 speeds in Europe, one is Germany/France axis ( ) and two the peripheral European countries. Could it be that the Euro will be split in 2 "versions"? I personally think it's the most viable option. Politically the German and French goverments can claim that they saved the euro and haven't abandoned their pet project, and the peripheral countries can devalue their currency kindof. Would this make the case for making sure you owe in Euros and you are net Pounds or US dollars? As bad as the situation may be in these other currencies, it definitely looks worse for the euro. Even the Swiss national bank has started putting restrictions on European bonds, which they are averse to doing because it makes their currency stronger. ) and two the peripheral European countries. Could it be that the Euro will be split in 2 "versions"? I personally think it's the most viable option. Politically the German and French goverments can claim that they saved the euro and haven't abandoned their pet project, and the peripheral countries can devalue their currency kindof. Would this make the case for making sure you owe in Euros and you are net Pounds or US dollars? As bad as the situation may be in these other currencies, it definitely looks worse for the euro. Even the Swiss national bank has started putting restrictions on European bonds, which they are averse to doing because it makes their currency stronger.

Just food for thought....

0

Like

Published at 1:57 PM Comments (0)

0

Like

Published at 1:57 PM Comments (0)

The day at the Notary

Tuesday, March 29, 2011

These dreaded days at the Notary are never short. For the life of me I cannot understand why they can't prepare the documents in advance, subject to them seeing the original documents on the day of the signing! Anyway, the world cannot be changed in one day. Or one decade for that matter.

Remember to take the same documents that you used for your original mortgage/hipoteca. This may include an expired passport that is not valid. Don't panic if you've thrown that old passport away after renewing it, but it makes things a lot smoother on the day of signing your linked mortgage if you have all the original mortgage's supporting documents.

Allow plenty of time at the Notary, like with everything else in Spain. Especially so if there are other peripheral contracts to be signed with the new mortgage, for example if you are obliged to take a life insurance with the new bank etc.

Your new bank will handle all payments, so ensure that you have deposited enough funds in the new bank's account to cover the expenses needed. This may include the cancellation fee for the old bank (yes, you don't pay the old bank directly, all is handled by the new bank), any Notary fees, the tax for Notarised Documents (impuesto de actos juridicos in Spanish), etc..

And a word of advice: make sure you cash in all your loyalty points with the old bank because somehow I don't see them giving you that toaster after they lose you as a customer!

0

Like

Published at 7:01 PM Comments (0)

0

Like

Published at 7:01 PM Comments (0)

Documentation needed for subrogacion mortgage

Wednesday, March 23, 2011

Just a quick note to point out certain documentation points that you may not be aware of.

The same documentation that was used to contract your original mortgage has to be used for the linked / subrogacion mortgage. I.e. if you used your NIE and passport to take out the original loan, you will need to bring both your NIE and passport to the notary, otherwise it cannot be confirmed that you are the same person.

Another point is that if the original loan was made to 2 persons, say husband and wife, then again both have to be named on the subrogacion mortgage. I know this sounds too obvious but many have been fooled into believing that "the obvious" is what is done in Spain to their detriment!

Keep your money safe!

0

Like

Published at 4:29 PM Comments (0)

0

Like

Published at 4:29 PM Comments (0)

Spam post or Abuse? Please let us know

|

|